UK #1 for funding rounds

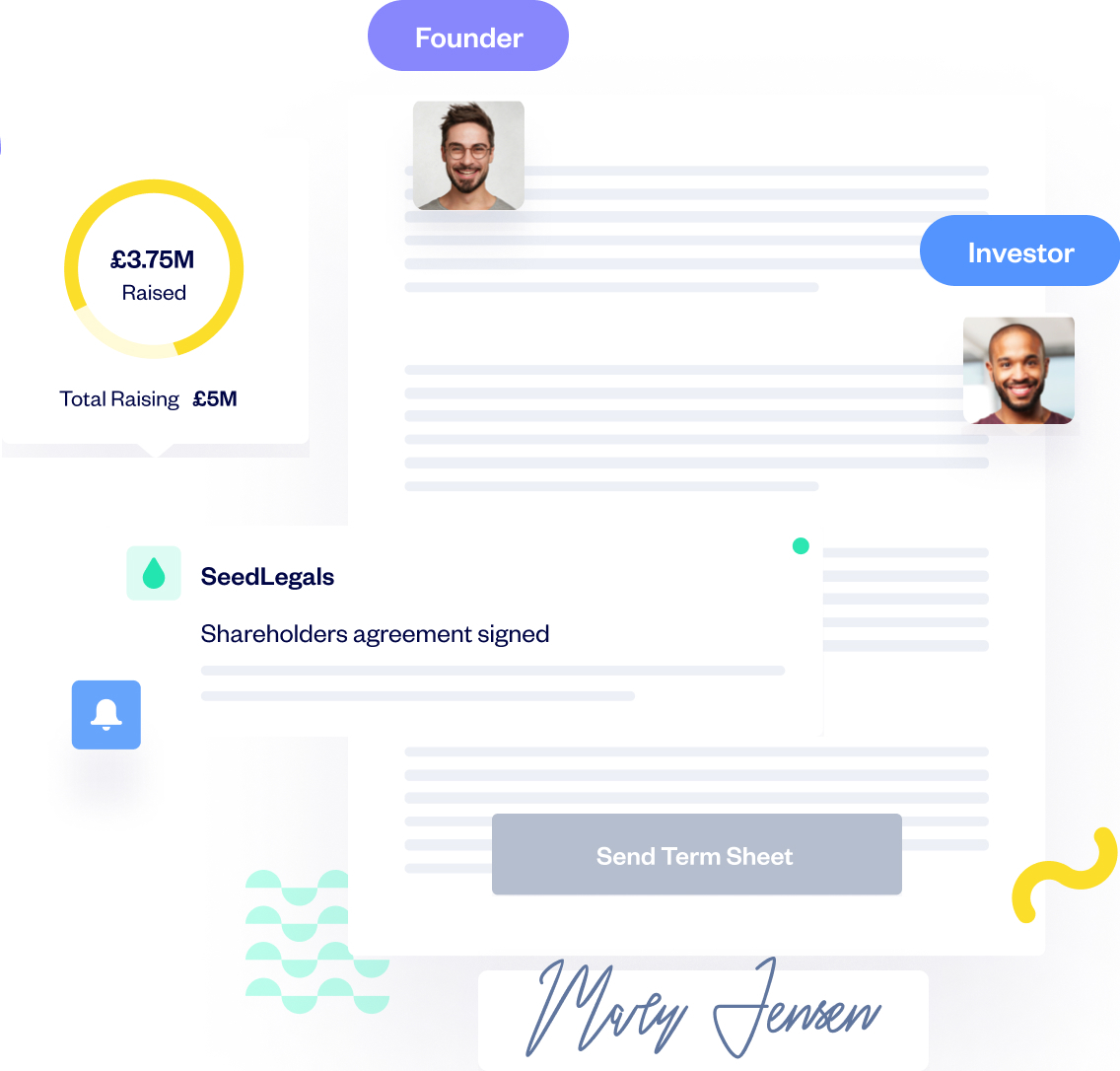

The faster way to do a funding round

Raise your funding round on the UK’s #1 platform. Create and negotiate all your investment documents in one powerful, streamlined workflow. Unlimited expert help included.

50,000+

companies use SeedLegals

£2b

raised on SeedLegals

UK #1

closer of funding rounds

1 in 6

UK rounds closed on SeedLegals

Startup funding made simple

Create your legal docs instantly

Forget billable hours and expensive back and forth with a traditional law firm. On SeedLegals it’s fast, simple and cost-effective to create, auto-update and sign all the funding round documents you need.

Generate customised fully compliant docs in minutes

Share, sign and store everything online

Save thousands on legal and accounting fees

Investor-ready, founder-friendly

Lead with the Term Sheet

Instantly create every agreement, every term, every clause - exactly how you want it. Your dedicated funding specialist is on hand to walk you through the deal terms so you can choose what’s right for your company.

