How founders should think about an exit (long before one is on the table)

Most founders spend their days focused on building. But preparing for an exit is really important too. Alex Arnot explai...

The slow summer months serve as an excellent opportunity to step back and review your approach to attracting investment into your business. Investors are looking to give promising businesses two things: money and expertise. In return, you need to be able to demonstrate that these will be good investments.

In this post, Kerry Dwyer, Equity and Grants Account Manager at Swoop, explains five things that make a business investable: these are the factors that investors will want to see from you to ensure that not only is your business sound, but also that you are someone they can work with.

At the core of everything is the fundamental idea of your business.

Front and centre, what problem does your business solve? It is important to be clear about this and not to make the mistake of overdoing the slide on your pitch deck that covers this, making it seem as though the problem is being ‘fluffed up’.

Airbnb’s seed pitch deck covered their problem in three key points, addressing:

Getting your solution in one line is important.

Be prepared to iterate time and time again over this, ask for opinions, and potentially enlist the help of some experts to get this right. It’s the one part of your business that is (in most cases) not going to change. When an investor takes your deck in front of an investor committee and pitches your idea, this is the first hurdle, so make it as simple as possible for someone else to explain your idea to others.

Once you establish that the business solves a problem, the investor will want to know how common the problem is and how many people are prepared to spend money on solving it. ‘Market opportunity’ can be split into two parts: market validation and size of opportunity.

If your business has competitors in the market, this demonstrates that customers are willing to pay for a solution to their problem. If a business has no competitors, investors will want to know why: it may be that your business is genuinely novel and game-changing – but it could be a solution looking for a problem with limited appeal.

Ideally, a business that seeks investment will have indirect competitors who are trying to solve the same problem, but in a different way. For example, a bulletin board such as Craigslist provided the opportunity to rent out and monetise properties, demonstrating that people were willing to do such transactions on the internet. Airbnb created a better way of doing this after the market had already been validated.

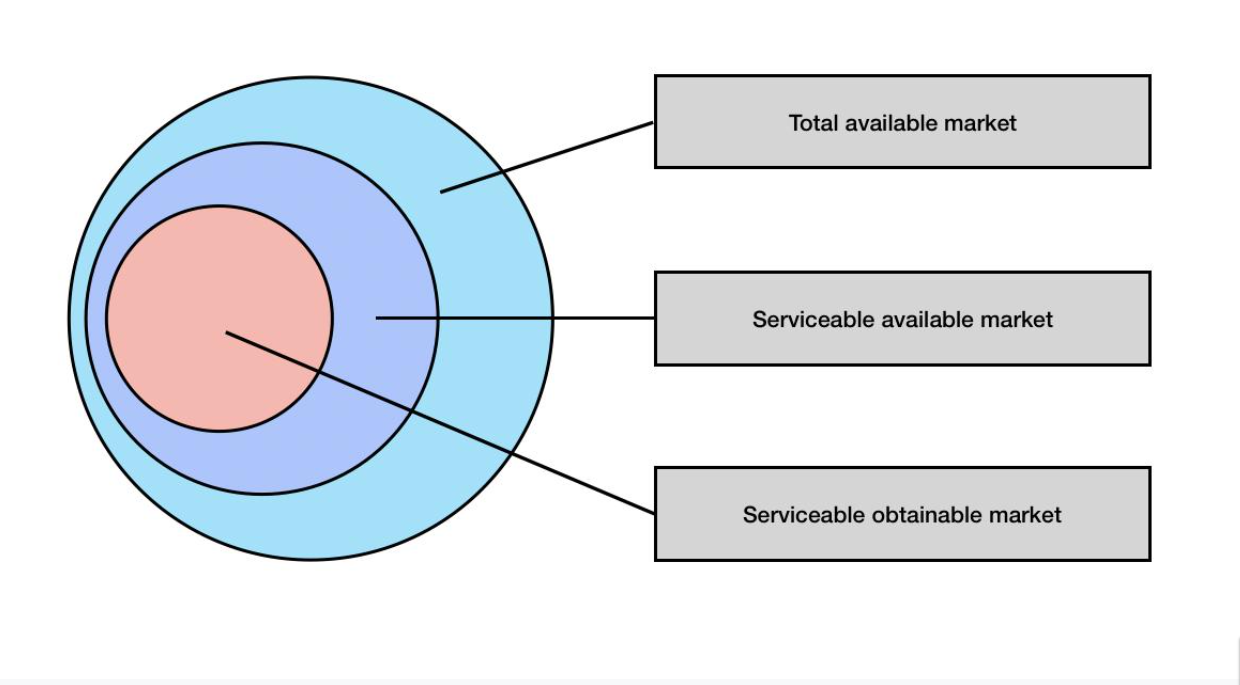

The solution may be better, but will people want to use it? Analysing the size of the potential market is important to the investor and there is a formula for estimating this potential, known as TAM, SAM, and SOM which stand for:

TAM: Total Available Market is the total market demand for a product or service. This can often be hardest to quantify. Airbnb’s TAM is ‘anyone wants to share their space’, which is obviously massive.

