How to sell your business: The founder’s survival guide

Our CEO Anthony Rose explains what you need to know about selling your business, to help you plan ahead. Anthony explain...

Usually all your energy as a startup founder goes into making your company a success. A plan for how you leave your business is probably the last thing on your mind.

But even when you’re deep in the everyday detail and celebrating each fresh sign of growth, it’s still important to have a longer-term view of your company’s trajectory.

When you know what your possible exit routes could be, it helps you plan for your company’s future, attract investors, grow strategically and maximise the returns for founders, investors and early employees.

In this post, we’ll break down the most-common exit routes for startups and explain why exits are so important to investors.

In the startup world, an exit refers to when a founder leaves their company. That means, they either sell their shares and majority stake of the company or they sell the company entirely.

A founder can exit for good, bad or neutral reasons. The best-case scenario is that your startup is such a success that you hit a sky-high valuation at IPO or a larger company offers to buy you out, your shares sell at a high price, and everyone who helped build the company cashes out.

But exits don’t just mean galloping to IPO as a unicorn. There are many reasons you might be ready to move on.

Our top quality documents and expert support help you sell your company for lower legal costs and much less effort.

Find out moreExits are essential to the startup lifecycle, because they’re how founders and early investors realise returns on their hard work and cash outlay.

When another company buys (‘acquires’) a startup or the startup makes its shares available for sale through an Initial Public Offering (IPO), it gives investors and founders the opportunity to sell their shares.

The best-case exit for a startup is to deliver huge returns to shareholders via an IPO or a profitable sale to another company.

You can’t plan for everything. But it pays to know what your possible exit routes are, and whether you’re building a company that might be attractive to a buyer down the line.

With an exit plan in mind, you can make more informed decisions about how to allocate resources, hire employees, and pursue growth opportunities.

Here’s why developing an exit strategy is so important:

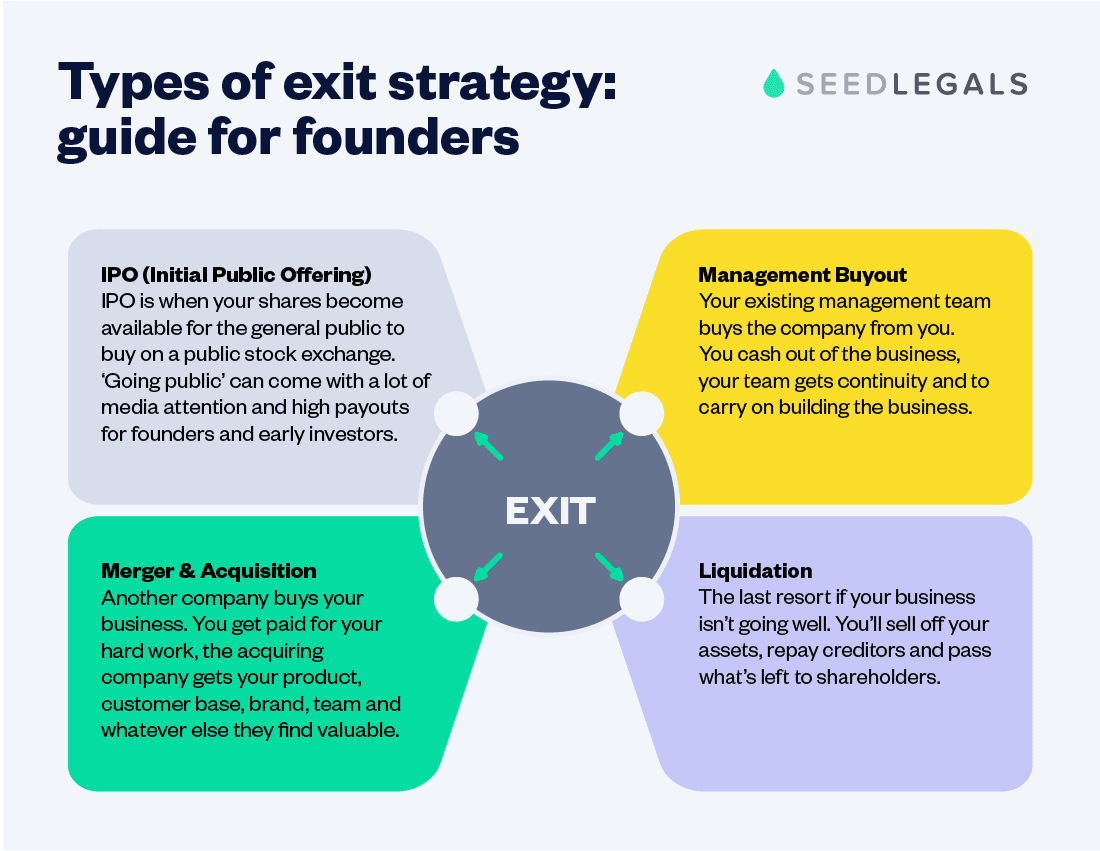

Whatever your reasons for pursuing an exit, you need to know what your options are. Whether you get a great offer or you’re focused on limiting losses, here are some of the possible exit routes.

