SeedFAST is the new Seed Round

On SeedLegals, more companies now raise money outside a funding round than inside a round. We explain what's happening a...

SeedFASTs are the UK market standard way to raise investment before a funding round. They’re our version of the popular Advance Subscription Agreement (“ASA”), with extensions for SEIS/EIS compatibility and more.

In this post, we explain the four key deal terms in a SeedFAST and dig into our data to help you pick the perfect terms for your SeedFASTs.

SeedFAST is the SeedLegals name for an Advance Subscription Agreement (ASA). They’re used to take investment before a funding round, and they’re quick and easy to create on SeedLegals.

Instead of rounding up all the investors to fill out a funding round, agreeing a valuation with them and doing all the legal paperwork, SeedFASTs allow you to raise when the opportunity arises. You can defer the valuation discussion and the complex legal documents (Term Sheet, Shareholders Agreement, Articles) until later.

Basically, a SeedFAST is an agreement that says “You give me money now, and I’ll give you shares when I do my next funding round. To incentivise you to give me the money now, I’ll give you a, for example, 10% discount compared to the valuation the investors will pay in my next round. And, if I don’t do that funding round within (typically, for SEIS/EIS compatibility) 6 months, then your investment will convert into shares at a valuation of, for example, £3,000,000”

SeedFAST agreements have four key deal terms:

When you and the investor have agreed on these terms – and how much they’re investing of course – it takes just a few minutes to create a SeedFAST on SeedLegals. Turnaround times on the investor side usually takes only a few days.

The big question then is… what’s market standard for these deal terms? Should you offer investors a 20% discount, or is that way too much?

Based on a sample size of 12,000 SeedFASTs completed on SeedLegals (we did say they’re popular!), we put together some data to help you choose your terms wisely, and also help in any negotiations with your investors. Point them to this article, if it’s helpful.

For our data analysis, we grouped SeedFASTs into three buckets:

| Size | Investment amount per SeedFAST | % of SeedFASTs |

| Small | less than £20K | 66% |

| Medium | £20K to £100K | 28% |

| Large | over £100K | 4% |

You can see that the majority use case for SeedFASTs is doing multiple SeedFASTs for smaller investment amounts.

That said, we’re also seeing rapid growth in large-value SeedFASTs. In fact, we think SeedFASTs are the new Seed round.

The next thing is the longstop date – that means if you don’t have a funding round before this date, then the SeedFAST will convert at the longstop valuation that you agree with your investor now.

HMRC require that for an advance subscription of shares (i.e. a SeedFAST) to be SEIS/EIS compatible, the longstop date has to be no more than 6 months. That’s quite short, you’d normally want a longstop date of 12 months or more so you can use the funds to grow the business and then raise again when you’re ready, but those are the HMRC rules.

That means SeedFASTs with 6-month longstop dates are likely to be SEIS/EIS investments. From the popularity of SeedFASTs with a 6-month longstop date, it’s clear that SEIS/EIS investments fuel early-stage funding rounds.

| Longstop date | % of SeedFASTs |

| 6 months | 74% |

| 12 months | 14% |

| 18 months or more | 12% |

With that as the background briefing, on to the results.