Create your Term Sheet, auto-filled from your key terms

View built-in tutorials to help you choose your terms

Use insights from the 1,000s of rounds closed on SeedLegals

Seal the deal online

Close your funding round in record time

After you've agreed the Term Sheet, we instantly generate all the documents your investors have to sign, including the Disclosure Letter, Shareholders Agreement and Articles.

Templates created and vetted by lawyers

Documents based on industry-standard BVCA model agreements with customisable terms - everything from Investor Consent and Founder Vesting to Growth Shares

Designed for SEIS/EIS

Document commenting feature

Negotiate effortlessly with live comments

Keep track of negotiations easily with instant comments on your funding round documents. Investors can ask questions, suggest counter terms and discuss privately with company admins. No more back-and-forth email threads.

Keep comments private between you and each investor

Never miss a comment with instant email and platform notifications

Negotiate on the go with optimised mobile version

Deal Data Room

Control access to your confidential info

Get ready for due diligence. Use your secure Deal Data Room to share documents with custom groups of investors, lawyers and advisors.

Upload documents to your Deal Data Room

Grant, edit and remove access for individuals and custom groups

All in the same place as the rest of your investment docs

Unlimited support for your funding round

Chat online anytime with our experts

Need some help? Not sure how to push back in your negotiations with investors? Confused by ‘drag along’ and ‘tag along’? Our expert team is here to guide you through your startup funding journey.

Talk to us via chat, phone, email or video call

Unlimited help included in all memberships - no extra cost

Ask us anything - we're here 9am to 6pm Monday to Friday

SeedLegals Advisory Service

Looking for specialist legal advice?

If you need a dedicated lawyer to support with negotiation and bespoke drafting for your Series A+ round, our Advisory Service can provide you with high quality legal advice, priced efficiently.

Get in touch with our experts at advisory@seedlegals.com to learn more.

You need it? We’ve got it

Here are just some of the reasons SeedLegals powers more funding rounds in the UK than anyone else.

Integrated Cap Table

Designed for SEIS & EIS

Companies House ready

Flexible ways to raise

Term Sheet review

Shareholders Agreement

Disclosure Letter

Articles of Association

Shareholders Resolution

Fund Tracker

SH01 Allotment of Shares

Share Certificates

How to raise your funding round on SeedLegals

FAQs

Frequently asked questions about funding rounds

What is a funding round?

A funding round is when a company raises money from one or more investors. Typically a startup receives investment in exchange for equity in the company.

Startup funding is organised into different rounds according to the startup’s stage of development. Each investment stage usually only gives the startup enough capital to get to the next stage.

This works for investors, because they can put in a smaller amount of money and wait to see whether their investment leads to the growth they expected before investing again. It’s a way to limit the investor’s risk.

For startups, raising in rounds means they can put the investment amount towards achieving specific goals and then raise again at a higher valuation.What are the different types of investment round?

Broadly speaking, the distinct funding rounds in the life of a startup are:

Pre-seed or Bootstrap

This is the very first stage of funding, and usually the investors are the founders themselves, or friends and family of the founders. The pre-seed funding gives the startup just enough to get basic operations off the ground.

Seed

This is the first funding stage in which the startup seeks a formal investment from an external investor, such as an angel investor or a venture capital fund that specialises in early-stage startups.

The money raised during a seed round is often used to conduct market research, make key hires, build a minimum viable product (MVP) and test their product to prove product market fit.

Series A

Series A funding comes in when a startup can show traction in the market and that it is ready to scale. Companies typically use Series A funding to grow the team and continue developing the product and business.

Series B, C and beyond

If the company needs to raise funding to continue to grow, the next rounds are called Series B, C, D and so on.How long does a funding round take?

The fastest a company has closed a funding round on SeedLegals is nine days. But even for us, that’s fast! How long a funding round takes depends on many factors, including the complexity of the deal terms and personalities of the investors and founders involved.

From negotiating the Term Sheet to completing due diligence, gathering signatures and waiting for funds, the average funding round closed outside SeedLegals takes three to six months.

At SeedLegals, we’re focused on helping you close your round quickly and efficiently. We think six weeks is a realistic time-frame to complete your round.

With SeedLegals, instead of working to an expensive lawyer’s schedule, you get immediate access to expertly written and reviewed documents based on BVCA model documents. You create the documents you need - with the support of your dedicated investment specialist - and cut out the middleman.

