SEIS/EIS compliance

SEIS/EIS compliance made simple

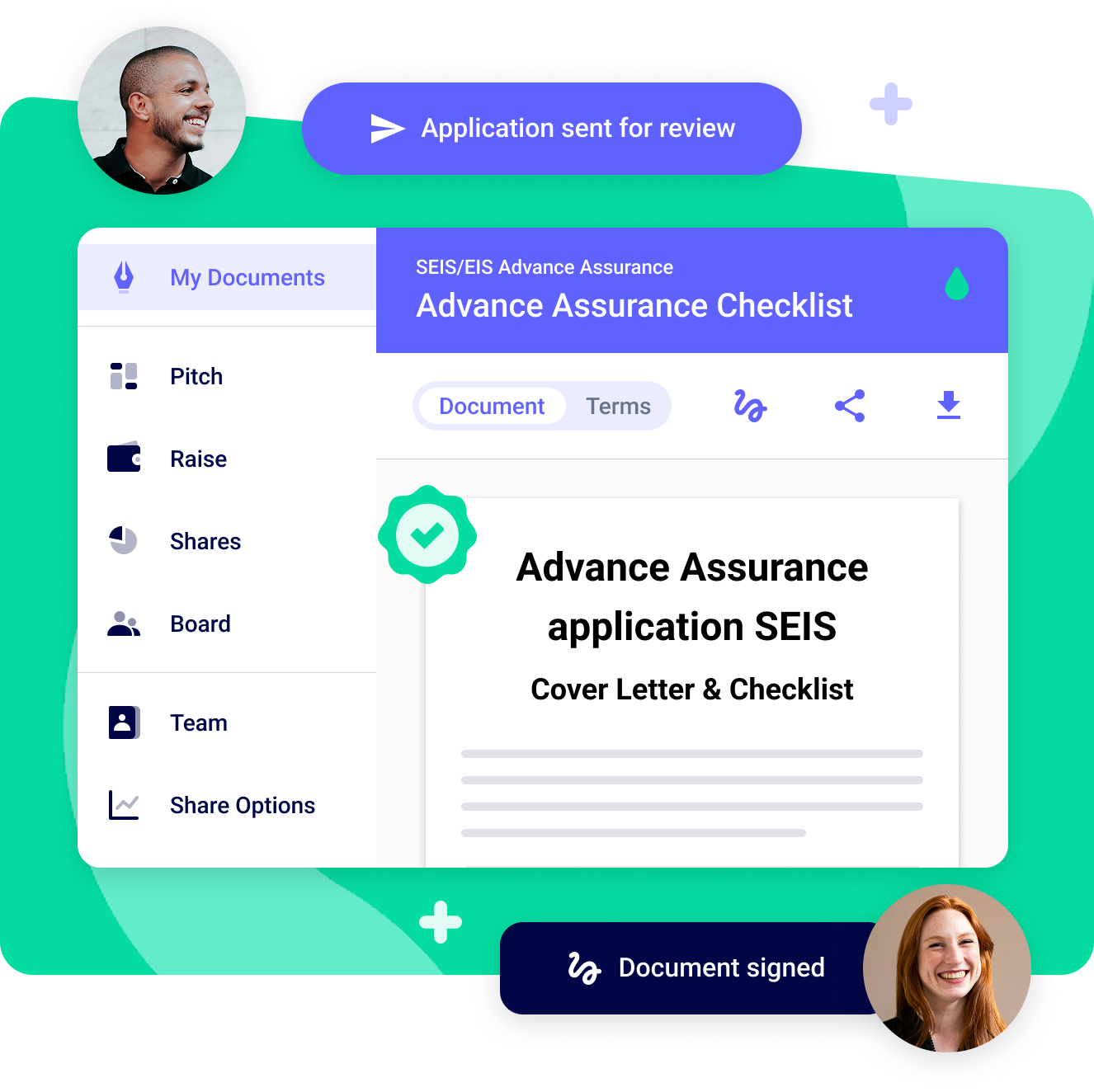

Give investors their SEIS/EIS tax relief the quick and easy way. Auto-complete forms, share and sign everything online and get unlimited expert help.

SEIS/EIS compliance - the fast way

Free up your time

Simplify the workflow

Use the UK’s #1 service

SEIS/EIS tax relief made easy

Get your investors their tax relief, without hours of paperwork

After a funding round, use SeedLegals to make things easy for you and your investors by sharing compliance certificates in a few clicks.