IPO is when your shares become available for the general public to buy on a public stock exchange. It involves issuing new shares to raise money, but investors and founders also have the opportunity to sell their existing shares.

‘Going public’ sometimes comes with a lot of noise and media attention. It’s true unicorn territory, and only the biggest and most successful startups go down this exit route. If your IPO goes well, you can raise a lot of money.

IPO comes with a huge amount of red tape, transforming your company from a private startup to a public enterprise which is subject to much more scrutiny and outside control. The exact rules and the process depends on the market you choose for your IPO.

IPO is a much less common destiny for startups than M&A. According to Beauhurst, the data platform tracking high-growth companies, just 215 UK businesses have managed an IPO since 2012. That’s compared to the 4,923 companies that have been acquired over the same period.

The more common destiny for a successful startup is to get sold to a larger company for a profit. The acquiring company might be a competitor or an industry juggernaut hungry for your product, team, customer base, market reach or general competitive edge.

If you see there’s potential to be bought out by another company in your sector, you can focus your growth strategy towards making your startup irresistible to a buyer. This shouldn’t come at the expense of building the best business you can. But if you can see a way to increase your sale value as you scale, your strategic groundwork might pay off in a stellar price and a smooth exit via M&A.

There are two types of sale exit: a share sale and an asset sale. With a share sale, the acquirer buys all the shares and owns the business outright. In an asset sale, shareholders keep their shares and the buyer acquires specific parts of the company’s IP, like the code.

Not all sales will be wildly profitable. If a startup isn’t working out, sometimes the best next step will be to sell off the stronger parts of the business through an asset sale.

Get the step-by-step guide to selling your company. Find out what to do to get your business in the best shape possible, and the steps to follow to negotiate and complete the sale.

This is when a startup’s existing management team buys the company’s ownership from its current shareholders. If you want to wrap up your involvement, but your team is keen to continue growing the company, this can be a mutually beneficial exit route.

Because your management team is already familiar with operations, they can often run the company more efficiently than an outside buyer. Plus, they will probably have a stronger emotional connection to your company and be more motivated to see it succeed.

It’s not something you plan for, but if you’re fast running out of money and looking for the exit sign, then liquidation is probably your most realistic option. It’s certainly likely to be the fastest way to end your involvement with the company. You’ll sell assets and repay your creditors. If there’s cash left, this can be passed back to the shareholders.

As well as freeing up the founders, an exit gives investors the opportunity to sell their ownership shares and collect a return on the money they invested. It’s how they take cash back out of the business they helped to build.

Without an ambitious exit strategy that benefits shareholders, you’ll find it harder to raise funds from angel investors and VCs.

Jonny SeamanWhen investors or ‘limited partners’ invest money in venture capital funds, the promise is usually to return the investment in 7 to 10 years. That’s one of the main motivators for VCs pushing for an exit after a certain period of time.

On paper, gains and high valuations are great, but they remain ‘on paper’ until an exit scenario occurs.

Similarly for founders, while it’s great to hold equity worth £5 million on paper, you can’t buy that Caribbean island or brand new Ferrari with hypothetical money. The exit allows you, your employees and your investors to turn the hard work and investment into something tangible.

Investor Partnerships Manager,

It might seem counterintuitive to be planning your exit before your company really hits traction. But, as above, to angel and VC investors, exit potential is a hugely important aspect of their internal calculations. It’s how they take cash out of the business.

So, during your pitch negotiations, investors need to understand your exit potential or they won’t invest. If you’re going for VC funding, be aware that they’ll expect dramatic growth and an exit within 5 to 10 years.

You might have seen advice that you should include an exit strategy in the business plan you share with potential investors. But any specific plan you could come up with at a very early stage is so ungrounded in reality that it might as well not be there.

So the challenge lies in communicating the opportunity, and your ability to meet it, without hurting your credibility. You could make it clear that your goal is to be acquired by a larger company in your sector, point to relevant recent acquisitions and set goals that would make you an attractive prospect to potential acquirers.

For more insights, watch this webinar to hear our CEO Anthony Rose talking with JP Lewin, CEO of Foundy about how to successfully sell your company. Find out:

Exiting your business is a crucial step in the lifecycle of a startup, and it’s essential to be well prepared. A clear exit strategy can help you make informed decisions about the future of your business, and it can also help you attract investors who share your goals. By understanding your options for exit, preparing for the process, and aligning your strategy with your investors, you can set yourself up for long-term success.

Selling your business is a major decision. If you’re ready to sell or just considering it, talk it over confidentially with our experts.

Book a free call