Can grants and R&D tax credits be used together?

As a startup, you’re probably constantly in search of funding to fuel your business. Depending on the stage of your busi...

Is your company spending money on making scientific or technological advancements? If so, you might be in for a well-deserved tax break. Let’s take a look at what makes you eligible for R&D tax credits and which costs you can claim.

R&D tax credits are a form of tax relief designed to encourage companies to spend money on developing new products and services, and boost innovation in the UK.

R&D tax credits apply to the fields of science and technology but aren’t sector-specific, meaning companies in any sector can apply for this tax relief if they have attempted a scientific or technological advancement of some kind.

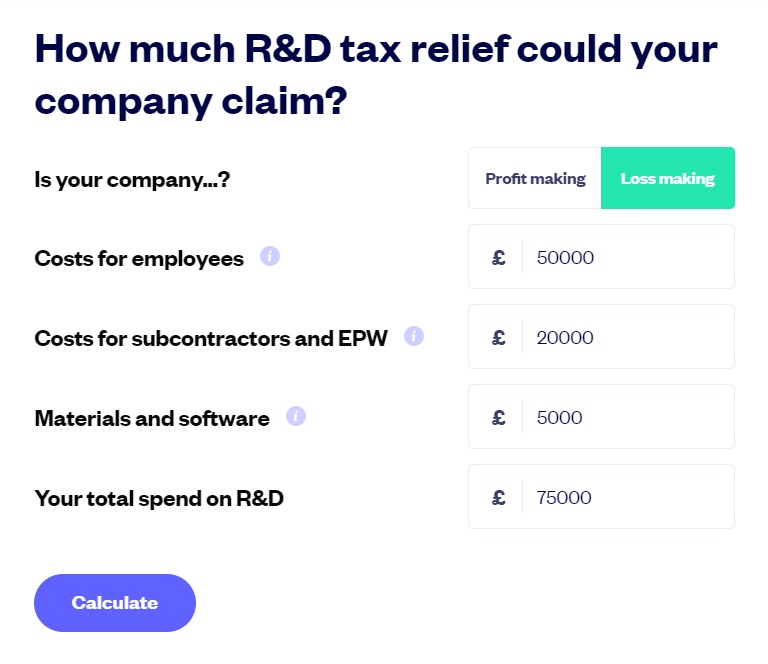

The type and amount of tax relief you can claim depends on how much you’ve spent, what you’ve spent it on and whether your company is making a profit or not. Some startups can claim as much as 33% of the R&D costs back with the tax relief schemes. There are two different schemes for R&D tax relief:

SME (Small to Medium Enterprise scheme)

This scheme is for startups and small businesses that:

You can claim up to 33% of your company’s qualifying R&D expenditure with the SME scheme.

RDEC (Research and Development Expenditure Credit scheme)

This scheme is for larger companies that:

If your company doesn’t fit the definition of an SME, then you might be able to claim using the RDEC scheme.

You can also claim from the RDEC scheme if your company is an SME but you don’t qualify for SME R&D relief because one or all of these apply:

You can claim up to 13% of your company’s qualifying R&D expenditure with the RDEC scheme.

Your company is eligible for R&D tax relief if you spend money researching or developing a new product, service or process; or if you’re improving an existing one.

To claim R&D tax credits, you need to show your company took a risk by investing money in trying to resolve a scientific or technological uncertainty.

The idea is that you should be rewarded for trying to advance scientific or technological knowledge and capabilities – no matter which sector your company is in. The project does not have to be successful for you to claim R&D tax credits.

Additionally, to be eligible for R&D tax credits, your company:

Use this handy checklist to understand what you need to do to prepare for a successful claim.

Download checklistBefore diving into the costs you can claim for R&D, let’s clarify the types of projects that qualify.

Your project has to improve on the overall knowledge or capability in science or technology, not just the company’s own state of knowledge or capability. To qualify, the company must be carrying out R&D work in the field of science or technology.

The tax relief is not just for ‘white coat’ scientific research but also for ‘brown coat’ development work in design and engineering that involves overcoming difficult technological problems.

The scheme’s definition of R&D is intentionally broad to cover activities in as many industries as possible.

Amina GhaforR&D actually has a very broad definition. It’s not just software development or life science companies that are eligible for R&D relief. We have customers in a range of industries who’ve successfully claimed large amounts.