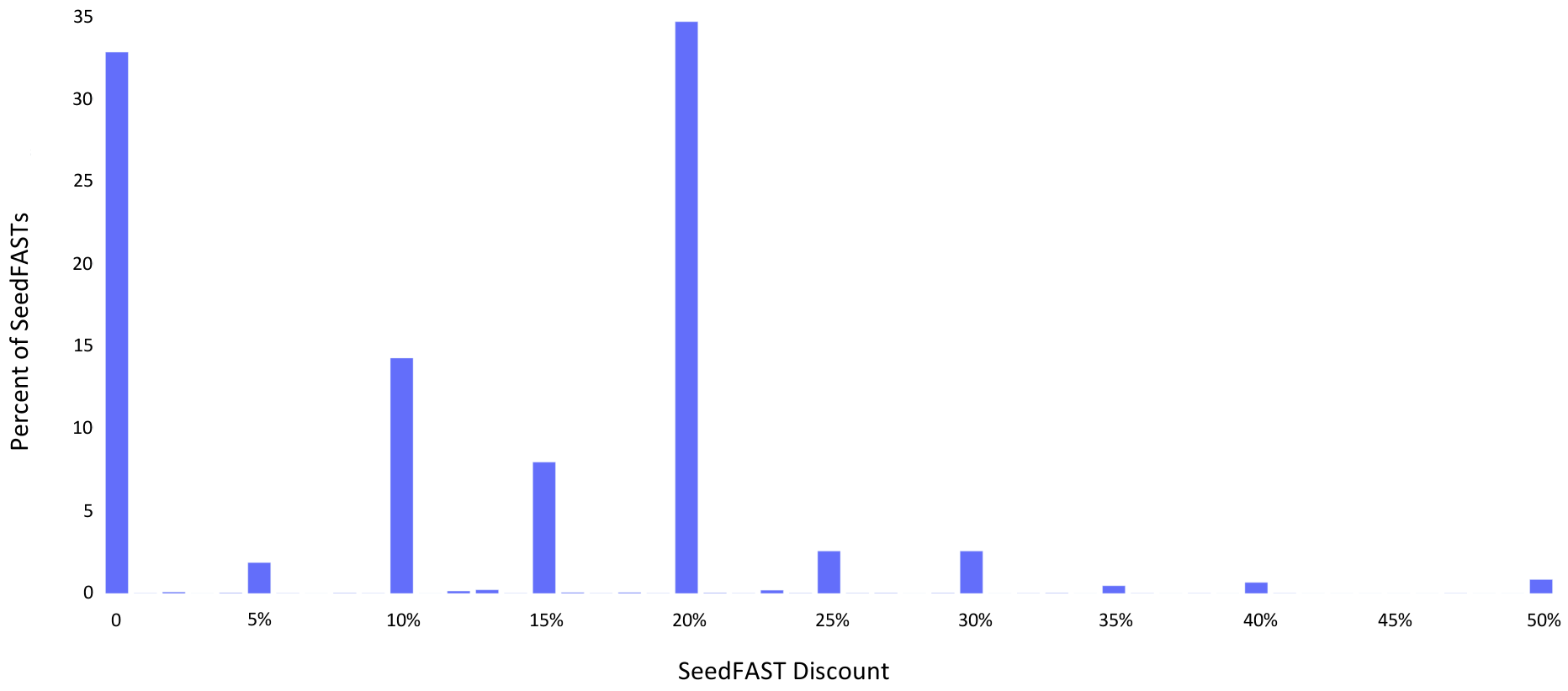

As the chart below shows, overall, SeedFASTs appear to have predominantly either no discount or a 20% discount on the next round valuation. Discounts of 10% and 15% are popular too.

Small SeedFASTs (less than £20K) tend to be more likely to have 20% discounts compared to larger SeedFASTs.

We think the reason for this is that companies are raising small SeedFASTs knowing it will be 6 months or more until their first funding round. They’re super early stage and raising small amounts to pay for developing the MVP or prototype, and they’ll raise more money when that’s done… and they’re compensating those early investors accordingly with a larger discount.

On the other hand, it’s possible that larger SeedFASTs are often used as bridge funding a few months ahead of the next funding round. Given that there’s more certainty and a shorter time before the funds convert into shares, it’s more likely the investor will be okay with not getting any discount, or a cap (see below) instead of a discount.

