SeedLegals Deals: Invest in great UK startups

For investors, SeedLegals Deals gives you access to vetted startups raising investment now. For founders, SeedLegals Dea...

Preparing to make an angel investment? Before you hand over a chunk of money to a passionate founder with a cool idea, make sure you’ve got all the information you need to make an informed decision.

We’ve asked industry experts to share their top questions to ask founders to gain a good understanding of a startup’s potential for success.

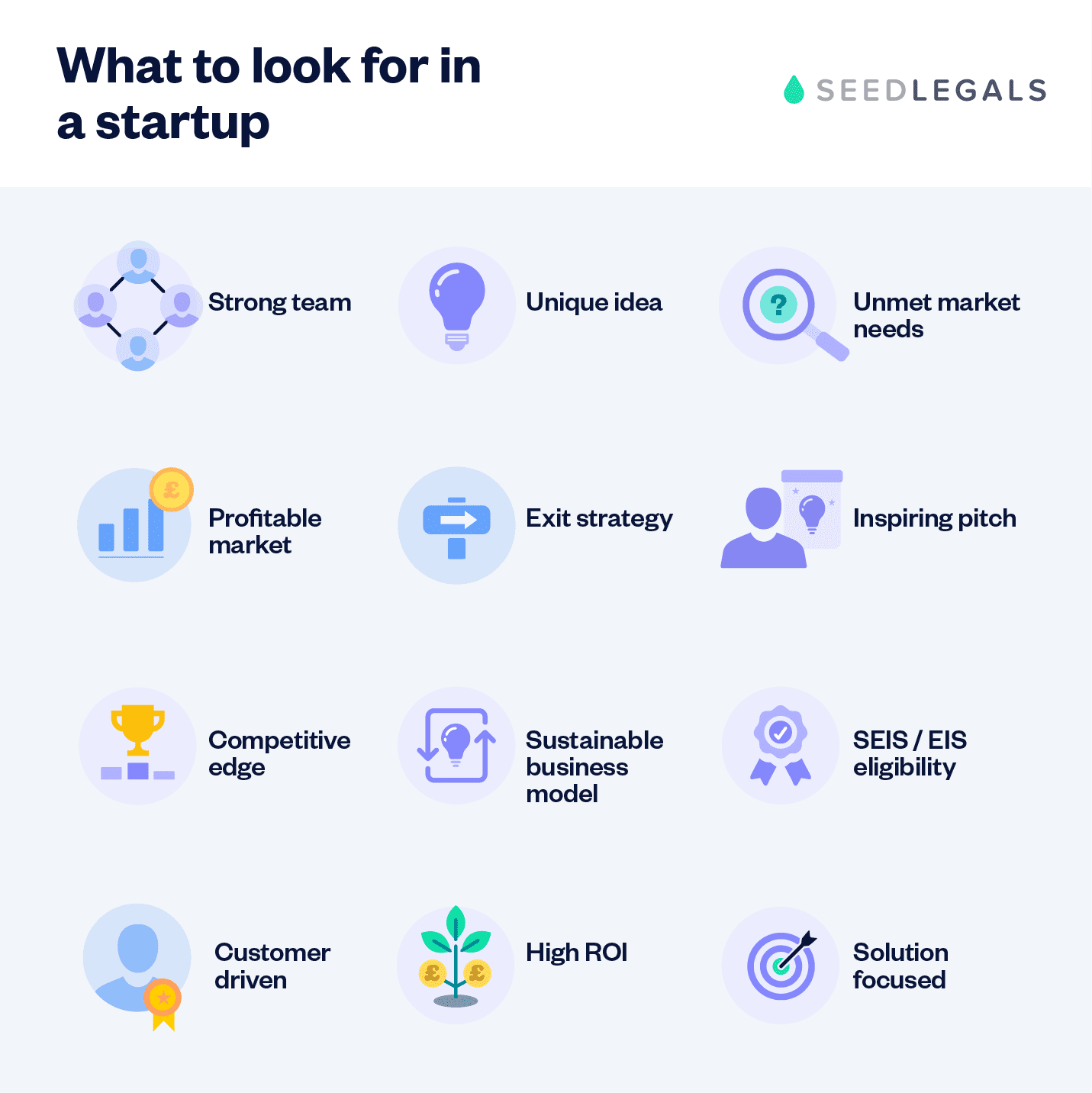

Based on conversations with hundreds of investors and successful founders, these are our top green flags for a startup investment 👇

A startup’s success not only depends on the market potential and business model, but equally important – if not more- is the team. If you’re going to invest in a company, make sure you believe in the founder and team. Ask questions that give you insight into who the team is, what their skills and expertise are and if the founder has a level-headed mindset geared towards success.