Plus, we’ve pioneered the idea of agile funding. On SeedLegals, you can raise before a round with SeedFAST advanced subscription agreements and SeedNOTE convertible loan notes and top up after with Instant Investment. These are quick ways of getting funds into your account without going through all the steps of a traditional funding round.What legal documents do I need for a funding round?

The main funding documents you’ll need for your funding round are:- Term Sheet

- Shareholders Agreement

- Articles of Association

- Disclosure Letter

- Previous Investor Notice

- Preemption Notice

- Board Resolution

- Shareholders Resolution

- SH01 Form

With SeedLegals, you can generate all these documents instantly and they update automatically whenever you make any changes to your terms - everything from Investor Consent and Founder Vesting, to Growth Shares.

When you’re ready to complete your round, all parties sign online and your documents are stored securely on SeedLegals.

For a complete list of everything you need and how SeedLegals can help, see our guide to closing your round on SeedLegals.Do shareholders need to approve a funding round?

Yes, every time you do a funding round, you will need the approval of your board of directors and your existing shareholders.

The documents you need to do this are:- Board Resolution

- Shareholders Resolution

When you do your funding round on SeedLegals, we’ll let you know exactly what documents you need and when you need to sign and share them.What does ‘closing a funding round’ mean?

After you have negotiated the terms, got signatures and received the funds, your round isn’t officially closed until you’ve issued the share certificates and sent Companies House the documents it needs.

You’ll need to send Companies House your Articles of Association, your Shareholders Resolution and the SH01 form to confirm that you have issued new shares in your company.

At the end of your round, our team do a final check to make sure every document is aligned and accurate. With SeedLegals, you can be confident that what you’re submitting to Companies House is correct.

Need help finding investors? See our resources here

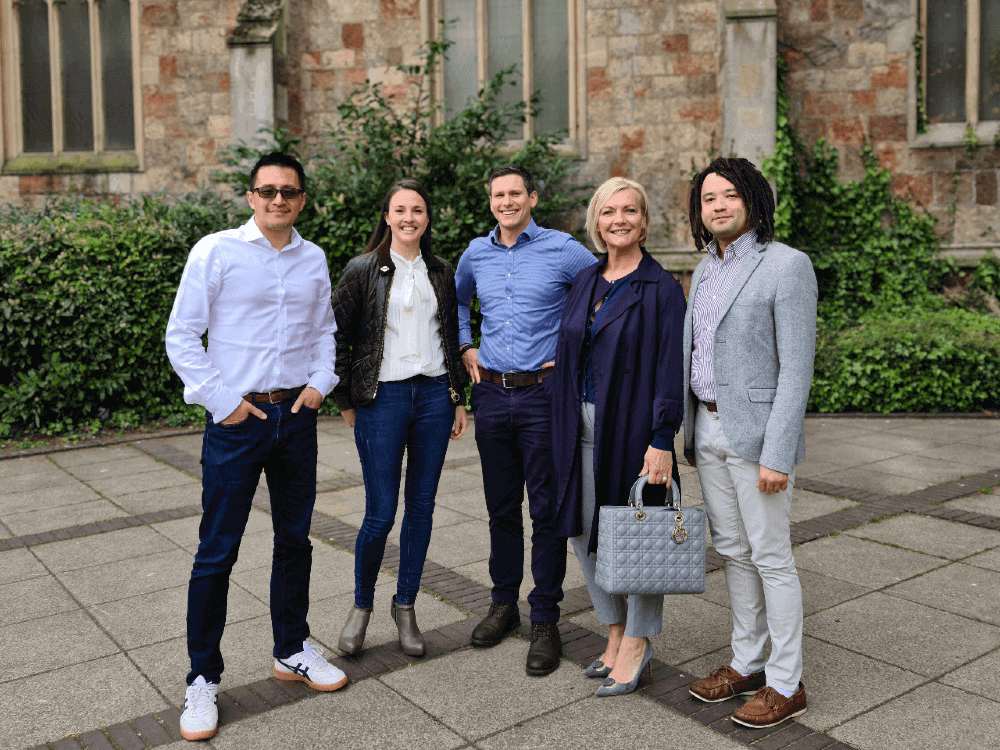

You’re in safe hands

Our team of legal and funding experts have helped thousands of entrepreneurs raise money and grow their businesses.

Beautifully organised

Your company's core agreements, all in one place

Secure signatures

Share and collect signatures online via SeedLegals

Backed by real lawyers

Create the exact documents you need at every stage of growth

Serious about security

Your information stays safe and confidential in our secure system

Helpful humans

Talk to one of our friendly team anytime on live chat

Extra protection

Don't worry, our insurance covers claims related to our platform

We’ve helped over 60,000 companies

From food to FinTech and beyond, join thousands of startups who use SeedLegals to start, raise and grow faster.

More customer stories