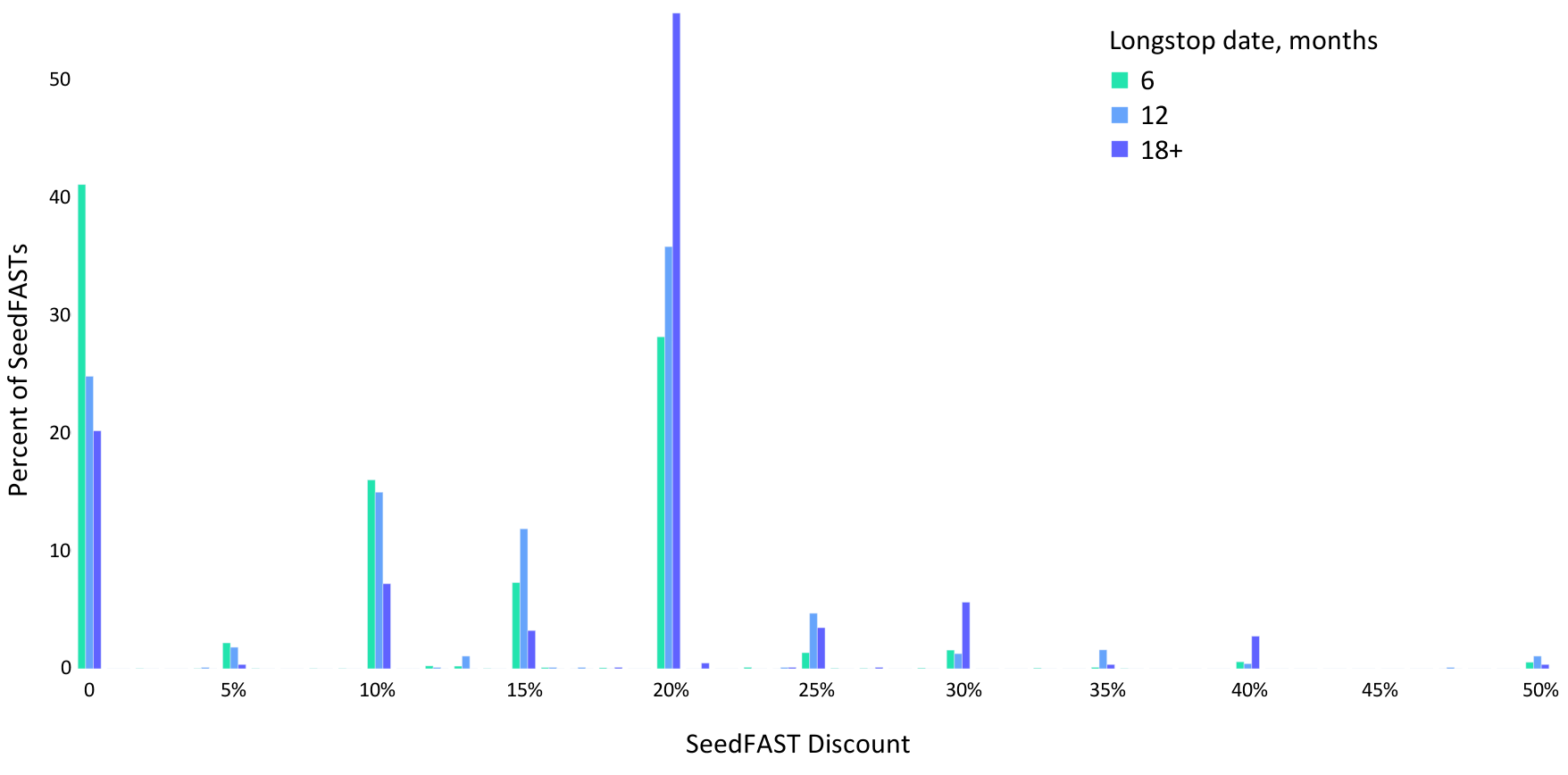

If we look at the discount offered grouped by longstop date – how long the company will have to do their next round before the SeedFAST automatically converts at the agreed longstop valuation – you can see, unsurprisingly, that the longer the longstop date, the larger the discount offered.

