R&D success stories: meet the companies claiming back cash

Meet the innovative companies who have successfully recovered money through the SeedLegals R&D Tax Credits service.

R&D tax credits are a form of tax relief offered as part of a government scheme to boost innovation in the UK.

If your company has spent money developing a new product or service, or significantly improved one that already exists, you might be able to claim back up to 27% of your research and development costs.

It’s a generous offer that many companies don’t take full advantage of. That’s why we’ve put together this article to cover how much you can claim and how to apply, if your business qualifies.

In 2023, the Government announced updates to the R&D tax credits scheme. Here’s what changed:

You can read more about the changes on the gov.uk website.

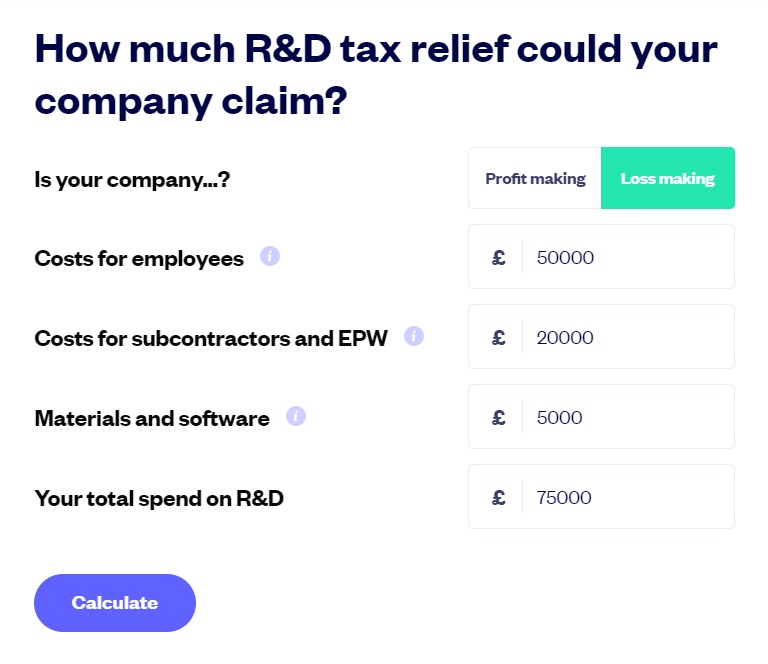

How much R&D tax relief could your company claim? Find out with our calculator.

Go to calculatorR&D tax credits are a tax relief designed to encourage greater R&D spending in the UK. They can be a phenomenal source of cash flow, and the good news is that they’re not going anywhere anytime soon. The government has emphasised how central advancements in science, research and innovation are to the UK economy, announcing its intention to increase UK investment in R&D to 2.4% of GDP by 2027 and to increase public funding for R&D to £22 billion a year by 2024/2025 (source: gov.uk).

R&D tax credits work by either reducing a company’s Corporation Tax bill or as a direct cash payment to the company.

The schemes allow companies to claim back up to 27% of the money they spent on research and development. And even better, it can be claimed on unsuccessful projects too.

To claim R&D tax credits, you’ll need to file an R&D claim with HMRC detailing the amount you spent on R&D-qualifying projects. You’ll submit this claim at the same time as you file your Corporation Tax return. You can claim R&D tax relief retrospectively for the previous two accounting periods.

To be eligible for R&D tax relief, your company must have worked on R&D projects, incurred qualifying R&D expenses in the last two financial periods, and be based in the UK.

The size of your R&D cashback will depend on your total qualifying expenditure as well as what exactly you spent the money on. You can claim more for some activities (employee salaries) than others (subcontractor fees). Some types of expenditure, like rent, won’t qualify for R&D at all.

Traditionally there were two types of R&D schemes available to UK businesses: SME and RDEC. However, this was replaced in April 2024 with the “merged scheme”. We have outlined the new rules of this new scheme below:

The Merged R&D tax relief scheme

The ERIS scheme (Enhanced R&D Intensive Support Scheme)

How much of your expenditure you can claim back as R&D tax credits depends on whether you’re claiming under the Merged Scheme or ERIS. For ERIS, it also makes a difference whether you’re profitable or not.

If you qualify for ERIS, you can claim up to 27% of your qualifying R&D expenses back from HMRC.

If you are claiming R&D under the Merged scheme, you can claim up to 18.6% of your qualifying R&D expenses.

R&D actually has a very broad definition. It’s not just software development or life science companies who are eligible for R&D relief.

To qualify for R&D tax credits, a company needs to have spent time and effort in trying to achieve an advance in a field of science or technology. In seeking this advance, the company must have tried to resolve scientific or technological uncertainty.

