Raising a glass to flexible fundraising: Shandy Shack’s road to exit

Discover Shandy Shack’s journey to a successful exit, made possible by SeedLegals’ flexible funding tools: SeedFAST and...

Over a hundred investors. Seven million pounds raised. Hundreds of thousands saved on legal fees. Here’s how we helped Just Move In close investment deals the smart way, using our flexible SeedFAST and Instant Investment top ups.

Just Move In is a home setup service that makes moving home manageable. They manage time-consuming and boring admin, such as informing the council, finding the best value water and gas tariffs, and searching for the best broadband deals around.

The company was founded by Tom Old and Ross Nichols after Tom had a particularly poor experience moving home. Combined with their urge to start a responsible business that benefits the planet, Just Move In (a certified B Corp) was born. It officially launched in 2018.

Startup founders will know that attracting early investors takes a lot of work. As well as convincing them that your business is viable, you’ll need to negotiate and go through all the legal paperwork before they sign on the dotted line. So think how complicated it could be to attract over 100 investors!

Tom OldOur strategy was to attract a large number of independent angels and high net worth investors. In fact, we had over 100 of them. So it was important that we could find a legal partner that was able to support that number of investors in an organised, streamlined and efficient way. It turned out to be incredibly easy to onboard all these investors using SeedLegals. They simplify what could be a really laborious task. It’s reflective of what we’re doing at Just Move In, actually.

Co-founder,

Tom shared that what made the process so easy was that they could:

✅Answer a few questions in a clean workflow to automatically generate customised shareholders agreements and Articles of Association that included all their preferences

✅Easily share the docs with all their investors

✅Make changes to the docs without hassle – SeedLegals automatically notifies all investors of any changes and prompts them to re-sign

