Series A funding: guide for startup founders

How to raise at Series A - probably your first round with VC investors. Where to find investors, what documents you need...

Series B funding – if you’ve made it here, you’re playing in the big leagues. You’ve made it through Pre-seed, Seed, Series A and now you’re on to your second round of venture capital funding. Your business is likely thriving and you’re ready to expand – big time.

In this article, we’ll cover the definition of Series B funding, how it works, how to raise a Series B round, and the challenges associated with it. We’ll also recommend some VCs in London you could approach for Series B funding. Let’s go.

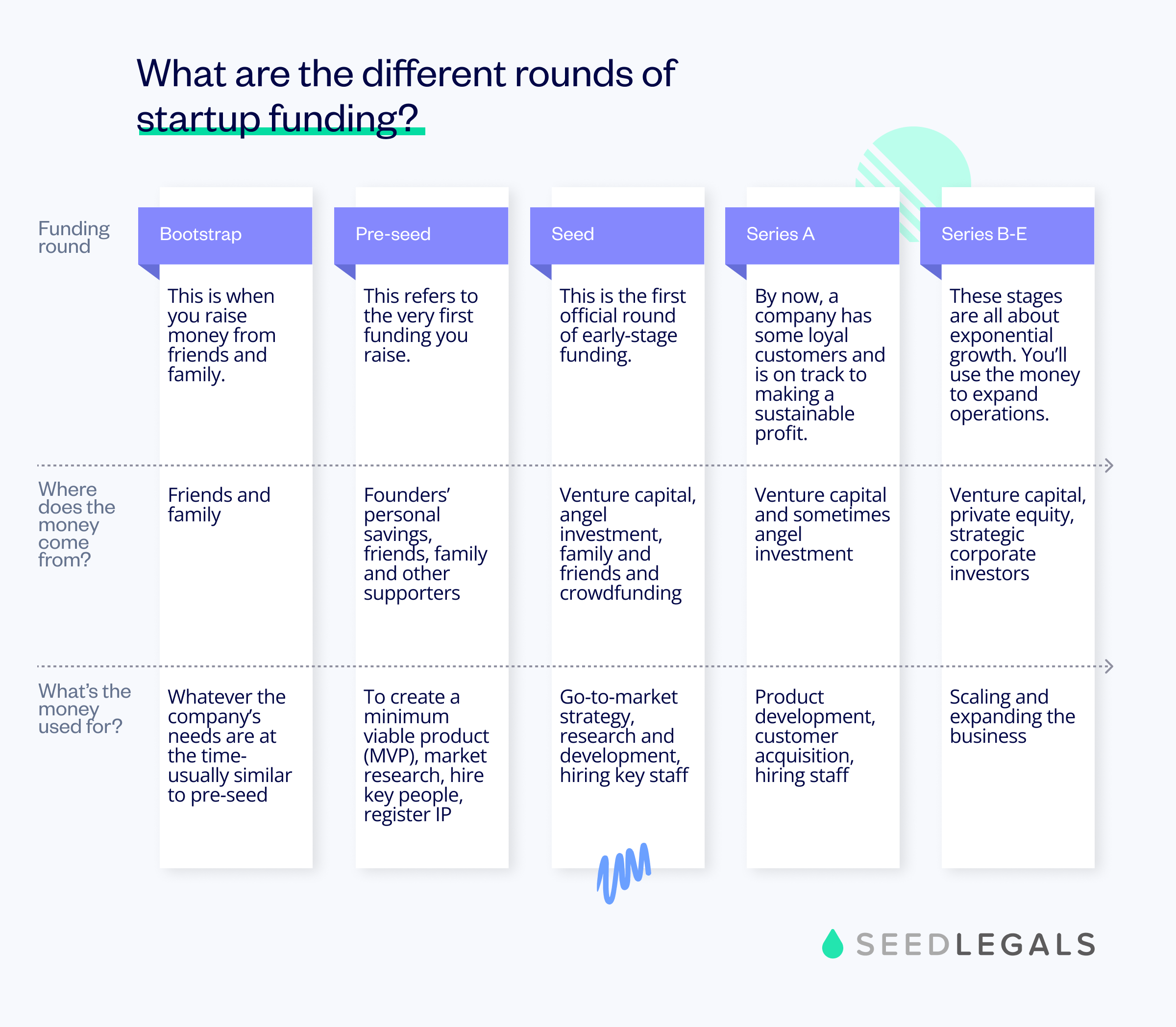

Series B funding is generally the second round of venture capital funding and the next step after Series A (read Series A funding: guide for startup founders).