R&D Team Lead,

The project must be clearly related to your company’s trade – either an existing one, or one that you intend to start based on the results of the R&D.

In your R&D claim, you’ll need to show how your project:

1. Looked for an advance in science and technology

2. Had to overcome uncertainty

3. Tried to overcome this uncertainty

4. Could not be easily worked out by a competent professional in the field

You’ll demonstrate this in your technical narrative, which is an appendix to your R&D claim that explains to HMRC why your work qualifies as R&D.

You can claim gross salaries, employer National Insurance contributions and employer pension contributions for your PAYE employees who were involved in your R&D project.

You can also claim R&D-related travel costs and bonuses. This covers both the employees who did the hands-on R&D work as well as the time spent supervising and managing those employees who carried out the work.

You don’t need timesheets for your R&D claim, you can simply make a reasonable assessment of each individual staff member’s time spent on R&D activities during the period you’re claiming for and allocate time based on a rough percentage.

2. Qualifying Indirect Activities (QIA)

Support staff costs, like administrative or clerical staff, don’t usually qualify unless you can show people performed indirect activities that supported the R&D project. This could include clerical work like note-taking at R&D project meetings, cleaning and maintaining equipment or security related to the R&D project.

✔ Create your claim in minutes

✔ Get unlimited expert support

✔ Receive your money from HMRC

3. Externally Provided Workers (EPWs)

EPWs are temporary workers that you hire via an agency. You can usually claim up to 65% of the payments made to the external agency for temporary staff hired to work on the R&D project.

4. Subcontractors

Under the SME scheme, you can generally claim up to 65% of the payments made to subcontractors.

Under the RDEC scheme, you generally can’t claim back subcontractor costs unless the work is directly undertaken by:

In these cases, you can usually include up to 100% of the cost in your RDEC claim.

5. Consumable items

You can claim for the cost of materials, water, fuel and power used to carry out your R&D project. However, you can’t claim the costs of materials used to build the products you sell.

6. Software

You can claim for the cost of software that is directly used in your R&D activity. If you use the software elsewhere in your business as well as for your R&D activity, you can only claim some of the cost, not all of it.

7. Prototypes

If you’re creating a prototype to test the results of your R&D, the design, construction and testing costs will normally be qualifying expenses. However, if you’re planning to sell the prototype itself, this counts as a production cost and is outside the R&D scheme.

8. Clinical trial volunteers

Pharmaceutical companies and research organisations often make payments to volunteers taking part in clinical trials. You can claim this back as an R&D expense.

9. Contributions to independent research

If you’ve paid a professional to do research for your project, these payments might qualify for tax relief if they’re a ‘qualifying body’ such as a university, research centre or charity.

When you submit an R&D claim, you’ll have to show what you spent money on. You’ll have to indicate the percentage of each cost that went towards the R&D project. When you build your R&D claim with SeedLegals, you can import your costs directly from Xero to speed up this part of your claim. .

How much R&D tax relief could your company claim? Find out with our calculator.

Go to calculatorR&D tax credits aren’t designed to support companies beyond the discovery and experimentation stage. That means that you can’t claim for costs incurred in the production or distribution of goods or services your company creates off the back of your R&D work. You also can’t claim for rent or land.

You can’t claim any costs related to creating patents, including the time spent by staff on preparing and submitting patent applications. However, there’s another HMRC tax relief scheme called Patent Box which gives eligible companies a 10% Corporation Tax break on profits earned on patented inventions.

R&D tax credits are claimed through your Company Tax Return (CT600) which is normally submitted on an annual basis and based on the figures from your Statutory Company Accounts. To claim R&D tax credits, you’ll need to submit the CT600 and your Technical Narrative as an R&D tax credit claim to HMRC.

If you want to make it easier to do your R&D claim, you can create it on SeedLegals – we take you through it step-by-step. All you need to do is fill in the information at each step and your claim is generated automatically.

When you claim your R&D tax relief with SeedLegals, you have the benefit of a dedicated tax specialist to help you out. Our pricing is much lower than most accountants and we have an excellent success rate with HMRC.

Here’s how it works:

Not sure if your project or costs qualify for R&D tax relief? Book a free chat with one of our R&D specialists to get answers fast.

Sources

Claiming research and development tax reliefs | gov.uk – accessed 15/10/2022

Use the patent box to reduce your Corporation Tax on profits | gov.uk – accessed 15/10/2022