How much should I pay my team? UK startup salaries revealed

As a founder, getting your team’s pay right can feel like a guessing game - but it doesn’t have to be. In this post, we...

In April 2020, SeedLegals analysed its data to share the immediate impact of CoVid-19 on UK funding rounds. As the largest closer of early stage funding rounds in the UK, SeedLegals has a unique insight into funding round patterns. The April data showed that existing funding rounds and valuations were not as impacted as feared (although new potential deals had slowed based on the number of Advance Assurance applications submitted). Three months on from this piece, we have refreshed our data to provide the latest update.

Most funding round statistics make use of Companies House data to provide data on rounds that have already closed and filed with Companies House. But, uniquely, SeedLegals is able to provide a leading indicator of funding activity by analysing patterns of investors being added and removed to rounds currently in progress.

Additionally, using SEIS-EIS Advance Assurance application data (around 15% of all Advance Assurance applications are now done on SeedLegals), SeedLegals is able to look ahead and predict funding activity 2-3 months into the future.

Taken from the beginning of UK lockdown (24 March) up to 29 July, the findings from SeedLegals data are as follows:

115 companies closed investments as at 29 July, stable as compared to the preceding 3 months, but lower than the end of tax year peak.

Terms sheets however are on the rise, over 185 companies issued term sheets on SeedLegals in both June and July, compared to 144 in May – a 28% increase and significantly more than historical average. Despite the current global economic uncertainty, the sentiment for early stage investing remains buoyant.

SeedLegals data does not support the rumours of valuations halving; there’s been no significant change in valuations over the period.

