SeedLegals vs Carta: which platform to choose for cap table, SEIS/EIS, funding and options

The days of painstakingly tracking equity allocation on a series of spreadsheets are over. In this post, we explore two...

The Seed Enterprise Investment Scheme (SEIS) and the Enterprise Investment Scheme (EIS) are two of a number of UK government initiatives designed to encourage innovation.

Under the SEIS and EIS schemes, private investors get a significant tax break as a reward for investing in early-stage, ‘high-risk’ companies.

It’s not hard to see the schemes’ appeal. New ventures get money, risk-taking investors get money, and the UK economy gets a boost from new waves of fast-growth companies.

There’s certainly plenty of take-up. In just one year (2020-2021), almost 6,000 companies raised over £1,800 million in SEIS and EIS funding. If you’re looking to do a funding round in the near future, one of the first questions you’re likely to be faced with in talks with investors is whether or not you have SEIS/EIS Advance Assurance.

If you’re not sure what SEIS and EIS are, whether your business is eligible, which scheme to use or how to apply, our guide to SEIS and EIS funding is here to help.

Many investors only invest in companies pre-approved for SEIS/EIS. We make it easy.

Apply for SEIS/EISThe two schemes have the same aim: to encourage investment in new, high-risk, high-potential UK companies. The difference comes in the type of company they cover and the amount of tax relief they offer.

SEIS stands for the Seed Enterprise Investment Scheme. As the name suggests, SEIS is designed for very early-stage companies that have been trading for less than three years. It’s restricted to companies with under 25 employees and less than £350,000 in gross assets. An individual investor can invest up to £200,000 per tax year and receive a 50% tax break in return. The investor will also benefit from a Capital Gains Tax exemption on any profits that arise from the sale of shares after three years.

There’s a greater tax incentive for investors under the SEIS, so if you’re SEIS eligible that’s the one to go for. You can also use SEIS and EIS together.

EIS stands for the Enterprise Investment Scheme. EIS is designed for medium-sized startups that have been trading for less than seven years, with under 250 employees and less than £15 million in gross assets. It allows an individual to invest up to £1 million per tax year and receive a 30% tax break in return. As with SEIS, the investor will also pay no Capital Gains Tax on any profit arising from the sale of the shares after three years.

With both SEIS and EIS, there is no inheritance tax to pay on shares held for at least two years. Also, if the SEIS/EIS shares are sold at a loss, the investor might be able to offset the loss against their Capital Gains Tax (loss relief).

As a quick summary, here’s a table showing the main differences between EIS and SEIS:

Broadly speaking, your company is eligible for SEIS funding if it:

Your company is likely to be eligible for EIS funding if it:

Most types of business qualify for SEIS and EIS funding, but there are exceptions. If a ‘substantial proportion’ (20%+) of your trading activities involves dealing in land or commodities, banking, insurance, money-lending or other excluded activities, your company will not be eligible for SEIS and EIS funding.

Any one individual can invest a maximum of £200,000 under SEIS per tax year, while individual investors are limited to no more than £1 million per tax year under EIS. Shares issued under the SEIS and EIS schemes must be ordinary and non-redeemable shares, with no preferential rights attached.

An individual investing under SEIS or EIS can’t hold more than 30% of the company’s overall shares, and they can’t be connected to the company as an employee.

Directors can invest under SEIS. However, with EIS, the rules are slightly more complicated:

Total investment amounts are capped at £250,000 for SEIS funding, and £12 million for EIS funding.

You might not be able to receive the full amount of SEIS investment if your company has already received de minimis state aid in the last three years. The amount of de minimis state aid you’ve already received counts towards your overall SEIS investment limit.

You can raise SEIS and EIS funding at the same time, so long as you do it in the right order. Because SEIS is designed for early-stage businesses, you can’t raise under the EIS scheme and then go back to claiming as a seed company.

But, if you time things right and keep on top of the admin, you can offer investors EIS shares after you’ve reached the SEIS limit of £250,000. Be aware, though, that HMRC rules state that you can’t raise investments under the EIS and SEIS scheme on the same day.

What this means for your funding round is that it’s important that you issue SEIS shares before you take EIS funding. You’ll need to issue SEIS share certificates first, or date them appropriately, and then issue the EIS shares at least one day after.

If you’re raising via SEIS or EIS on SeedLegals, we make it easy to keep track of dates, who’s signed what and where exactly you are in the process. To find out more about how we can help, talk to a funding strategist.

