Advisory shares: How much equity should you give your advisor?

Startups commonly give 1% equity to General Advisors paid only in equity, who work less than 2 days a month. Discover m...

Giving employees equity is an excellent way to attract top talent, incentivise employees and offer compensation, especially in the early days of a startup when you might not be able to offer large corporate salaries.

In this article, we’ll cover what you need to know about how much equity to give employees. We’ll look at the benefits of giving employees equity, how much of the total company equity to reserve for employees and how much equity to give individual employees based on seniority and the company’s stage. We’ll also cover what startup equity is and how distributing it works.

In business, equity refers to the amount of money each shareholder would get if all the company’s assets were liquidated and debts paid off. Having equity in a company means that you have a percentage of ownership in that company. Equity is usually divided among founders, investors, employees and advisors.

A company starts out being 100% owned by the founders, meaning they hold 100% equity in the company. If there are multiple founders this percentage will be split among them according to the contribution they make (e.g. 50/50 or 20/20/60). Equity in the company is later given to investors in exchange for capital. After that, another chunk of equity is given to employees and advisors in exchange for their expertise and dedication.

Each company only has a limited amount of equity to give, and it’s up to the founders to decide how much ownership they want to give away, and how to distribute it amongst various stakeholders. The chart below shows the distribution of equity amongst stakeholders in an example company.

In an early stage startup, you’re competing with large corporate salaries. Many startups give employees equity to attract top talent and make up for the salary gap.

Plenty of startups also offer equity in addition to paying high salaries to attract the best employees and make them feel invested in the company.

Looking forward to the opportunity to sell valuable shares for a large sum of money a few years down the line is a great motivator for talented employees.

Although it’s become common for startups to give employees equity, any company no matter what size or stage can award equity.

Giving employees equity is the perfect win-win, here’s why:

When it comes to giving employees equity, there are three key areas that will determine how it works in your company and how much you give. We’ll highlight these key areas below, but you might also find it beneficial to read SeedLegals CEO Anthony Rose’s insights on how to give out shares and share options in your startup.

A good way to give employees equity is through options. This is because someone who purchases shares becomes a shareholder in the company (with voting and other shareholder rights) immediately.

To grant options, on the other hand, gives someone the right to buy shares in the future. The rights associated with these shares can only be accessed once the shares are purchased. Most companies give employees equity in the form of options.

2. Decide your option pool size

The amount of equity set aside for employee options is known as an option pool, or employee equity pool. The decision on how many options to give each employee will vary depending on the overall size of your option pool (a bigger pool means you have more equity to give them).

There are many different types of option schemes to choose from in the UK – you can use any of the four HMRC approved option schemes or design your own unapproved scheme.

Choosing the scheme that’s right for your company depends on things like:

The EMI Option Scheme is by far the most popular, particularly because it provides both employee and company the opportunity to save a lot on tax and encourages commitment from employees which is incredibly valuable to companies.

Mo SaedLosing a key employee can take up to 26 weeks to replace and upskill, and can cost the company around £15,000. This is why we’ve seen an increased demand for companies adopting an EMI scheme as it fosters accountability and supports true team cohesion due to employees now having skin in the game

Options Team Lead,

Check out our Options Schemes resources centre to learn about options schemes and how to set them up.

As we mentioned earlier, the portion of company equity set aside for employees is called an option pool. It’s also referred to as an equity pool or an employee stock ownership plan (ESOP).

