Startup funding strategies for 2026

With data, experience and insights gained from £2B+ raised on SeedLegals, we’ve curated these top three funding strategi...

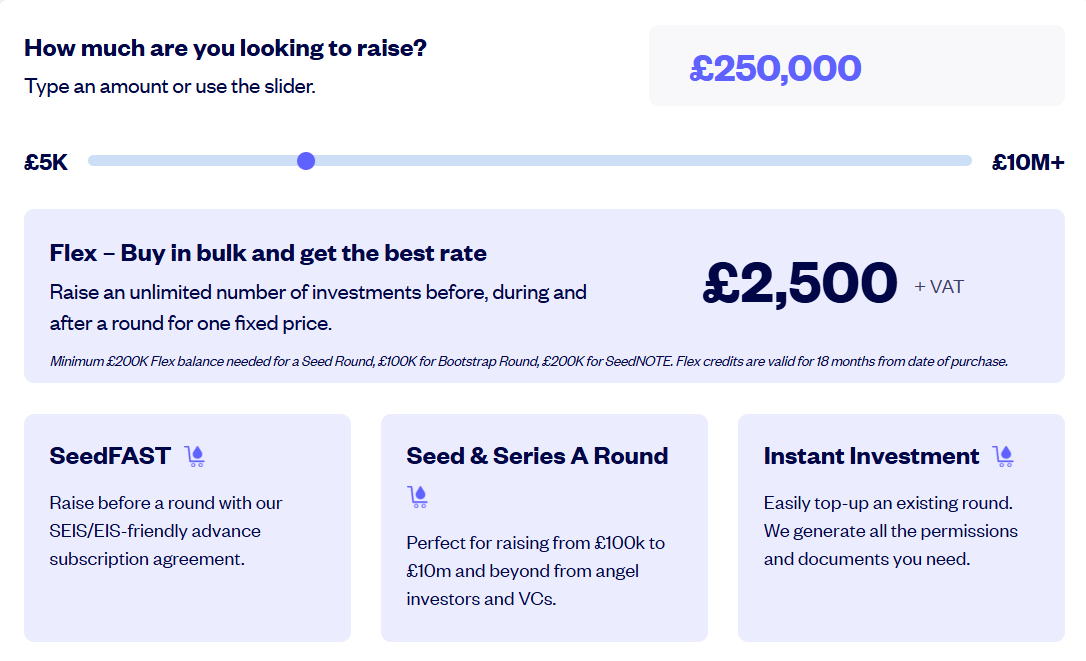

SeedLegal Flex lets you raise up to a specified amount in any combination of SeedFASTs, Instant Investments and funding rounds at no additional cost.

In this video and article I explain how to use Flex and agile fundraising to reduce the cost and time of your fundraising.

Flex gives you peace of mind. There’s no need to lock in your funding strategy upfront because Flex allows you to change course anytime as investment opportunities arise – at no additional cost.

For example, let’s say you plan to raise £300K. You’re not sure if you’ll be able to find enough investors to do that all at once in a funding round, or whether you should start by raising £50K from some angel investors first who’ve expressed interest, and then do the main round later.

Now, with SeedLegals Flex, you can purchase an amount of fundraising to use any way you like for 18 months. Start by raising with SeedFASTs from investors as you find them. Then do a funding round with the lead investor. Then top up later from any number of investors on demand. All for one fixed price based on the total amount you plan to raise.