By the time your company is ready to raise Series B, you’ll have usually:

The amount raised during a Series B round is usually £10m – £50m. To raise this amount, your company valuation for Series B funding could be from £35 million up to as much as £1 billion, especially if you’re raising in the US.

The money raised at Series B is often used to:

A series B round commonly lasts 6 to 12 months, and 3 months at a minimum.

Series A vs Series B

The way Series A and Series B funding rounds work is largely the same. There are two key differences between Series A and Series B:

Before you start raising Series B funding, it’s important to get everything in tip-top shape so your company looks attractive to investors.

Jonny SeamanGet investment ready and make sure the company looks healthy going forward. Series B investors will expect a return, so they’ll be looking for a £250m+ exit to make it worth their while. Prove that you really intend to build a company ready for a large exit or IPO.

Funding expert,

To get investment ready and begin your Series B round, you can follow the steps below. Every company has a unique journey, but these are the usual steps:

After the round has closed, the goal is to scale, scale, scale. Ask yourself what you need to do and who you need to hire to turn your company from an £80m company to a £1 billion company. Work with your investors, finalise the plan, then get your head down to hit the numbers every month until you find yourself ringing the bell at the stock exchange.

The legals in a Series B round are far more bespoke and heavy-weight than a Seed or Series A round. You’ll most likely need to work with an experienced venture capital lawyer and the legal fees can often be as high as £100,000+.

The main funding documents you’ll need for your Series B funding round are:

The best place to start finding investors for Series B funding is by reaching out to your Series A lead investor to ask about other companies they co-invest with.

Given how big these rounds can be, most of the major Series B+ players can be found after briefly scrolling TechCrunch. While there are firms in every geography, many are found in Silicon Valley, so it may be worth buying a plane ticket and attending a few events and conferences out there.

Here are a few more ways you can meet Series B VCs:

Be ready with your elevator pitch – you never know when or where you’ll bump into someone who could become your next investor.

Venture capital firms provide Series B funding. It’s a good idea to investigate whether the firms that invested in your Series A round can invest in your Series B round too. Here are some top VC firms in the UK for Series B funding:

More money, more problems, right? Series B is known to be one of the more challenging funding rounds. As the amount invested is larger, there’s more on the line.

Jonny SeamanRemember you’re negotiating over large amounts of money, so the stakes are high and as a consequence, expect a longer raise with multiple VCs. Series B rounds can be a challenge to conduct if the revenue / growth numbers aren’t pointing in the right direction, so step one is to get your house in order.

Funding expert,

The challenges that come with Series B funding include:

SeedLegals was designed to help founders overcome these challenges. If your legal process is streamlined, you can save time and increase your ability to overcome the challenges associated with raising big rounds like a Series B. Our automated workflow for creating, negotiating and signing legal documents combined with our Advisory service makes the legal side of your fundraise much more efficient.

A traditional Series B funding round can take from 6 to 12 months from start to finish. But there are alternative ways to raise the financing you need:

Raise before a round with SeedFAST

SeedFASTs are ‘advanced subscription agreements’. An investor gives you money now in exchange for shares in an upcoming funding round. For a SeedFAST, you don’t set a company valuation.

MORE: SeedFAST – how ASAs work

Use a SeedNOTE for more complex deals before a round

If an investor wants interest or a return of capital, you can use our convertible loan note, SeedNOTE.

MORE: SeedNOTE – how convertible loan notes work

Top up after a round

With SeedLegals you can build into your funding round the ability to top up the round to an agreed limit after the round is closed without needing to get further consent from your existing investors. This is particularly useful when most of your investors are ready to sign but one or two need more time.

Then, after the round is closed (and you’ve got the money from the round investors), you can then use an Instant Investment with additional investors to top up the round.

Want to know if SeedLegals could help you with your Series B round? Or not sure whether to try agile funding or start a full funding round? Book a free call with a funding strategist to get your questions answered, fast.