Instead of (or in addition to) giving SeedFAST investors a discount on the next round valuation as an incentive to invest early, you can cap the valuation at which the SeedFAST will convert. If the next round valuation is higher than the cap, the SeedFAST will convert at the cap, giving the investors a potentially significant advantage for coming in early.

Here’s how that discussion with your investor might go:

Investor: You’ve told me you’re looking to raise investment by SeedFAST now so you can build the app and increase the valuation for your next round. That’s great, but what’s in it for me?

You: We plan to do our next round in 4 months, so how about I give you a 10% discount for coming in now? That’s much more than you’d earn at the bank in the meantime.

Investor: That’s nice, thank you. But as of today you just have a PowerPoint slide deck and a Figma mockup. When you do your next round, you’ll hopefully have a working app and your valuation will be 3X what it is now. So I’m really funding the riskiest part of your business, for a 10% advantage to help you multiply your valuation by 3X.

You: Ok, so let’s say our valuation is £1M now, and if all goes well the valuation in our next round will be much higher than that. So I’ll agree on a valuation cap of £1.5M, so that if our next round is at a valuation above that, your SeedFAST will still convert at a valuation of £1.5M. Of course that’s much riskier for me. If our next round is at a £3M valuation, you’ll be effectively getting a 50% discount, so I’ll agree to a cap but no discount if the round valuation is below the cap.

Investor: It’s a deal! Share the SeedFAST with me.

And that’s the thing with agreeing a valuation cap – it’s much riskier than agreeing a discount because if things go well and the next round valuation is substantially above the agreed cap, then the investor will effectively be getting a substantial discount, which will dilute the existing shareholders more.

So, what does the data show?

50% of SeedFASTs have a valuation cap

Interestingly, I would say it’s mostly US investors asking for a cap, because the pattern is different there.

In the UK, because of the 6-month maximum longstop date for SeedFASTs to be SEIS/EIS compatible, founders are using SeedFASTs as a bridge to their next round. You already have a reasonable idea of the valuation you’re aiming for in your next round – you just need some investment now to help you get there.

In the US, it’s different. The high costs of legals ($50K or more) to do a funding round (there’s no SeedLegals in the US!) and no 6-month SEIS/EIS longstop date limit means that companies use SAFEs (the US equivalent of a SeedFAST) instead of a funding round. Companies might raise millions in SAFEs, then go for years before raising a $10M seed round. In that case, companies are using SAFEs to skip the legal cost, but agreeing a valuation cap so it’s almost the same as doing a funding round now, at today’s valuation, even if the SAFE converts 2 years later in a monster funding round.

We recommend going with a discount instead of a cap where possible, to avoid the possibility of guessing the cap value too low and giving away more equity than you had intended. But, if the investor insists on a cap (and US investors usually will) then, sure, you can do that… but do think carefully about what the next round valuation might be if things go well, and if things don’t go well.

Here’s something to keep in mind: the cap and longstop valuations can also be used as a form of signalling to investors in the next round. “We’re pricing the round at a valuation of £4M. You can see we have a bunch of SeedFASTs with £4M caps so that makes sense.”

Of course the valuation cap has nothing to do with the next round valuation, but from a social engineering perspective you can leverage that to set a high cap with early SeedFAST investors, then use that cap as a peg for the next round valuation. Again, there’s no legal basis for it, but it’s a useful anchoring that might help you agree the next round valuation faster.

US investors are familiar with a SAFE which is a US equivalent of a SeedFAST. So if your investor is based in the US it’s possible they’ll ask for a SAFE, not a SeedFAST.

Using a standard US SAFE agreement won’t work (not English law, unwanted SEC and US tax commitments, no longstop date, wrong share class conversion and more). The good news is we have a 1-click solution which allows you to create a SeedFAST that’s configured as an English-law version of a YC SAFE – read all about it here.

We hope this helped clarify how to decide on the right SeedFAST terms for your deal. If you still have any questions, book a free call with one of our specialists.