R&D success stories: meet the companies claiming back cash

Meet the innovative companies who have successfully recovered money through the SeedLegals R&D Tax Credits service.

If you use Xero and you like free money, you’re in the right place. Our Xero integration is now live so it’s even easier to claim back up to 33% of your R&D spend.

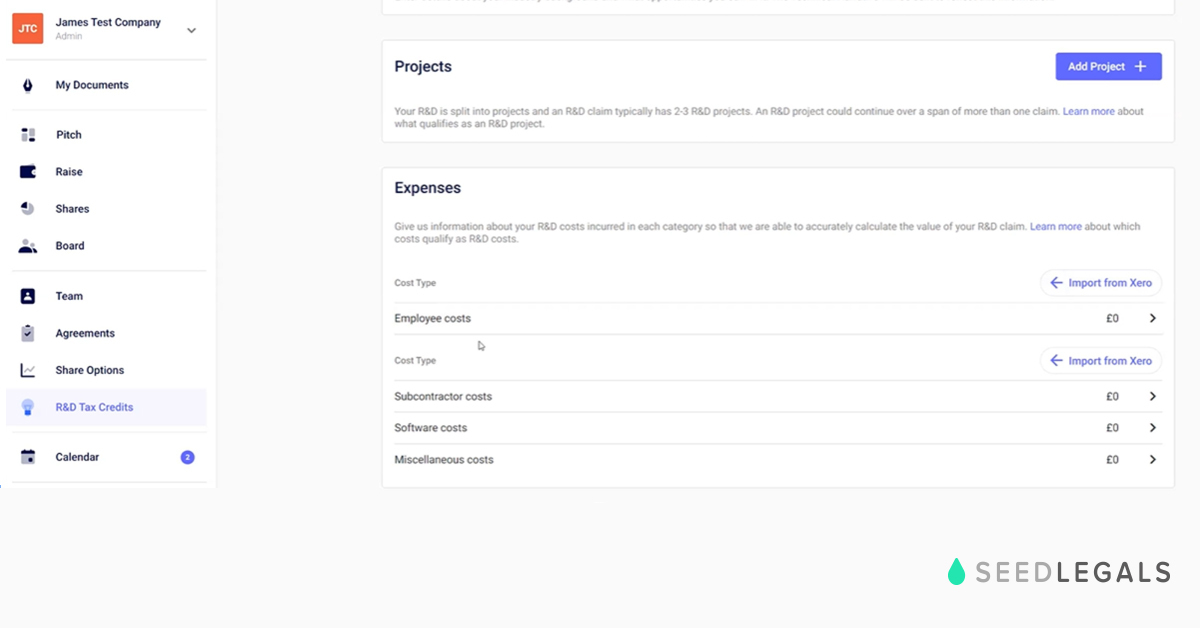

To save you having to manually input the numbers for your R&D spend, you can now connect to Xero from SeedLegals to pull in the numbers to populate your forms – a few clicks and it’s done.

Claims can only include expenses for research and development so on SeedLegals, you can easily adjust the numbers from Xero to fit your claim. For example, if you have an employee who spends 70% of her time on research and 30% on sales, you can import the figures for her payments and change the percentage to 70%.

Here’s how it works:

SeedLegals is one of the fastest ways to complete your R&D claim. Now, with our Xero integration, it takes even less time to get your claim together and submitted to HMRC.

Why have we made it easy to connect to Xero? Because Xero is so popular with small businesses: over 3 million startups, SMEs and accountants use Xero to manage their transactions. We want to make it as simple and seamless as possible for UK startups to get their R&D cashback – so it makes sense to integrate our R&D workflow with your favourite book-keeping system.

If you use another book-keeping system, it’s still easy to create your R&D Tax Credits claim with us. You can add your costs directly into the workflow, or ask us to do it for you – we’re happy to help.

Our team of R&D specialists know exactly how to put together winning claims.

To find out if you can claim, how much you might get back and how to get started, book a demo with our experts.