How to find startup funding

One of the most common questions founders ask is ‘How do I get funding?’ Read our comprehensive guide to finding funding...

Many founders roll their eyes at the idea of forecasting the growth of their business for the next five years. However, having a clear plan that sets out your ambitious yet realistic growth targets can help get investors on board.

In this article, we’ll reveal why you need to write a five-year business plan with tips from Anthony Rose, SeedLegals’ CEO and serial entrepreneur.

A five-year business plan gives an overview of what a business does, what it intends to do and how it plans to do it.

It includes everything from vision statements to market research, strategic planning and financial forecasts. The five-year plan helps prospective investors get an idea of whether they feel a business has long term potential.

Founders and investors both know that a five-year business plan includes some artistic licence. You don’t know exactly how things are going to go. Things can take longer than you expect and the economic landscape can shift overnight.

However, there’s still plenty of value in a five-year business plan. If you get your numbers right, you can use the business plan to show investors why they should invest in you and how they could see a return on their time and money.

Your five-year plan is also necessary if you’re applying for SEIS/EIS Advance Assurance. HMRC needs to see a three or five-year business plan in your pitch deck so they can be confident that you actually plan to grow the business.

In the startup space, a five-year business plan is especially useful for founders and investors.

It helps founders strategise how their business is going to work and shows investors how they might get a return on their investment.

Founders can use the business plan to align on the direction of travel with other senior members of the team.

Investors see the five-year business plan as a measure of the market opportunity for the business. If the opportunity looks good, investors are more likely to want to get involved.

It’s a good idea to create two versions of your business plan: a detailed version and a compact general overview.

A detailed plan that covers all aspects of your business can help you gain clarity and refine your goals.

Once you’re clear on what you want to do, the general overview shows investors what your plans are in a digestible way.

The purpose of your five-year plan is to explain the who, what, why and, most importantly, the how behind your company’s plans. The detailed version of your plan should include:

Once you have that, you can condense it into a general overview.

Creating a general overview helps you to convey the most important information about your business in a concise manner.

When dealing with investors, your time is limited. No investor wants to go through a 20-page business plan. They want to cut to the chase, and founders need to be prepared to accommodate them.

Based on feedback from founders who’ve been through funding rounds themselves, we recommend that you condense your detailed five-year plan into the following:

Your pitch deck for investors should include the line graph, SWOT analysis and executive summary. HMRC will also want to see this info when you apply for SEIS/EIS.

In your pitch, you’ll need to describe your business and point out your business goals, but you don’t need to include all of the finer details from your in-depth business plan at this stage. The financials spreadsheet doesn’t need to be in your pitch deck. It’s only for later on when you meet with investors.

It’s worth having a look at some pitch deck examples for inspiration.