You have to spend the funds you raise under SEIS and EIS on qualifying business activity. That means it must be used to promote the growth and development of the company, for example by hiring new employees, product development or marketing activities.

There’s also a time limit attached to SEIS and EIS investment.

SEIS and EIS are so central to the UK early investment ecosystem that many investors only consider companies that come pre-approved by HMRC.

That’s where SEIS/EIS Advance Assurance comes in. And here’s how it works: you submit an application with supporting documents to HMRC, they give you the stamp of approval that your investors need to get their tax relief.

To apply, you’ll need various documents and information like a pitch deck that includes your business plan, financial projections and a copy of your latest company accounts. If you have not previously received Venture Capital Scheme investments, you’ll also need to include the details of at least one proposed investor. You can find a more detailed list of what you need in our article SEIS: guide to the seed enterprise investment scheme.

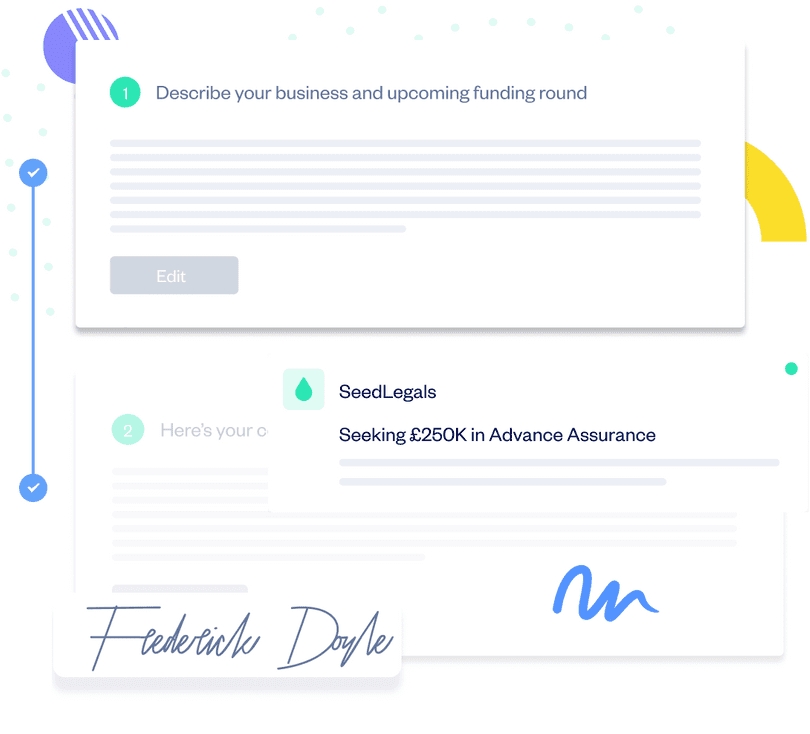

To get started, simply start your Advance Assurance application on SeedLegals. Fill in the questionnaire with help from our hint text and appoint us as your agent for SEIS purposes. We’ll conduct a thorough review based on our extensive experience and robust internal checklists and get back to you within three working days. After we’ve helped you make any recommended changes, we’ll also apply on your behalf via HMRC’s website.

On SeedLegals, we complete more SEIS/EIS advance approvals than anyone else in the UK. This expertise is reflected in our 98% approval rating – the industry average is only 62%.

For more information, see how to apply for SEIS/EIS Advance Approval.

After your funding round is closed, and shares and share certificates have been issued to investors, you’ll need to send an SEIS1 and/or EIS1 compliance statement to HMRC before your investors get their SEIS or EIS tax relief.

After your SEIS/EIS compliance is approved, HMRC provides your investors with a unique investment reference number. You can then issue SEIS3/EIS3 certificates to your investors, so they can claim tax relief.

If that sounds like a lot of work, don’t worry. On SeedLegals, we generate your SEIS1/EIS1 compliance statement and SEIS3/EIS3 investor certificates for you. And it just takes one click to share the certificates with your investors.

Now you know why SEIS and EIS are so important and how to apply, the next and most important step is actually finding investors. By getting SEIS/EIS Advance Assurance, you’ve already got over one hurdle. Many angel and early-stage investors exclusively invest in SEIS/EIS eligible businesses.

For some ideas of where to look for potential investors and how to approach them, read our guide on how to find startup investors. Or see where to scout for active investors in London and Manchester.

We know SEIS and EIS inside and out. To learn more about how we can help smooth your investment journey, book a slot to speak to a funding strategist.