Generate forms in minutes, for any number of investors

Simplify your post-funding admin

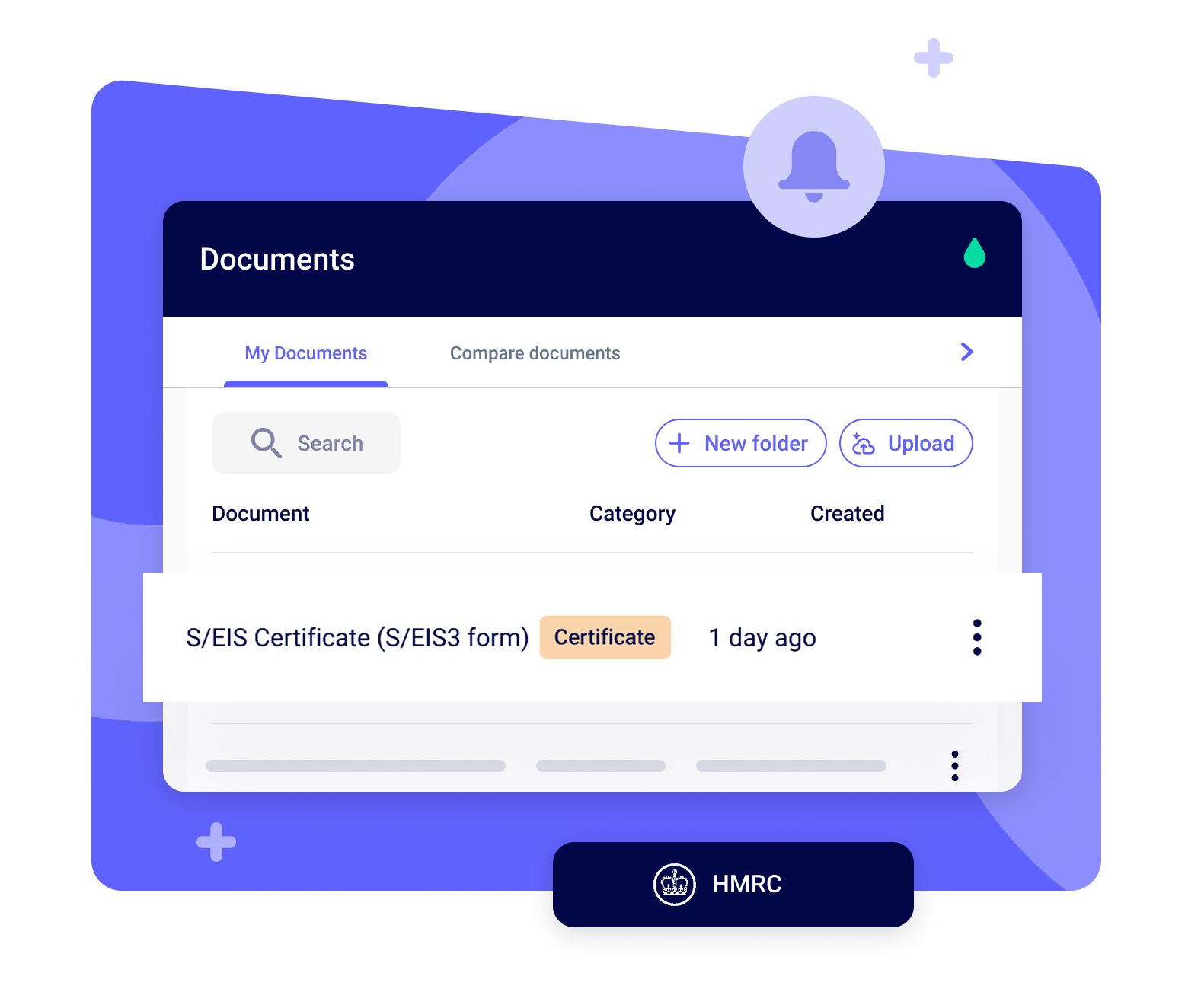

Store all your SEIS/EIS forms on SeedLegals

SEIS/EIS compliance certificate

All the documents you need - reviewed by legal experts

All the documents you get on SeedLegals are designed and reviewed by experts.

SEIS/EIS forms and cover letter, in our standardised format loved by HMRC

Forms auto-completed with your information

HMRC-compliant SEIS/EIS certificate to send to investors

5-star customer service

Unlimited help from our SEIS/EIS experts

Not sure where to start with SEIS/EIS compliance? Need help with your supporting documents? Our expert team are here to guide you.

Talk to us your way via chat, phone, email or video call

Unlimited help included - no extra cost

Ask us anything - we're here 9am to 6pm Monday to Friday

How to do SEIS/EIS compliance on SeedLegals

Success stories - our customers raising with SEIS/EIS

More resources on SEIS and EIS Compliance

FAQs

Frequently asked questions about SEIS/EIS compliance

What are SEIS and EIS?