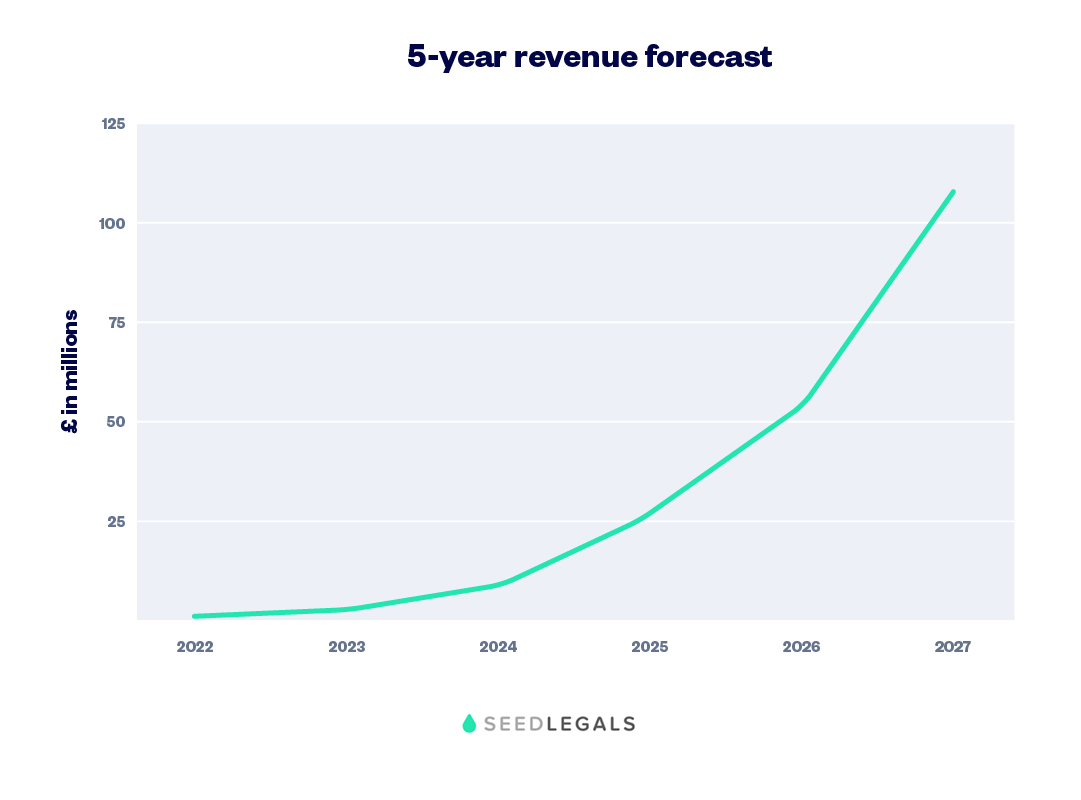

The purpose of the graph is to depict your projected growth in revenue at a glance.

The number of years you show depends on your business’ initial growth rate. If it’s going to take a few years before you generate revenue because you have complex product development to do, you’ll want to forecast far enough into the future to show when the exponential growth happens.

The graph should include:

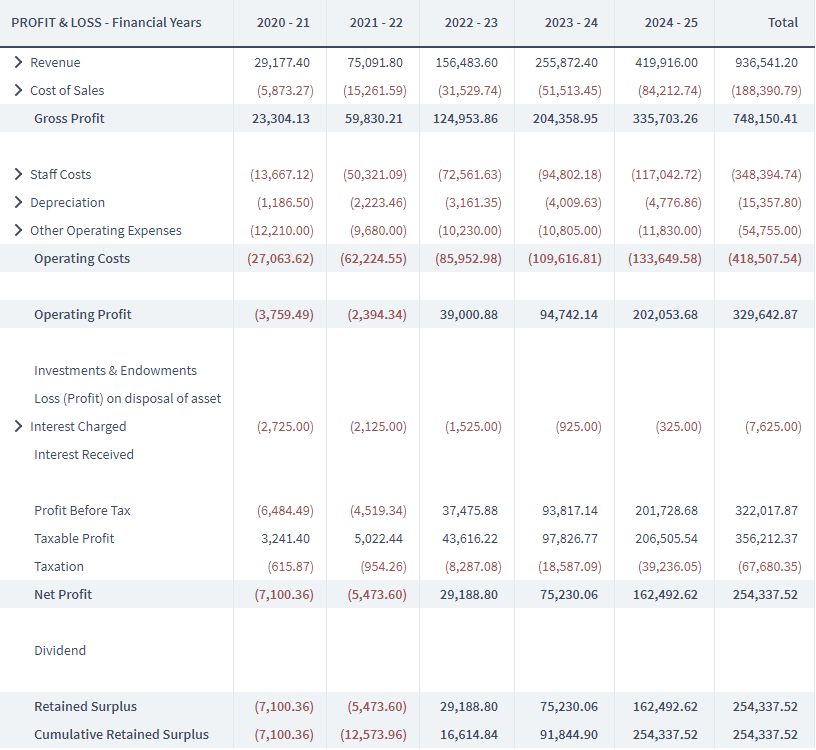

This is your opportunity to break down every financial detail behind what’s depicted in the line graph. Your spreadsheet should include:

The more information the better. This is what you’re going to present to investors once they’ve expressed interest in your pitch.