In addition, to qualify the company must be carrying out R&D work in the field of science or technology. The relief is not just for ‘white coat’ scientific research but also for ‘brown coat’ development work in design and engineering that involves overcoming difficult technological problems. The scheme’s definition of R&D is intentionally broad so that it covers activities in as many industries as possible, however, in recent years HMRC has published statistics which show that there has been a high level of compliance activity in sectors such as entertainment, recreation and the hospitality sector, which includes accommodation and food services (hotels, restaurants, bars).

HMRC is also explicit that arts, humanities and social sciences (including economics) are not qualifying fields of science or technology for the purposes of R&D tax credits.

In the Technical Narrative of your R&D claim, you’ll need to show how your project:

We’ve looked at the type of projects that HMRC considers R&D. Now let’s go into the kinds of costs you can claim back as an R&D expense. Salaries and other staff costs usually make up the bulk of R&D claims.

Direct R&D staff costs

You can claim for gross salaries, employer National Insurance contributions and employer pension contributions for your PAYE employees who were involved in your R&D project. This covers both the employees who did the hands-on R&D work as well as the time spent supervising and managing those employees as they carried out their work.

Qualifying Indirect Activities (QIA)

Support staff costs, like administrative or clerical staff, do not usually qualify unless you can show individuals performed indirect activities that supported the R&D project. This could include clerical work like note-taking at R&D project meetings, cleaning and maintaining equipment or security related to the R&D project.

Externally Provided Workers (EPWs)

You can usually claim up to 65% of the payments made to the external agency for temporary staff hired to work on the R&D project. For accounting periods starting on or after 01 April 2024, you can’t claim for payments made to EPWs outside the UK.

Subcontractors

Under both the Merged Scheme and ERIS, you can generally claim up to 65% of the payments made to subcontractors inside the UK. For accounting periods starting on or after 01 April 2024, you can’t claim for payments made to subcontractors outside the UK.

Consumable items

You can claim for the cost of materials that were scrapped/wasted/destroyed or ‘transformed’ in the course of your R&D project. This includes the cost of materials, water, fuel and power. However, you can’t claim for the costs of materials used to build the actual products that you sell.

If you are creating a prototype to test the results of your R&D, the design, construction and testing costs will normally be qualifying expenses. However, if you’re planning to sell the prototype itself, this counts as a production cost and is outside the R&D scheme.

It can be exceptionally difficult to separate the split between what is R&D expenditure and what is production cost. To talk through how to classify your project spends in your claim, book a call with our R&D team.

Software

You can claim for the cost of software that is directly used in your R&D activity. If you use the software elsewhere in your business as well as for your R&D activity, you can only claim a proportion of the cost.

Data license and cloud computing costs

You can claim for any costs relating to data licenses and cloud computing and data storage, for example AWS costs.

A data licence is a licence to access and use a collection of digital data.

Clinical trial volunteers

Pharmaceutical companies and research organisations often make payments to volunteers taking part in clinical trials. You can claim this back as an R&D expense.

R&D tax credits are a financial incentive for companies to spend money on activities that lead to advancements in science and technology.

As such, they’re not designed to support companies beyond the discovery and experimentation stage. That means that you can’t claim for costs incurred in the sale or distribution of goods or services your company creates off the back of your R&D work. You also can’t claim for rent or land-acquisition costs.

Perhaps surprisingly, you also can’t claim any costs related to the creation of patents, including for the time spent by staff on preparing and submitting patent applications.

However, there’s another HMRC tax relief scheme called Patent Box which gives eligible companies a 10% Corporation Tax relief on profits earned on patented inventions.

Now you know what kinds of projects and costs are eligible for R&D tax relief, it’s time to get into the maths behind how your tax credits are calculated.

Calculate your total eligible R&D costs

Based on your company’s R&D activities, calculate the total of your eligible expenditure.

This includes your staff costs (salaries, employer National Insurance and employer pension contributions, bonuses and reimbursed expenses), EPWs and subcontractors, materials and software costs.

The calculation for the Merged Scheme will work in a similar way to the old RDEC scheme and has 7 steps:

Calculating R&D tax credits under the old* SME scheme

*still in force but only for accounting periods starting before 01 April 2024.

Step 1:

All companies can deduct 100% of eligible R&D costs from their tax liabilities. Companies that qualify for the SME scheme get an additional 86% – this is called the ‘uplift’.

When you add this 86% uplift to the default 100%, you get the ‘enhanced expenditure’ amount of 186%. Multiply your total eligible R&D expenditure by 186%.

This is the figure on which the value of your R&D payable tax credits (or tax relief) will be calculated.

The next step depends on whether your company is making a profit or loss:

For a profit-making company

If your company is making a profit, you will receive R&D tax relief in the form of either a reduction or a refund of your Corporation Tax bill. This reduction will be up to around 24.7% of your R&D expenditure.

To calculate the value of your reduced Corporation Tax liability, subtract the enhanced expenditure amount from your net profits before tax to get your adjusted profit before tax. Then multiply the adjusted profit before tax by 24.7% to get your final, reduced Corporation Tax bill.