SAM: Serviceable Available Market is the segment of the TAM targeted by a business’s products and services which is within that company’s geographical reach. The internet can extend this reach: Airbnb’s SAM would therefore include any internet user who is able to access their website or app.

SOM: Serviceable Obtainable Market is the portion of the market a business can capture in the short term. This is the figure on which investors are largely basing their decision. At this point, founders should be ambitious but not unrealistic in their projections as you need to demonstrate a clear strategy to deliver on this ambition (or at least, come close).

SOM is often shown at different points in time, so your estimated SOM in two years might be £3m, growing to £14m in year five based on certain assumptions.

Finally, consider scalability: could your business easily open another branch in a different town or country? If your customer base doubled, would you be able to meet the demand? Many startups are self-limited in how much work they can carry out; an investor who wants to multiply their investment by a factor of ten will want to know that this capacity can be expanded.

How will your business execute your idea after validating the opportunity? Investors are betting on the founder to be the best leader of the business, but also that the team will support them.

Investors don’t just back an individual, they back teams.

While many businesses are founded by an individual, a growing business needs a team to scale. Having the right co-founder and team behind you is vital.

A well-balanced team will be able to meet the diverse needs of a business, from attention to detail in accounts to the blue-sky creativity in marketing. A business should be able to show that there are employees, advisors or mentors who can support the founder.

Those first hires should cover the areas that the founder cannot do themselves, whether because they don’t have the skills or the time, such as: Website design, sales, marketing, accounting and bookkeeping, and the fundraise management itself, among other roles which require specialist skills.

Think of the pitch deck as your CV and just like a CV, there are certain expectations on what should be in it. Your pitch deck should be between 10 and 15 slides, with a limited amount of text on each slide. Keep it snappy and to the point.

Investors view hundreds of pitch decks every week, so leave out the jargon and buzzwords, and don’t waste their time: investors should be able to tell what your business does and the problem it solves within the first three slides.

Investors may make a fast decision whether they want to go ahead with meeting a founder or moving on to another opportunity. It is very easy for them to say “no” so how do you get them to say “tell me more”?

This is also a good time to think about the raise size (ie. how much money you are asking for) and valuation (how much your business is worth): consider other businesses in your space and what they raised at a similar stage to you. If you are raising more or asking for a higher valuation, be able to justify this with a breakdown of your planned use of funds, how long this money will last and a timescale for your next raise (this is called the ‘runway’).

Anthony RoseTo show your ambition, you’ll need to go beyond an inspiring vision statement. It’s about creating hype through numbers – the real, grounded kind of hype that makes investors feel excited and confident that the goals can be achieved.

But if you’re not ambitious enough, an investor might see it as a ‘hobby business’. Your five year business plan needs to include financial projections that show a steady, exponential increase in your revenue – which means the same for the return on their investment.

CEO and Co-Founder,

Lastly, design and branding are key to attracting attention: do not underestimate the impact of a pitch deck that is easy on the eye and free of spelling, grammar or formatting errors (tip: export your deck to a PDF as it may look different on different computers).

Review and proofread your deck, pitch it yourself to someone you trust and iterate until it’s perfect. Don’t crowd the slides with words; the pitch deck is not the place for detail, it’s for prompting the investor to want to know the detail.

“We love your idea but come back when you have some traction.” If this is something you’ve heard before, you’re not alone. But what is traction?

Traction is tangible evidence of demand for your product or service. Investors are not going to throw their cash at a pitch deck alone: you should have a Minimum Viable Product (MVP) and evidence that there is demand for this product. If you don’t have products to show with screenshots or a demo within your deck, you’re probably not ready to be pitching. There are exceptions, such as products which require big capital investment to be built, but generally, investors need to see the idea in action.

From an investor’s perspective, ideally, you can show some revenue as revenue growth is their number one priority.

If you’re a pre-revenue business, think about other ways in which you can show growth and make it easier to attract attention and investment, such as user growth and milestones achieved. If you can show that your user base is growing rapidly, this may convince some investors to back your venture and get it to the revenue stage.

Consumer product businesses should be able to show proven sales and rapid growth whereas a SaaS business might need a lot more initial investment to reach this point. User testimonials are another great way of showing genuine demand for the product: enthusiasm and loyalty from customers is very attractive to an investor.

Know your cost of acquisition of customers (CAC) and the lifetime value (LTV) of those customers, or the return you get on your marketing spend. Investors want to see your CAC/LTV ratio declining ideally before they invest.

SeedLegals sat down with Swoop to discuss how companies can demonstrate traction to investors even when they’re pre-revenue. Check out the webinar:

Finding the right investor for a business is a bit like dating: you may have to kiss a few frogs before you find your prince. Taking the right approach, however, should mean that you’ll have to deal with fewer frogs and may even be in the position of picking which prince to go home with.

Ultimately there are no guarantees, but if you see your business through the eyes of an investor, you can take actions that will make your operation much more attractive to the people holding the purse strings.