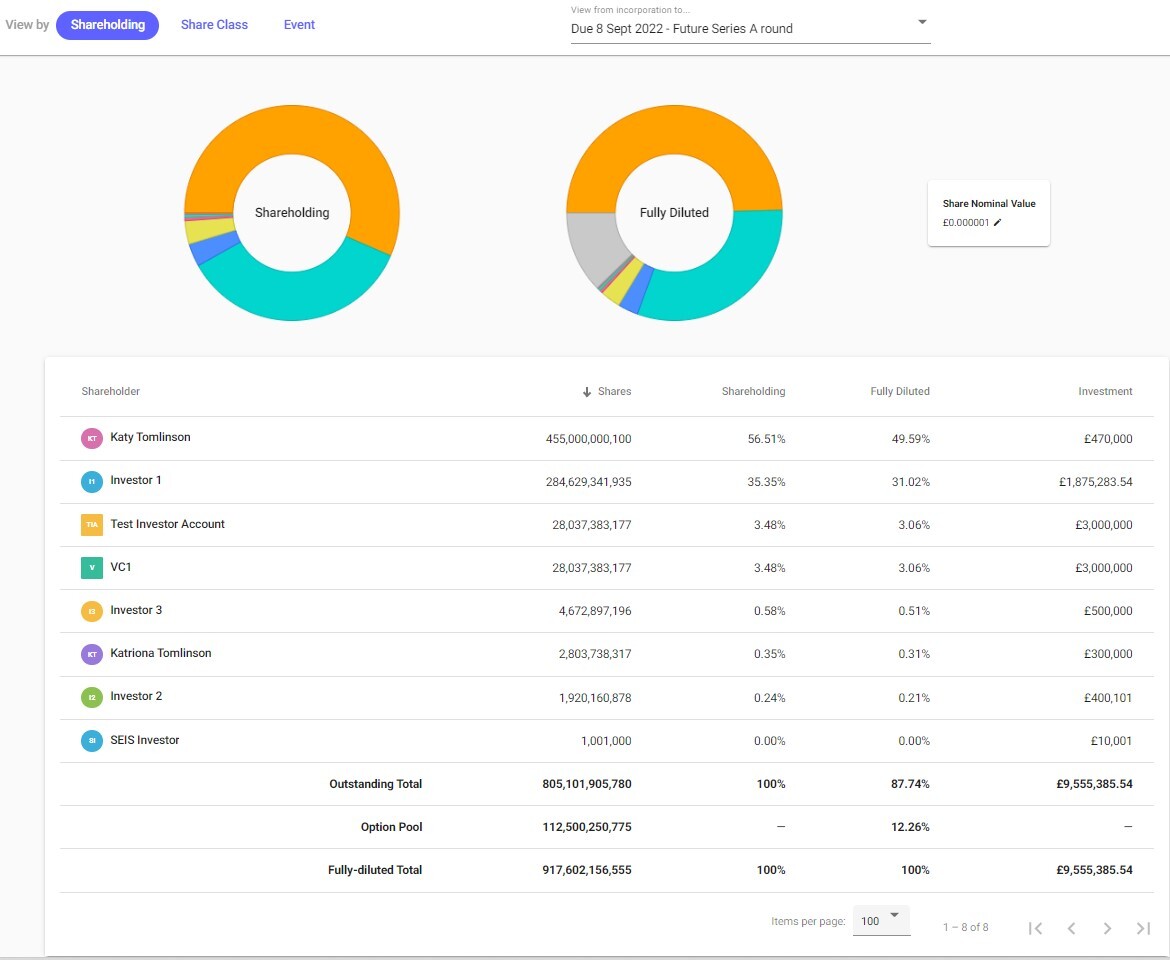

Tom OldI think most people would assume that having lots of investors results in a really large and difficult-to-manage cap table, but in practice, it hasn’t been a problem – at least with SeedLegals. In fact, it’s one of the reasons we chose SeedLegals. If we’d gone down the traditional route, we’d have wound up with a bulky spreadsheet that we’d have had to keep manually updated. But SeedLegals keeps it automatically updated for you, every time you make a change or bring in a new investor. It’s saved us a lot of time and hassle.

Co-founder,

SeedLegals isn’t just for closing your seed round. We’ll support you through all your investment rounds, no matter how far down the alphabet your rounds go.

Tom OldComing to our next round, we thought we might have outgrown the SeedLegals platform. After all, ‘seed’ is in the name! We briefly considered using other legal firms, but after speaking with the SeedLegals team, we were pleased to learn they could continue to support us for years to come.

Because everything was already on the platform, there wasn’t much setting up to do. And it was really easy to contact all our investors. It was quite a relief, to be honest!

Co-founder,

The benefits of using SeedLegals for multiple rounds includes

✅Having all your documnets in one place – which helps founders as well as investors

✅Quick access to your current and previous funding round docs

✅A digital cap table where founders and investors can have a clear, up to date view of their holdings

For most startup founders, raising investment isn’t something they’ve done before. So while we’ve designed SeedLegals to be as simple and intuitive as possible, we also offer incredible support when you need it. We believe that platform PLUS people make the perfect formul

Tom OldThere’s a lovely team of people at SeedLegals. Huge shout out to Janhavi, Anna, Emma B and Aleena for all their support. I didn’t realise that there would be so much support on hand, and they all far surpassed my expectations. They did a really great job guiding us through the process and answering our questions.

One of the reasons we originally considered using a law firm was for the hand-holding. We assumed an online service like SeedLegals wouldn’t be so personal. But actually, SeedLegals offered all the hand-holding we needed. There was always someone available to talk to, they knew their stuff and the response times were super fast. It was really impressive.

Co-founder,

👆 Tom sums it up perfectly. When you use SeedLegals, you gain access to

✅Unlimited support from a team of trained specialists at no extra cost

✅A smart, friendly human to answer your questions any time via live chat, video call or email

✅ Super-fast response times so you can get get everything done as quickly as possible

With SeedLegals, founders don’t have to just raise money using the rigid traditional approach (Seed, Series A, Series B, etc). Instead, they can use SeedFAST to raise cash ahead of a funding round, and Instant Investments to top up a previous round and add new investors when the opportunity arises. It’s an approach that’s proven to be very effective.

Tom OldWe used SeedFASTs to bring cash into the business as and when we needed it. If we stuck to a seed round, we’d have been bound by strict timelines and completion dates.

We’ve raised over £7 million from individual investors as-and-when the opportunities came up. And while they’re completely supportive of the business, I’m not sure all of them would have been able to invest if we pinned them down to a specific deadline. So taking this agile approach to fundraising has proven really valuable.

Co-founder,

👆 Tom sums it up perfectly. When you use SeedLegals, you gain access to

✅Unlimited support from a team of trained specialists at no extra cost

✅A smart, friendly human to answer your questions any time via live chat, video call or email

✅ Super-fast response times so you can get get everything done as quickly as possible

Just Move In closed over £7 million from over 100 investors using agile fundraising, thanks to SeedLegals. This has proved to be an effective way to fuel growth because they’ve been able to stay open to investment at all times and put more cash into the business between rounds as they meet investors who believe in and want to support their mission.

Tom Old“The market and macro economic environment has been anything but stable over the last few years, but using SeedLegals has given us the ability to adapt, keep the business well capitalised and continuously invest in the technology and infrastructure that are core to our growth and future success. It’s also allowed us to receive investment from investors when they wanted to invest and had funds available.

Without the distraction of an impending fundraise, we’ve been able to focus on what matters – our customers.

We want every move to feel personal. So we spend a lot of time focusing on personalising our recommendations so that the experience is contextual – a renter who’s moving in a week has a different journey to a home owner who’s committed to buying a home in six months time, for example.

It’s important to us to solve a genuine problem – my co-founder Ross and I aren’t the kind of people who’d create a company for the sake of it. So we focus a great deal on creating a great customer experience. Sometimes we invest a little more than we have to, but we believe that delivering a great customer experience will ultimately pay off in the long run.

Co-founder,

We’re thrilled to have helped this awesome B-corp bring their vision to life and help make so many people’s lives so much easier. This is what we love to do. We wish Tom and his team at Just Move In every success.🥂

We’d love to help you too. Talk to one of our funding experts to find out more – book a free call below.