For a loss-making company

If your company is loss-making, you’ll receive tax credits in the form of cashback from HMRC. This could be up to 18.6% of your eligible R&D expenditure.

However, as a loss-making company you’ll have to make a strategic choice about whether you want to ‘surrender the loss’ for your current financial period.

You can choose to carry forward your loss to offset your tax bill for a future profitable period. You also have the option to carry losses backwards if you have trading profits in prior years.

If you decide you’d rather have the cash now, you’ll be ‘surrendering the loss’. It’s called surrendering because you won’t be able to use it later to reduce your Corporation Tax liability. If you decide to surrender, your cash credit is calculated by applying a rate of 10% to your enhanced expenditure figure.

The amount you can claim back as a cash credit might be limited by how much you’ve spent in the period on payroll staff. The cap for SMEs is calculated as 300% of total PAYE and NIC liabilities, plus £20,000.

Under ERIS, the calculation is similar to the old SME scheme calculation above, however, instead of applying a 10% surrender rate, you apply a 14.5% surrender rate. This results in an ‘effective tax benefit’ of up to 27%.

The old* RDEC Scheme

*still in force but only for accounting periods starting before 01 April 2024.

The RDEC rate of tax relief is a flat 20%. However, the amount of tax credit you can actually claim is lower, because it takes into account the rate of Corporation Tax (19% for companies with profits under £50k and 25% for companies with profits over £250k). This means that the ‘effective tax benefit’ you can claim is up to 16.2% of your total R&D spend.

Say you had £100,000 of qualifying R&D spend. Multiply that by the 20% RDEC rate to get £20,000. You then take off the tax rate at 19% and you are left with your RDEC tax relief amount of £16,200.

The amount you can claim back as a cash credit might be limited by how much you’ve spent in the period on PAYE and NIC. For companies claiming under the RDEC scheme, the amount of credit you receive cannot be higher than your PAYE and NIC liabilities relating to your R&D staff.

Curious about claiming R&D tax relief? Our comprehensive checklist makes it simple to identify eligible activities and prepare for your claim.

Download checklistR&D tax credits are claimed through your Company Tax Return (CT600) which is normally submitted on an annual basis and based on the figures from your Statutory Company Accounts.

To claim R&D tax credits, you’ll need to submit the CT600 and your Technical Narrative.

Your Technical Narrative is where you explain to HMRC why your work qualifies as R&D.

It should outline the work done by your company, which technical uncertainties were encountered and how you attempted to overcome them. You do not need to be successful in overcoming these uncertainties to qualify for R&D tax relief. A failed project or work done before a change in direction will still qualify.

You also need to justify the size of your claim by outlining the number of projects that took place in the period, the amount of time spent on those projects (employees or contractors) and any other expenditure that may be relevant.

You can claim R&D tax relief retroactively for the previous two accounting periods. For example, if your accounting year end is 31 December 2023, you have until 31 December 2025 to submit your claim.

It is worth noting that for accounting periods starting on or after 01 April 2023, a company will need to submit a Pre-notification Form within 6 months of the end of the financial period. If you miss this deadline, you will not be able to make a claim for that period. [Read more about the Pre-Notification Form below].

What is a Pre-Notification Form?

If you’re planning to claim R&D tax relief or expenditure credit for accounting periods beginning on or after 1 April 2023, you must submit a claim notification form if:

HMRC have provided further guidance on how to work out your claim notification period, here.

Once you have prepared your R&D claim you will also need to submit an Additional Information Form.

What is the Additional Information Form?

All R&D claims regardless of accounting period start date will require an Additional Information Form. This form is completed using a portal on the HMRC website and requires companies to provide the following information:

The Additional Information Form must be submitted before you submit your CT600 (tax return) otherwise HMRC may not register that the form has been completed and will reject your claim.

Bear in mind that many companies have December as the end of their financial year. This means there’s a rush to pay Corporation Tax bills at the end of September. If you submit your claim during HMRC’s busy period between September and December, you might be waiting a long time to get your application and payment processed.

In general, we suggest that you submit your claim before September to take advantage of shorter turnaround times.

HMRC have recently increased their standard processing times for R&D claims – from 28 days to 40 days.

This rise in average turnaround times makes it all the more important to submit your R&D tax credit claim early. At SeedLegals, we make it quick and easy to submit an accurate and comprehensive claim. See how we can help you submit faster.

It might seem complicated to submit an R&D tax credit claim, considering all the data gathering and narrative crafting.

Whether you’re claiming under the SME or the RDEC scheme, when you claim R&D tax credits through SeedLegals you’ll have the benefit of a dedicated tax specialist to help you out.

Here’s how claiming under the SME scheme works:

Swap R&D for some R&R – chat with us today to see how we can speed up your tax credit claim.

To find out how your R&D claim will work, get in touch directly with a member of our R&D team.

Still unsure if your costs qualify or how to write your Technical Narrative? Book a call with one of our experts, and we’d be happy to answer any questions you have.