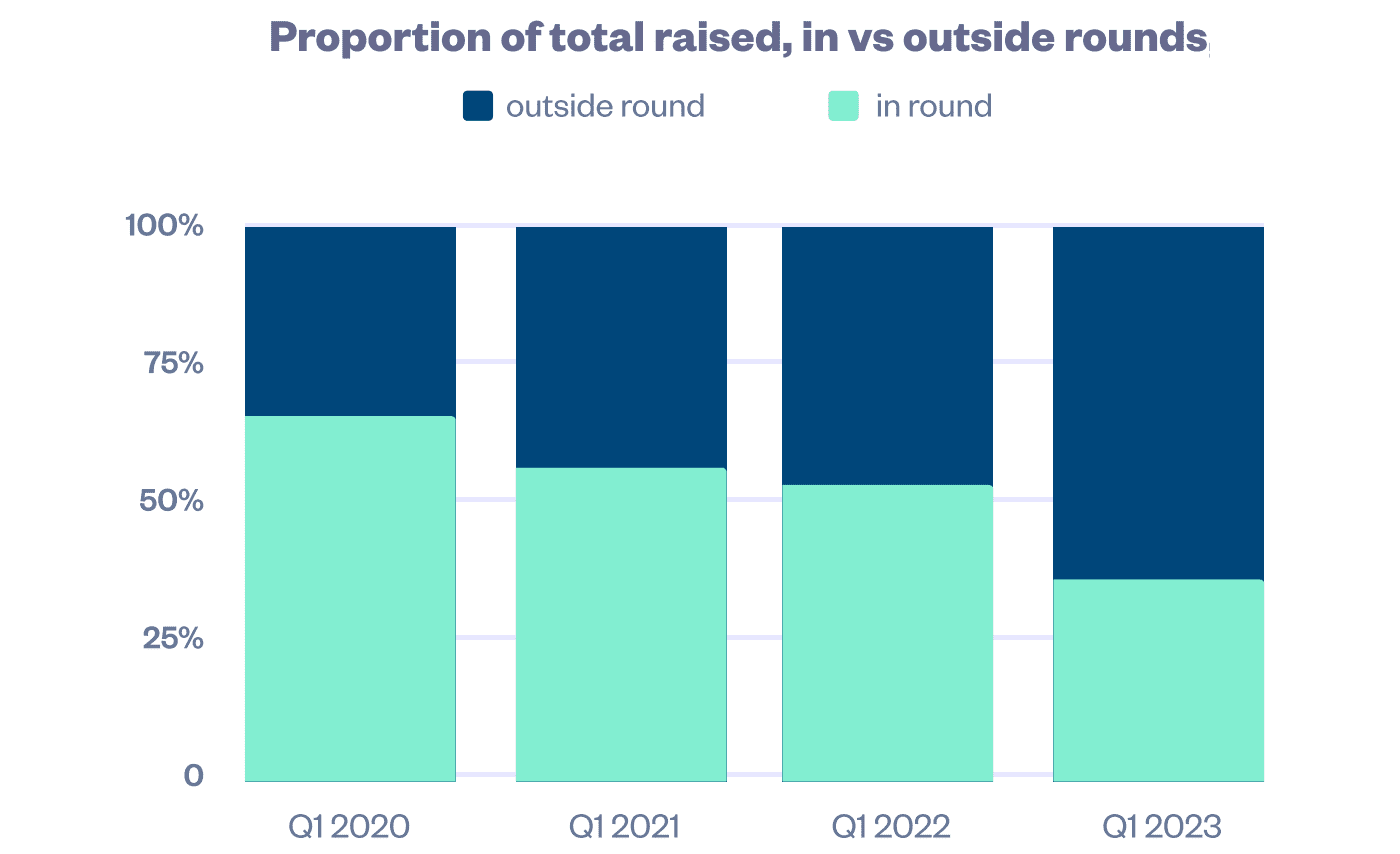

Over the past few years, there’s been a fundamental change to the way startups raise investment.

Previously the way to raise investment was to “do a funding round” – which means taking a best guess as to how much money you’ll need for the next 12-18 months, then finding enough investors and investment amount to meet that need. Then, everyone gets together to sign a Term Sheet, and Shareholders Agreement. And only then does everyone send the funds.

But that’s all changed. Our data shows that there’s now more investment raised on SeedLegals outside a funding round than in a round. That change has accelerated in the past two years. More than two-thirds of all investment is now raised in individual investments before or after a round rather than collectively in a round. We call this agile fundraising and you can learn more about it in:

Back in 2018 when we introduced SeedFASTs to raise opportunistically before a round, and Instant Investment to opportunistically top up a round, those were the exception rather than the rule. So we priced each of those, and funding rounds, as if they were one-off events.

But with the total inversion in fundraising, it’s time to recognise agile fundraising as the new norm, with a pricing model that makes it seamless to raise any way you like and to switch your fundraising strategy as you go. So, we’ve adapted and introduced Flex.

Here’s how to get started with Flex:

Each time you create a new investment, it’ll come off your Flex balance, nothing more to pay. And of course you can top up your Flex balance at any time.

Here are some ways you can use Flex to save money and raise faster.

With VC funding harder to find, we’re finding that more and more founders are doing what might be called a private crowdfunding round, using SeedFASTs to raise amounts ranging from £500 to £50,000 from anywhere between a half dozen to a hundred or more angel investors.

The sweet spot we’re seeing is 10-20 angel investors (though we’ve seen 100 or more) each investing £5,000 to £20,000 (though we’ve seen minimum investment amounts down to £200).

Previously you’d buy one SeedFAST for each investment, with a £100 minimum cost per SeedFAST. Now, with Flex there’s no minimum cost per SeedFAST. So next time you meet someone in the pub saying “hey, love what you’re doing, I want to invest £1000,” you can create a SeedFAST for them in minutes with no minimum cost from your Flex balance.

Planning to raise, say, £1M over the next year? Buy £1M of Flex funding and benefit from our sliding-scale pricing model (1% of the first £500K raised, 0.5% for the next £500K, 0.2% of the amount over £1M, 0.1% of the amount over £2M).

Perhaps you’ll start by planning to raise that all in a single funding round. But, as is often the case, finding a lead investor is hard. No problem – switch tack and use that Flex towards SeedFASTs to raise quickly from investors who are happy to come in now. Then, when you’ve found a lead investor or enough investors to make up your funding round, use your remaining Flex balance for that. And then top up afterwards as needed.

Whichever way you decide to raise, SeedLegals Flex combined with the SeedLegals platform and unlimited support from our team of experts makes it faster and more cost-effective than ever before.

When you use SeedLegals to raise, you get unlimited support from our funding strategists, who can guide you through your funding journey.

With over £1.5 billion in deals closed through our platform, we have the experience and data to help you:

✅ Understand all your funding options

✅ Make informed decisions about your investment deals

✅ Navigate your deal to achieve the best outcome for you

✅ Save time and money on your funding admin

Book a call with one of our funding strategists below. We’ll be happy to help.