Growth shares: What are they and when to choose them over share options

Are growth shares an alternative to share options? We explain how growth shares work, to help you decide if this special...

In this post, we’ll explain why, when and how to use a Subdivision Resolution when you do a share split – typically you’ll do this to increase the number of shares available to give to investors before a funding round.

A subdivision resolution is a document that needs to be signed by all shareholders as part of a share split.

You can create, sign and download a Subdivision Resolution and SH02 form on SeedLegals – try us free for 7 days.

When someone incorporates their company on Companies House, they usually create 1 share per founder, or perhaps 100 shares split between founders.

That’s fine… until the company wants to raise funding. Then they’ll need to do a share split, here’s why:

You can see immediately that there are two problems:

The solution is a share split (or, as Americans would call it, a stock split), where you turn those 100 shares into, for example, 100,000 shares. At the same time, you reduce the nominal value of each share by the same ratio, so that the total value of your shares is unchanged.

The good news is that SeedLegals automates the whole process. Assuming you’ve built your cap table on SeedLegals already, it’ll take just a few minutes to do everything – here’s how:

1. Select Shares in the left menu.

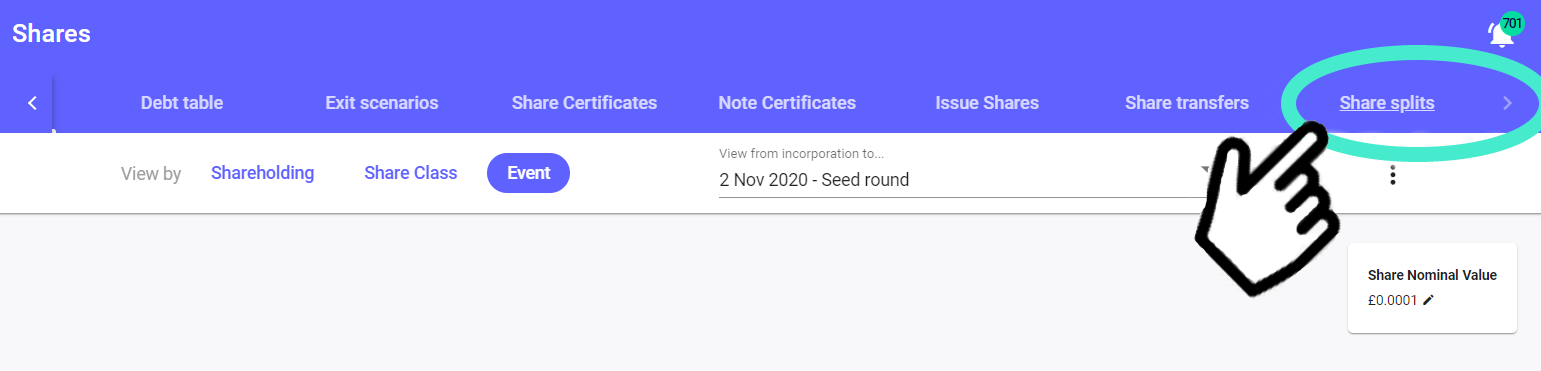

2. On the top banner, click the right arrow to go to the Share splits tab:

3. Click to create a New Share Split

4. Choose the multiplier you’d like – e.g 1000:1, and set a date for the share split.

5. SeedLegals instantly builds your Resolution documents and SH02 form.

6. Upload the SH02 to the Companies House website.

Or you can download and print the SH02 and post the signed form to Companies House. They must receive it within 30 days of the share split. The address is:

Registrar of Companies (England and Wales)

Companies House

Crown Way

Cardiff

CF14 3UZ

DX 33050 Cardiff

7. Lastly, and very importantly, click the button to Approve share split button. This will update your cap table to increase the number of shares and reduce the nominal value of each share accordingly.

We recommend having at least 100,000 shares before you do a funding round. For example, if you have 100 shares now, we recommend a 1000:1 share split. Or to future-proof your shares so you don’t have to do another share split for a future funding event, you might want to create, say, one million shares.

Make sure you pick a multiplier that creates a share nominal value that can be fully represented in 8 characters after the decimal point – the maximum allowed by Companies House. For example, if the nominal value is £1, doing a 300:1 share split is a bad idea because it will create a new nominal value of £0.003333333333…. which means the total nominal value of all the shares after the share split can never exactly match the amount before. So ideally go with 10, 100, 1000, etc. as the multiplier for the share split.

Got questions about share splits? Not sure how best to prepare for your funding round? Book a free call with one of our experts to get answers fast.

SeedLegals Plus is our best-value membership package of the services startups need to fundraise and grow, with big discounts and perks.

View plans