The Enterprise Investment Scheme (EIS) and the Seed Enterprise Investment Scheme (SEIS) are UK government initiatives which grant private investors a significant tax break when investing in early-stage, ‘high-risk’ companies.

Most investors in the UK will only invest in these types of companies if they are SEIS/EIS compliant, so it should be a priority for founders seeking investment.

You can learn more in our SEIS and EIS essential read for UK startups and Our complete guide to SEIS.What's the difference between SEIS and EIS?

Both the SEIS and EIS encourage investment in UK businesses. The difference between the schemes is the type of company they cover, and how much tax relief investors get.

The Seed Enterprise Investment Scheme is for investments in early-stage companies.

The Enterprise Investment Scheme is for investments in medium-sized startups.

With both schemes, investors can invest in qualifying companies in return for Income Tax relief. For SEIS, they can invest up to £100,000 per tax year for 40% tax relief.

For EIS, it’s up to £1 million per tax year for 30% tax relief.

For both SEIS and EIS, investors pay no Capital Gains Tax on any profit they make from selling their shares, as long as they’ve held the shares for at least three years.

Learn more in our Our complete guide to SEIS.What are the changes to SEIS from April 2023?

In autumn 2022, the government announced changes to the Seed Enterprise Investment Scheme, to come into effect from 6 April 2023:

- raise up to £250,000 in SEIS investment (up from £150,000)

- raise with SEIS for up to three years from when you first started trading (up from two years)

- raise SEIS with company gross assets up to £350,000 (previously £200,000)

- individual investors can now invest up to £200,000 in any tax year (up from £100,000)

How are SEIS/EIS Compliance and Advance Assurance different?

SEIS/EIS Advance Assurance is confirmation from HMRC for your investors that your company is eligible for SEIS or EIS funding. Before you offer SEIS or EIS investment opportunities, you should apply to HMRC for SEIS/EIS Advance Assurance with SeedLegals.

SEIS/EIS Compliance is the official certification from HMRC that investments in your company qualify for the scheme (i.e. your company is SEIS/EIS compliant).

For your company to remain SEIS/EIS compliant, you must stay eligible and follow the scheme rules for at least three years after the investment(s), otherwise, HMRC can withhold or withdraw the tax reliefs from your investors.

You can read more about how SEIS and EIS work on the HMRC website.Do all my investors need an SEIS/EIS compliance certificate?

It depends. For an investor to get SEIS/EIS tax relief, they must meet certain criteria, so it’s possible not all of your investors will qualify.

For more about the SEIS/EIS eligibility criteria for investors, read our article: SEIS and EIS rules for startup investors.When can investors claim their SEIS/EIS relief?

Investors can claim their SEIS/EIS tax relief for the tax year their shares were issued. To keep your investors happy, it’s smart to do your SEIS/EIS compliance promptly - your investors need their certificates to complete their tax returns and get the tax relief.I'm raising £250,000 in SEIS investment. When should I do SEIS compliance?

To make the most of the new increased limit for SEIS fundraising, you can raise up to £250,000 as long as the shares are issued on or after 6 April 2023.

But because this change to SEIS is still going through Parliament, it hasn't yet officially become law so you'll need to wait to do SEIS compliance. If you send your compliance application before the law has been updated, HMRC will reject your application. We expect Parliament to approve the changes around July 2023.

For your investors, they'll still get their tax relief in the same tax year, but they'll need to wait until you're able to do the SEIS compliance to get their certificate.

For the full details, read our post: Raise £250K SEIS now - but wait until July to do SEIS ComplianceI have multiple investors - do I have to pay more to do SEIS/EIS compliance with SeedLegals?

No. Whether you have one investor or one thousand investors, our SEIS/EIS compliance service costs the same. When you have authorisation from HMRC, you can issue certificates on SeedLegals for as many investors as you like.Help! I’m stuck with SEIS/EIS compliance!

We can help. Hit the chat button to message our friendly team. We do more SEIS/EIS compliance than anyone else - we can help get your SEIS/EIS compliance done quickly and easily.

You’re in safe hands

Our team of legal and funding experts have helped thousands of entrepreneurs raise money and grow their businesses.

Beautifully organised

Your company's core agreements, all in one place

Secure signatures

Share and collect signatures online via SeedLegals

Backed by real lawyers

Create the exact documents you need at every stage of growth

Serious about security

Your information stays safe and confidential in our secure system

Helpful humans

Talk to one of our friendly team anytime on live chat

Extra protection

Don't worry, our insurance covers claims related to our platform

We’ve helped over 60,000 companies

From food to FinTech and beyond, join thousands of startups who use SeedLegals to start, raise and grow faster.

More customer stories