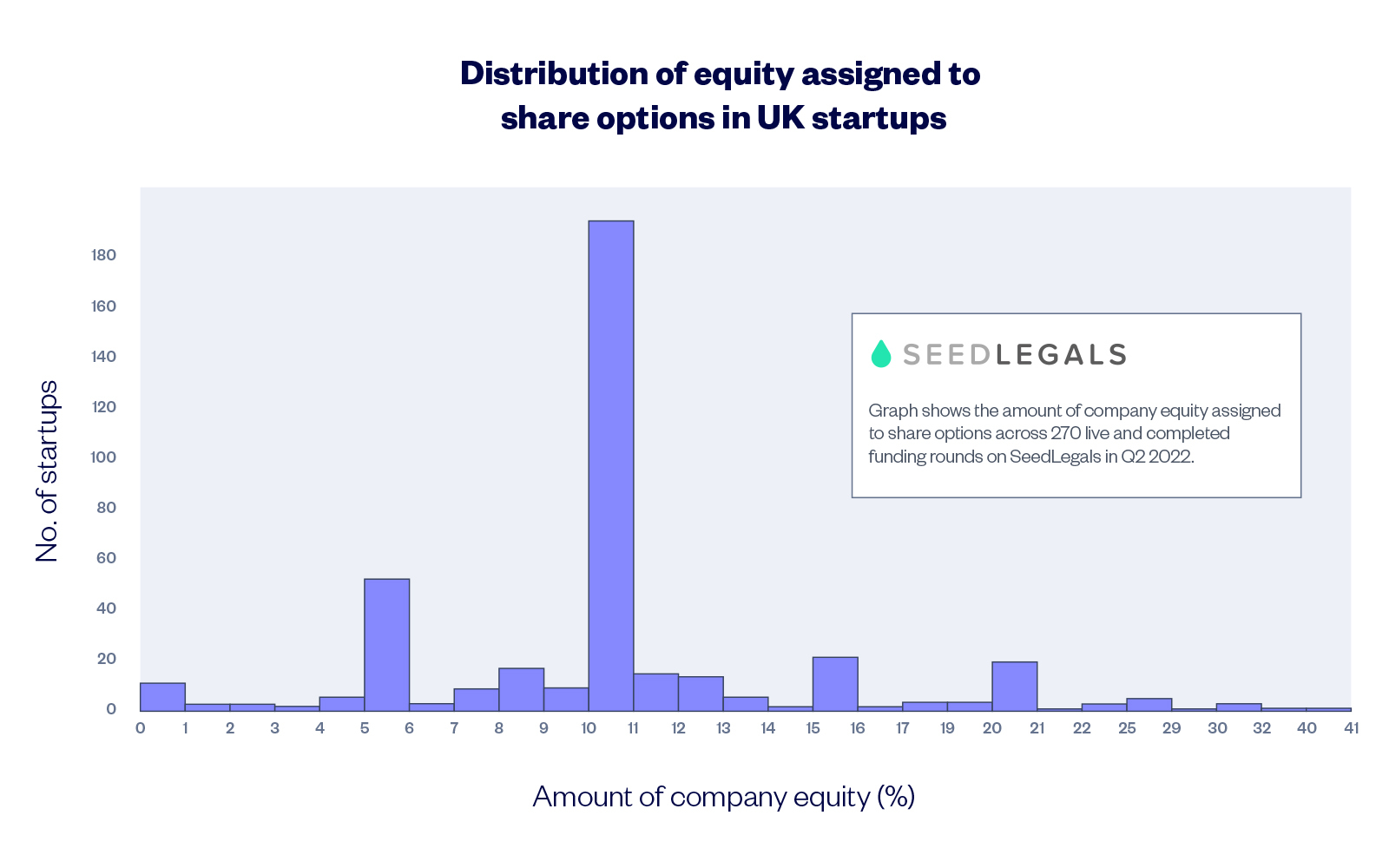

Our data shows:

For companies raising early stage funding (between £200k and £3m) both Index Ventures and Balderton Capital agree that at the seed round companies should set aside around 10% of total company equity for their employee option scheme. The amount committed to the option scheme is then likely to rise when the company progresses through later funding rounds.

Below is a graph from Balderton Capital showing the percentage of shares available, allocated and vested in option pools. Note how 10% is set aside as early as the Seed round. The percentage of shares available, allocated and vested increases as a company progresses through funding rounds.

Image Source: Balderton Capital

Image Source: Balderton Capital

*A vested share is a share that an employee can exercise, i.e. they can act upon it.

