Update for accounting periods starting on or after 1 April 2024

The information on this page applies to accounting periods starting before 1 April 2024.

If your accounting period starts on or after 1 April 2024, a new merged R&D scheme is now in place.

👉 Find out what’s changed and how it affects you In 2021, we launched our R&D Tax Credits service to help founders claim money back they’ve spent on research and development.

R&D tax relief is an HMRC initiative that pays your company back up to 33% of what you spend on qualifying activity for research and development. You get the money back in the form of Corporation Tax relief or, if you’re a loss making company, as a tax credit (that is, a cash payment). You can now make your R&D claim with SeedLegals.

Let’s answer some of your questions

Am I eligible for R&D tax relief?

For how many years can I claim R&D tax relief?

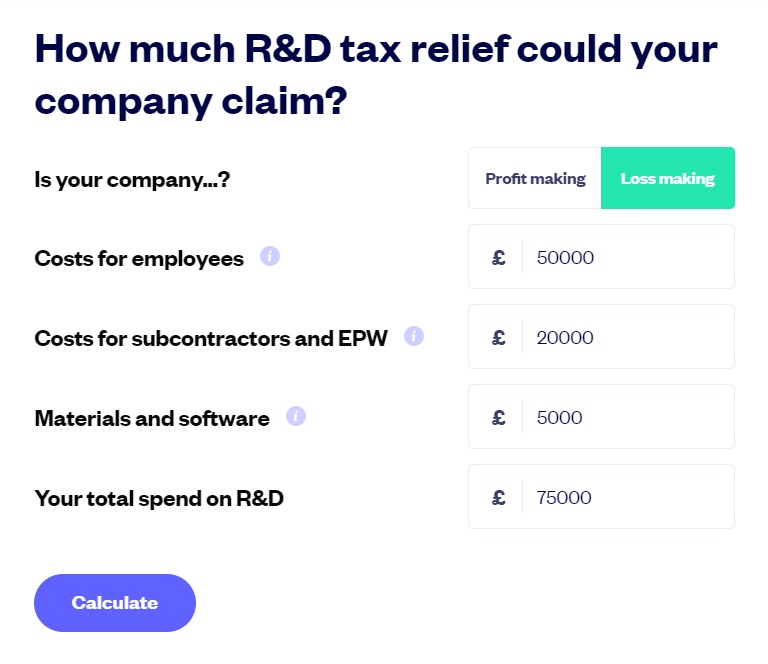

How much R&D tax relief could your company claim?

How to make your R&D claim with SeedLegals?

Am I eligible for R&D tax relief?

Maybe! It isn’t only tech companies that qualify for R&D tax relief. As long as your company is innovative, you could be eligible.

To find out if you’d be eligible for tax relief, book a call with us. Our team includes specialist accountants and lawyers – you’ll speak directly with one of our experts.

For how many years can I claim R&D tax relief?

You can claim R&D tax relief retrospectively for the previous two accounting periods.

How much R&D tax relief could your company claim?

To find out how much your company could claim, try our quick calculator »

How to make your R&D claim with SeedLegals

As you’d expect, we’ve made it as easy as possible to create a comprehensive and accurate claim.

Here’s what happens:

- Log in to get started

If you’re new to us, setting up an account is quick and easy. - Create your Technical Narrative

This is the core of your R&D claim. The Technical Narrative is your ‘story’ where you tell HMRC about your company and your R&D projects. Follow our online guidance to structure your narrative. We prompt you to include information about advances, technical uncertainties and resolutions, and to describe the people involved in your projects. Our R&D experts are on hand to help. - Connect to Xero and automatically add your costs

We make it easy to add all your relevant expenditure to your claim in a few clicks. On SeedLegals you can connect straight to your Xero account and automatically pull in eligible costs, including employee salaries and payments to subcontractors. - Upload your company accounts

When you’ve uploaded your most recent company accounts, all the data for your claim is stored securely on our platform. Next you’re ready to… - Submit your claim for review

Our R&D experts thoroughly review your claim. We don’t just check it’s 100% correct, we’ll maximise what you get back. We’ll get back to you within three business days with our detailed report. If we have any questions, we’ll be in touch before that. - Send to HMRC

When we’ve completed our review and you’re ready, submit your claim to HMRC.

That’s it! All you need to do is wait for the response from HMRC. You’ll usually hear from them in four to six weeks.

R&D Tax Credits

R&D cashback calculator

How much R&D tax relief could your company claim? Find out with our calculator.

Go to calculatorJonathan Prezman

Jonathan manages our R&D Tax Credits service. He's an ex-founder himself, and a qualified lawyer.