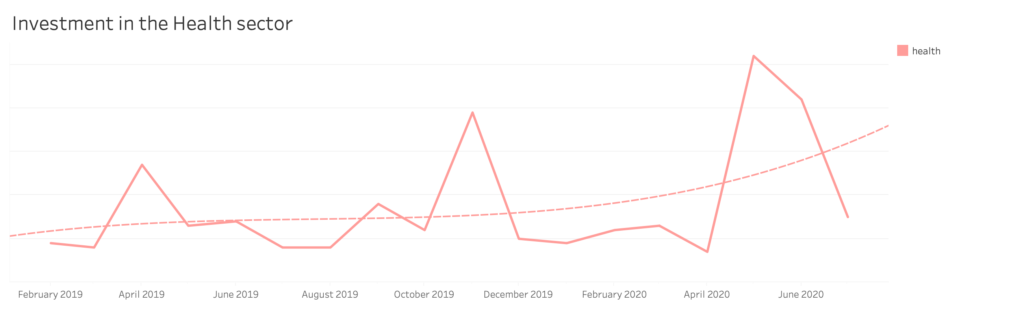

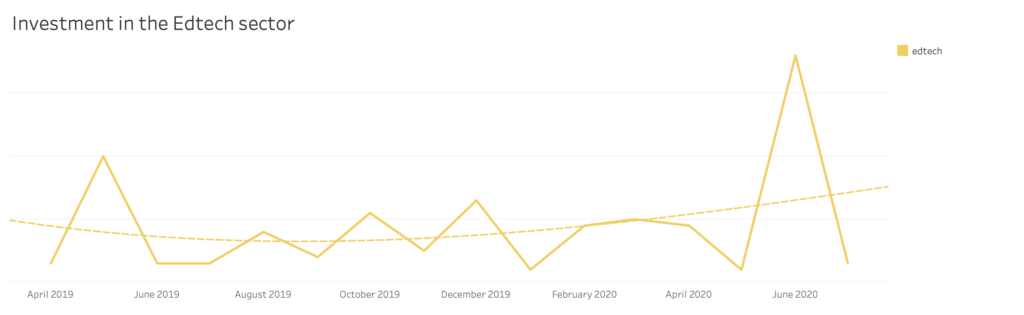

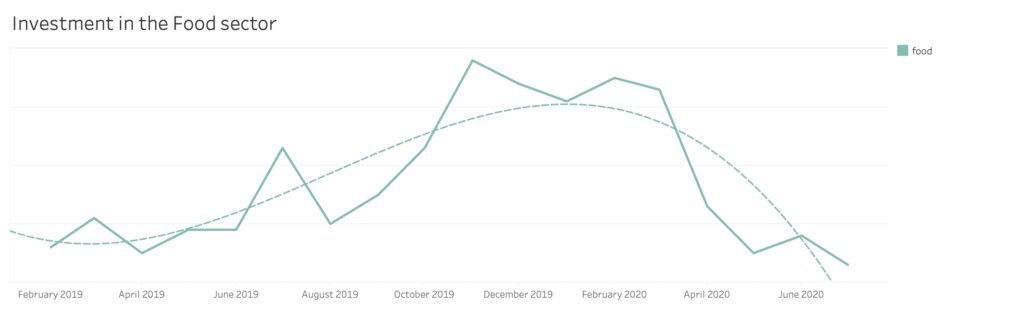

Across the 20 sectors into which SeedLegals categorises companies, it’s clear that some sectors experienced a large change in their relative investment levels in the past few months – notably the Health sector, EdTech and Food startups.

Healthcare saw large jumps in investment in May and June, and EdTech in June. That appetite appears short-lived for now as those investments have either returned to or are approaching pre-lockdown levels.

However, while the number of investments in Health and Edtech has climbed, the Food sector has been dramatically impacted by the crisis and thus the number of investments in Food has decreased throughout the pandemic.

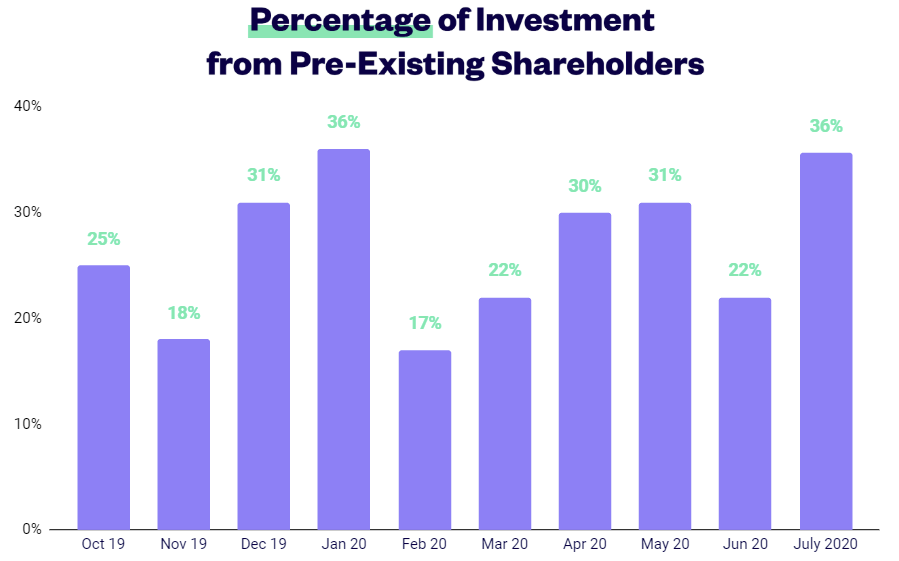

Despite reports of new investors pulling out of deals and leaving existing investors having to step in to keep their portfolio companies afloat, SeedLegals data doesn’t support that hypothesis.

Investment from existing investors is hovering around historic averages of 25%. As has been the case historically, bridging investments (ASAs and convertible notes) are more likely to come from existing investors (25% of investments), as are top-ups to funding rounds (35%), compared to funding rounds, where an average of 10% of investment comes from existing shareholders.

As SeedLegals has digitised the whole legal process for fundraising, it has the unique position of being able to look under the hood to the lifecycle of a funding round, being:

SeedLegals has tracked the number of investor signatures executed on SeedLegals from the commencement of UK lockdown (24th March) to 29 July to seek an indication of investor sentiment. Sentiment has been rather volatile based on our data. In short, the story is:

SeedLegals has also provided insight into future funding rounds based on Advance Assurance applications submitted on its platform. Around 1 in 8 of all SEIS/EIS applications in the UK are now done through SeedLegals thus giving them unique insight into the SEIS/EIS landscape.

And here the news wasn’t good in April, but is now getting better, as through May to July applications have gradually returned to 82% of their January levels.

![]()

Four months on, CoVid-19 evidently has had impact on investor appetite based on the prolonged round closures and the rush (and abandoning) of certain business sectors. Deal activity is down marginally, but on the positive side for those looking to raise is that (i) valuations remain largely unchanged and (ii) investor confidence appears to be rebounding based on the number of Advance Assurance applications and deal signatures made is close to reaching pre-lockdown levels.

Despite what you may have read, investors are not abandoning startups in droves.

If you’re looking to raise, here’s our advice: