Share Transfers

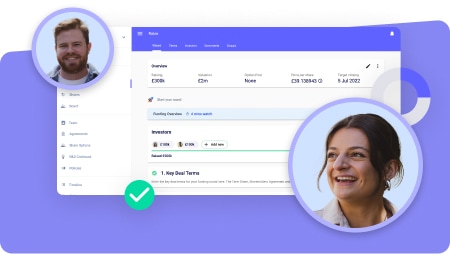

Transfer shares to anyone, anywhere

The fast way to do a share transfer online, all in one simple workflow.

Online share transfer service

Transfer from existing shareholders to anyone

It’s easy to invite the new shareholder to sign. Simply add their email address and they'll go straight to the documents they need to sign.

Fast and easy workflow

All the documents you need

New owner added to your cap table

Unlimited help with share transfers

Chat online anytime with our experts

Need some help? Not sure how to get started? Our share transfer workflow features built-in guidance but if you need any help, our expert team is here to guide you through.

Talk to us your way - chat, phone, email, video call

Unlimited help included - no extra cost

Ask us anything - we're here 9am to 6pm Monday to Friday

How to transfer ownership of shares

FAQs - Share Transfers

Frequently asked questions about transferring ownership of shares

What is a share transfer?

A share transfer is the process where you hand over legal ownership of shares in a company. You’ll sometimes hear it called a ‘stock transfer’.

In a share transfer, you’ll either sell the share to the buyer, or gift them (give them for free).

You can’t just give a share certificate to the new owner - you have to complete the proper legal formalities.

Not that long ago, to do a share transfer you and the person you’re transferring to had to go into a lawyer’s office to sign. Not any more - with SeedLegals, you can do the whole thing online for just £290 +VAT.Does the company need to approve a transfer of shares?

Yes. That’s why you need to get the Board Resolution signed - it‘s the official permission that you can go ahead with the share transfer.What are the documents required for share transfer?

The documents you’ll need for a share transfer are:- Share Purchase Agreement

- Preemption Notice

You only need this if other shareholders have preemption rights. - Deed of Adherence

You only need this if the buyer is not already a shareholder - Board Resolution

- J30 Form

- Share Certificate

For more detail about these documents, see: How do I do a share transfer on SeedLegals?How long does it take to transfer shares?

It depends. Because you need to get company approval to transfer the shares, it can take up to a few weeks. If you use our online share transfer and you have everyone lined up and ready to sign, you can complete a share transfer in one day.How do I transfer shares in a private limited company?

With SeedLegals, it’s quick and easy. See: How do I do a share transfer on SeedLegals?Where can I see my company’s Share Certificates?

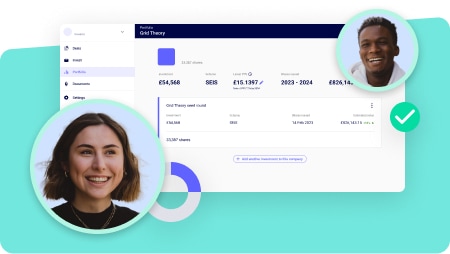

Log in and go to Shares > Share Certificates to see your company’s up-to-date share certificates. You can share or download them anytime.How do I do a share transfer on SeedLegals?

First of all, are you sure it’s a share transfer you need? If you want to give shares to a co-founder or team member, and your company doesn’t yet have investors, it might be easier to create new shares for them instead of transferring yours. If you’re not sure what to do, hit the chat button to message us.

It’s easy to do a share transfer on SeedLegals. Our service costs £290 + VAT - with unlimited help included - but you can get started for free.

You’ll only need to pay for a share transfer if you need the legal documents. If you want to use Share Transfer to update your cap table to show a transfer you’ve already done, or do a transfer that doesn't need any documents, it's free of charge. See: How do I show an existing share transfer on my SeedLegals cap table?