Jonny SeamanI always ask about the team because I want to have a good understanding of the industry knowledge they have. I’m looking for them to demonstrate that the people behind the idea understand their industry and market. It’s important for me to trust a startup’s leadership team to achieve success before I make angel investments, and I know it’s the same for other investors I speak to daily.

Investor Partnerships Manager,

Eva DobrzanskaMaking an investment decision at the early stages can often feel unsubstantiated as there are few metrics to go by. What you want to test for instead is:

1. viability of the business model

2. credibility of the financials and go-to-market strategy

3. resilience and founder-market fit on the part of the team.The best Questions to ask Founders are those that stress-test their ideas and assumptions.

Personally, in my early stage investments, I don’t want founders who are pitching the next Unicorn to me, I want founders who show me a solid plan on how they will survive and grow the first 5 years in business.

Investment Manager,

Eva Dobrzanska is an investment manager at Sixth Wave ventures. She’s a seasoned expert in understanding how to select good investment deals. Here are the top questions she asks founders.

Tell me about your go-to-market strategy:

(i) What are the different distribution channels you will utilise to reach your target market?

(ii) How many users/customers/clients do you expect to come from each, and at what cost per acquisition (CAC)?

(iii) How will you reach your first 1000 users, or first 10 paying clients?

✅This question helps you understand the founder’s path to monetisation and growth. A robust go-to-market strategy with many diversified channels is great, but you also need to know how equipped they are to actually deliver on their plans.

How many people are on your team? How many full-time? Are they enough to deliver on your go-to-market strategy?

✅This question helps you understand how prepared the founder is to deliver on their growth strategy. Ask them if they’ll need to hire more team members, who the key hires will be and why.

What happens to your business model if you do X (eg take away Ads?), or ‘what is your strategy if X channel does not perform as well as expected?

✅This question helps you stress-test the viability of the business model and understand if it’s agile enough to adapt when things change in the market.

What are the key risks to your business?

✅This question helps you understand how level-headed and realistic the founder is. You want to invest in a company that knows – and can prepare for – the risks it faces.

Kritika AmarnathA major green flag is a founder who cares about the customer journey and experience. Are the founders willing to listen to feedback from their customers? Are they prioritising customer satisfaction? The happier the customers of the company, the more of an advantage it’s at to succeed

Founder,

Kritika Amarnath is a seasoned financial executive and angel investor with experience across capital markets and early stage advisory. Below are her top recommended questions to ask founders.

What does your customer traction look like?

✅ This question helps you understand if the product/service is actually wanted by customers. Evidence in the form of customer feedback, surveys and demos really helps. High demand and customer satisfaction is a good sign.

What are you fundraising for? Marketing? Product development? Hiring?

✅This question helps you understand what your investment money is going towards. Do you feel good about how it’ll be used?

Who is your competition and what are the barriers to entry?

✅This question reveals how much a founder understands their market and what differentiates them from competition. Competitive analysis is a sign of maturity in a founder and shows an interest in identifying blind spots.

Rarely is any product truly novel and new. If it is, make sure to ask what patents/protections/moats they have in place.

Aaron DukeStart with ‘Explain your startup to me like I’m a seven-year-old.’ This helps you understand how the idea will translate in the market for customers. If you as an investor can’t understand it, how will the customers?

Account Associate,

Aaron is an Account Manager at SeedLegals and previously worked as a partnerships manager at top VC fund Seedrs. After being immersed in the startup funding and investing ecosystem for years, these are the top questions he’s learned are important to ask.

What is your unique selling point (USP)?

✅ This question helps you understand what edge this product has, and if it’s solving a real problem. It’s one of the most common question investors because you need to understand if there’s something that’ll drive customers to buy from this company.

What is your protection? Why can’t just anyone create this?

✅ This question helps you get a better understanding of how much the company will be able to stand out in the market. The more protected they are, the more they’ll stand out. This includes IP, patents and moats, but also things like the expertise and experience amongst the team.

Manage your investments with ease, browse hot, hand-picked startups to invest in and sort S/EIS in a few clicks with SeedLegals for Investors. To learn more, book a free call with our team or start your seven-day free trial now.