How much should I pay my team? UK startup salaries revealed

As a founder, getting your team’s pay right can feel like a guessing game - but it doesn’t have to be. In this post, we...

You’re the founder of a startup. You’ve put your heart and soul into the venture these past 3 years, initially for no salary at all, and then for a modest salary, well below what you could earn working for a bank.

Finally, all that hard works begins to pay off, it’s time to do your Series A at a valuation of a few million pounds. You have 30% of the company’s equity, now’s the time to sell a few shares, pay off the mortgage, buy that Ferrari.

Even better, since you own more than 5% of the shares you’re eligible for Entrepreneurs’ Relief, which means you pay just 10% capital gains tax on the sale of yours shares, one of the many amazing tax breaks the UK government provides to fuel the UK startup ecosystem.

Problem is, you can’t sell your shares, because your previous funding round deal documents most likely includes provisions specifically to prevent you doing just that.

So, let’s take a step back, see why that is, and how SeedLegals is helping change that.

When investors invest in your company, one of the first things they’ll tell you is that they’re investing in the founders. They know it’s going to be a winding road ahead, with the product that eventually takes off bearing little resemblance to the original pitch deck. They’re putting their faith and their money in the founders to turn that idea into a success. Initial idea didn’t gain traction? No problem, they knew that, the first release rarely takes off. They’re betting on the founders to figure it out and iterate until they get product/market fit.

So, to ensure the founders stay with the company and don’t bail when things get tough, the Shareholders Agreement and updated Articles of Association that are agreed in a funding round will contain a set of provisions that prevent the founders from selling their shares without the consent of the investors or shareholders.

But, what if you could agree up front that the founders could sell some of their shares…

Back in one of my previous startups, my then business partner knew all about this (I had no idea about this back then) and had the foresight to build into our deal terms

that the founders could sell up to 10% of their shares without needing investor consent. That turned out to have been a genius idea, allowing us to sell hundreds of thousands of pounds of our shares at just 10% CGT when the right opportunity arose.

At SeedLegals, our goal is to democratise knowledge like this, allowing founders and investors to get full and transparent access to knowledge and data that hadn’t previously been widely available, to provide all parties with benefits that previously only a select few knew about or understood. In this case it’s allowing founders to take advantage of the 10% Entrepreneurs Relief well before an exit event, in other cases it’s to provide investors their SEIS and EIS tax benefits, including a little-known Liquidation Preference provision – more on that here.

So, when you do a funding round on SeedLegals, you now have a 1-click option to allow founders to sell some percent of their shares. This provision goes into the Term Sheet and the Articles, so that it’s fully disclosed and agreed with the investors up front.

We think that allowing the founders to sell up to 10% of their shares is the right compromise between allowing the founders to get early value from the success of the business vs. protecting the investors’ interests, and that’s what we show as the default.

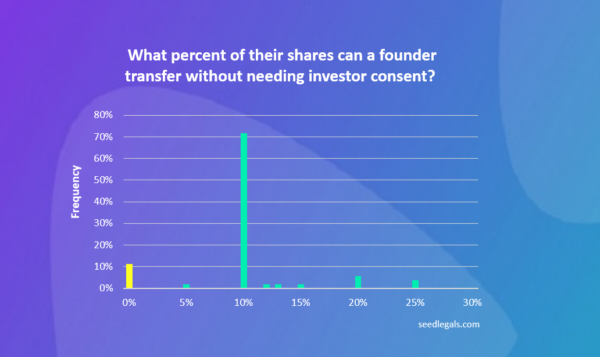

So, after providing this feature over hundreds of funding rounds, we took a look at our data to see what percent of the time investors were allowing this (it’s really at their discretion) and what % shares founders were asking to be able to sell without permission.

As you can see, 90% of the time investors agree with this, so long as the percentage of their shares that founders are able to sell is reasonable, usually 10%.

We were delighted to see this. Deciding to use SeedLegals for their funding round is giving founders hundreds of thousands of £ potential value, for something that few people knew about, and no law firm would propose for you (because, well, they’re there to do what you ask, not what you didn’t know to ask).

Note that when you sell your shares in this way, you’ll need to offer them to other shareholders before offering them to a 3rd party (known as a right of first refusal), giving the other founders and shareholders the right to buy shares from selling founder before they get sold to strangers. That’s a standard provision that protects investors from losing control of the company without being given the option to buy those shares first.

If you have any questions about how to implement this provision or are interested to hear more about how SeedLegals can help you with your funding round, just press the chat button and we’ll be more than happy to take you through everything.

This forms part of our SeedLegals Deal Data series, keep browsing for more. If there are any other deal points you’d like to see data on, let us know.