What you present will be a significant factor in whether they invest in you or not. Here’s an idea of what your spreadsheet might look like.

Image source: Brixx

SeedLegals CEO Anthony Rose has been through a fair amount of funding rounds and seen hundreds of pitch decks himself. In the video below, he offers his insights on “The art of the five-year business plan”.

We’ve put Anthony’s thoughts from the video into a written breakdown below to help you digest the information.

Showing your ambition goes beyond an inspiring vision statement. It’s about creating hype through numbers – the real, grounded kind of hype that makes investors feel excited and confident that the goals can be achieved.

A five-year business plan that’s going to close investments needs to show the founder’s ambitions to grow the business exponentially. The investor is going to want to see that making this investment is worth their while.

Many founders are satisfied with a modest approach. The fact that they can create a good, profitable business that will add value to its market and pay the salaries and bills that need to be paid is what makes them happy.

But an investor might see it as a “hobby business” if you’re not ambitious enough. Your five-year business plan needs to include financial projections that show a steady, exponential increase in your revenue (which means the same for their ROI).

Anthony RoseAn investor is going to want to see a massive return on investment. In five years they’re going to want to see a 10x or a 50x return on the investment to make it worthwhile, given the risks involved.

Co-founder & CEO,

The key here is to get your five-year number just right. Your graph should show a steady increase in revenue, but not at an unachievable rate.

If you’re not delivering on the numbers you projected at the get-go, you’ll have unhappy investors and a lot of changes to make. You will most likely have trouble getting investors on board in the first place if you’re projecting growth at a statistically unlikely rate.

Seeing that founders can run the numbers is an important measure for investors. If the numbers aren’t connecting from one year to the next, or you appear to be losing money altogether, investors aren’t going to have a whole lot of faith in you running your business well.

Before we dive into the formula, it will help to know that a company is classified as a unicorn if it is valued at US$1 billion or more (around £800 million).

The unicorn formula is the growth pathway to becoming a unicorn company, and it goes like this: triple, triple, triple, double, double.

So what does that mean for your five-year business plan? It means that if you can create a graph projecting financial growth at a rate of tripling year-on-year revenue for three years and doubling it for two, you’re on a good, steady growth path towards becoming a unicorn.

At a rate of 10x revenue for your valuation, reaching that (roughly) £100 million in revenue after five years would classify your company as a unicorn.

Not every company intends to become a unicorn, however, so how does this apply if that’s you? Well, the golden nugget in this formula is the rate of growth it suggests. It’s ambitious and steady, which will appeal to investors. So even if you’re not aiming for a unicorn valuation, applying the formula to your financial forecasting will still be beneficial.

The line graph below depicts a hypothetical business’s revenue according to the unicorn formula rate. It’s the shape of the line that’s important here – this is the shape of a healthy growth rate.

We covered this in the section on how to write a five-year business plan, so make sure you read and re-read that section. In case you missed it, though, we’ll reiterate the point here.

The most important part of your meetings with investors is presenting a robust breakdown of your company’s financials. Make sure you keep an up-to-date spreadsheet that details current and future income and expenditure.

Be fully transparent about where your business’s revenue is now. Don’t allow for disparity between what is displayed in the graph on your pitch deck and the revenue your business is making today.

Make sure your financial forecasting is up-to-date and begins with where you stand currently. Make sure you update it regularly so you remain confident and transparent whenever you meet with investors.

The five-year business plan still has value. It will help with procuring investment and getting your SEIS/EIS Advance Assurance from HMRC.

The key takeaway is to get your financials just right. Show ambition, grow steadily and be transparent. First-hand advice from people who have been there and done that is extremely valuable, so turn to expert input for help.

At SeedLegals, we have a team of experts who can help you with all the nuances involved in starting and growing your business, so hit the chat button to get in touch. We’ll be happy to guide you and answer any questions.

Raising funding? You’re in the right place – 1 in 6 of all UK funding rounds are closed on SeedLegals. Because we help founders save time and money, close deals super fast and give expert guidance along the way. Book a call with our team below and we’ll talk you through how we can help.