Generally, the relative amount of equity you give away as the company grows will be dependent on company cash flow. Earlier stage companies can’t normally afford to pay the market salary value for employees and therefore equity option compensation for first employees is higher.

According to Balderton Capital and Index Ventures, how equity is given based on the stage of the company generally looks like the following.

For first employees and founding team:

At an early stage (up to 10 employees) you might expect to give up to 1% of the total company equity per employee.

For mid-size companies:

At a mid-sized company (15-50 people), salaries start to increase compared to the market value, so you might start to give out options based on seniority or performance of the employee.

For growth-stage companies:

For later stage and larger companies (50+ employees) it is generally advised to stick to a scheme that assigns options based on the type of role and seniority of the employee. At this stage you’d start assigning options as a multiple of employee salary.

How much equity to give an employee based on seniority is affected by:

We’ve summarised guidelines on how much to give by Balderton Capital and Index Ventures below. This is relevant to early and mid stage companies (up to 50 employees).

| Seniority level | C-level | VP | Directors | Managers | Other employees |

| % of total company equity awarded | 0.8%-2.5% | 0.3%-2% | 0.5%-1% | 0.2%-0.7% | 0.0%-0.2% |

C-level executives include Chief Operations Officer (COO), Chief Technology Officer (CTO), Chief Financial Officer (CFO), Chief Marketing Officer (CFO), etc. Most Series A and B startups will have no more than three true non-founding C-level execs.

Options are generally granted at 0.8 to 2.5% of the total diluted equity amount for C-level execs. Below is a graph showing the distribution of equity given to non-founder member c-level executives.

For Vice-Presidents, you might grant a lower amount of 0.3 to 2%. You’re likely to have five to eight VP’s in the organisation at Series A and B.

| Seniority level | Senior-level staff member | Medium-level staff member | Junior-level staff member |

| % of annual salary awarded in options | 50%-90% | 25%-50% | 10%-25% |

The larger the company valuation, the more employees you have, so the less of an option pool you have to give away.

In terms of what value of options to give away to non-executive staff members, the general recommendation is as per the table above.

Example:

At a £20m company valuation, a senior staff member on £100,000 a year salary would get granted £50,000 to £90,000 worth of options which is equal to 0.25% to 0.45% of total company equity.

Of course, all these percentages are guidelines. It depends on both what the company is willing to offer and what the employee wants.

When the whole team is offered equity options, it means that every hire is invested in your business. It encourages collaboration and has the power to create a cultural shift in the business emphasising that everyone is in it together.

There are also advantages to not offering everyone equity options, though. If you don’t offer every employee options, it allows you to be selective with option distribution and only give options to key hires or star performers as a reward and an incentive to stay with the business.

You could strike a balance and offer a bit of both – give everyone in the company a low base value of options on joining, then allocate extra to the key performers as a reward.

Whether you should offer the whole team equity options or only some individuals comes down to preference. There is no right or wrong way to allocate equity options.

Advisors are experts whose knowledge is very valuable to a company and can help to make decisions. The way in which companies compensate advisors varies a lot. Some are compensated with salary and equity, while others are compensated with only salary or only equity. In some cases, they are not compensated with either. It all comes down to the circumstances. Our research shows that the majority are compensated with equity only.

As a general rule, early stage startups compensate advisors with 1% equity in the company. This amount varies according to the advisor’s expertise, role within the company, and the stage of the company.

Advisors generally include:

Want to learn more? Read our guide on how much equity to give advisors. In this article, we go into detail on how to compensate advisors with respect to role, time commitment and company valuation.

There are various factors that affect how much equity to give employees. These factors change as the company grows and changes, so it’s important to constantly revise how much equity you give. In summary:

We know how overwhelming it can be to decide and set up equity schemes for your employees. But at SeedLegals, it’s something we do daily so you can count on us to answer your questions and help you set up your scheme.

Our Options experts have a deep understanding of how each scheme works and how to set them up efficiently, so book a call and get all the help you need.