- Get started

Log in and go to Shares > Share Transfers > New Share Transfer - Enter the transfer details

Follow the prompts. First, select the Seller, who must be an existing shareholder in your cap table. Then select the Buyer - you can choose from your existing shareholders or set up the person or company as a new SeedLegals user. The Buyer can’t be your company because this requires a different procedure called a share buyback. - Generate the documents

All the documents are automatically filled with the Seller and Buyer’s details.- Share Purchase Agreement

- Preemption Notice

You only need this if other shareholders have preemption rights. - Deed of Adherence

You only need this if the buyer is not already a shareholder - Board Resolution

- J30 Form

- Send shareholders the Preemption Notice

You only need to do this if you have shareholders with preemption rights on a share transfer (different to preemption rights on allotment). If you’re not sure, just ask us. - Sign the Share Purchase Agreement

You can ignore this document if you are giving away your shares for free - Sign the Deed of Adherence

The Deed brings your new shareholder within the terms of your existing Shareholders Agreement. Because it’s a deed, it must be witnessed - here’s how. You can ignore this document if the buyer is an existing shareholder. - Get board approval

Get your board to approve the Board Resolution. This is the permission you need for the transfer. - Sign the J30 Form

The share transfer goes into your next annual Confirmation Statement (CS01). You don’t need to file any of the share transfer documents now. - Approve the transfer

When all the documents are signed, hit Approve share transfer - this applies the transfer to your cap table. - Sign and send the new Share Certificate

The share transfer annuls (make invalid) the share certificate of the original shareholder and creates a new Share Certificate for the incoming shareholder.

If the new shareholder paid more than £1,000 for the shares, then they’re probably liable to pay stamp duty. For full details including how to pay, read this page on the gov.uk website.- Get started

How do I show an existing share transfer on my SeedLegals cap table?

You can use Share Transfer to update your cap table to show an existing transfer. It’s free of charge on SeedLegals.- Get started

Log in and go to Shares > Share Transfers > New Share Transfer - Enter the transfer details

Follow the prompts. First select the Seller, who must be an existing shareholder in your cap table. Then select the Buyer - you can choose from your existing shareholders or set up the person or company as a new SeedLegals user. - Skip the documents

You don’t need the documents because you’ve already done the transfer. - Approve the transfer

Hit Approve share transfer to apply the transfer to your cap table.

- Get started

How do I create a Confirmation Statement (CS01) on SeedLegals?

- Log into SeedLegals and go to Shares

- Click Confirmation Statement and follow the prompts

The CS01 is auto-filled using information from your cap table.

To use our board management tools, including the CS01 generator, you’ll need to be on a Standard or Plus membership.Can I transfer shares to someone as a gift?

Yes, you can transfer shares to another person or to a company or charity. You’ll still need to carry out the share transfer legal process.

Read more about transferring shares as a gift, including the tax implications and tax relief in our article: Share transfer – tax and tax reliefCan I transfer shares to my wife / husband / partner?

Yes, you can usually transfer shares to anyone. But your Board might have the right to refuse to register a share transfer to a bankrupt, a minor or a competitor, depending on what’s written in your company’s Articles.

Whoever you are transferring shares to, you’ll still need to carry out the share transfer legal process. Read more about transferring shares as a gift, including the tax implications and tax relief in our article: Share transfer – tax and tax reliefDo I pay tax when I sell or transfer shares?

It depends. There’s tax relief available on some types of share transfer. Take a look at our article about the tax implications of transferring shares in our article: Share transfer – tax and tax reliefDoes the person I’m transferring shares to have to pay tax?

It depends. There’s tax relief available on some types of share transfer. Take a look at our article about the tax implications of transferring shares in our article: Share transfer – tax and tax reliefWho pays the stamp duty on transfer of shares?

The buyer is responsible for paying the stamp duty, if it applies to the share transfer.

For more about stamp duty when you buy shares, visit the gov.uk websiteHow much should I pay to do a share transfer?

You no longer need a lawyer to do a share transfer. You can use SeedLegals to quickly transfer shares to anyone, anywhere.

It’s fast and straightforward, and everything happens online. No need to meet the recipient in person or post them paper share certificates.

To get started, log in or register, go to Shares in the left menu. Then follow these instructions to do the share transfer.

If you need any help, hit the chat button to message our experts.

You’re in safe hands

Our team of legal and funding experts have helped thousands of entrepreneurs raise money and grow their businesses.

Beautifully organised

Your company's core agreements, all in one place

Secure signatures

Share and collect signatures online via SeedLegals

Backed by real lawyers

Create the exact documents you need at every stage of growth

Serious about security

Your information stays safe and confidential in our secure system

Helpful humans

Talk to one of our friendly team anytime on live chat

Extra protection

Don't worry, our insurance covers claims related to our platform

We’ve helped over 60,000 companies

From food to FinTech and beyond, join thousands of startups who use SeedLegals to start, raise and grow faster.

More customer stories