The new and improved SeedLegals investor experience is here

It’s now easier and faster than ever to create, close and manage your startup investments on SeedLegals. Learn more abou...

Over the past months we’ve been hard at work on the next iteration of the SeedLegals platform, it’s all come together for our August update.

Introducing Team to help you manage your team, a better way to do your board meetings, new subscription pricing (you get more, for the same or less), debt table for managing SeedFASTs, Deal Manager for investors, and more. Keep reading…

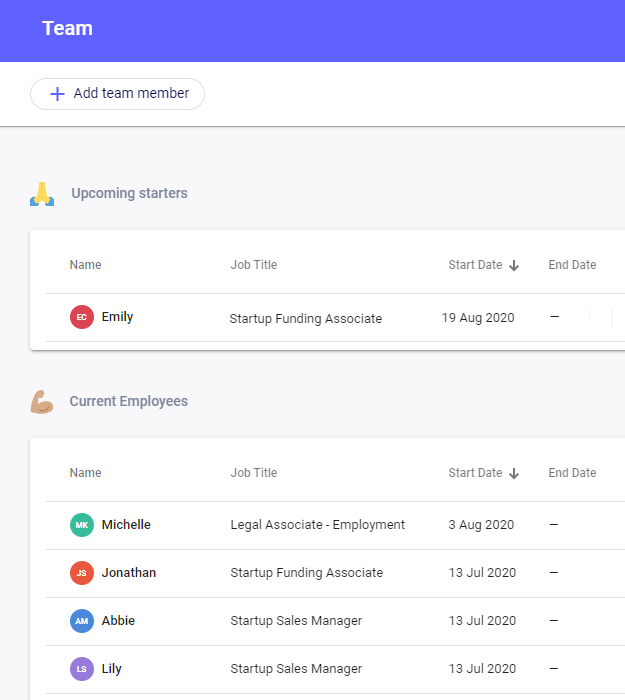

In the 3 years since we launched SeedLegals, our customers have grown with us. The two-person companies that closed their round on SeedLegals back then are now 40+ person companies. Our vision is to help companies grow faster, so we’re busy adding features to power later-stage companies. So, introducing Team. For now it’s a simple set of features to make it easier to see all your current and past employees, hire, change salaries, vary employment terms and, yes, these are difficult times, handle redundancies and terminations. We’ll be adding a lot more over the coming months…

Company board meetings fall, broadly, into two categories:

We decided it was time to make this all much easier, so welcome to the future of board meetings.

For those little things that need board approval, instead of hours messing around manually creating board resolutions and Companies House filings, it’s all sorted in a few clicks.

For your investor board meetings and more complex board matters there’s a delightful new way to do that:

We’re looking forward to using this for our own board meetings!

One of the mild nuisances of having a company is the annual Confirmation Statements you need to file with Companies House.

Good news, SeedLegals now creates those for you in 1 click, creating your CS01 form from your SeedLegals cap table, ready to download and send to Companies House. You’ll find it in the Board section.

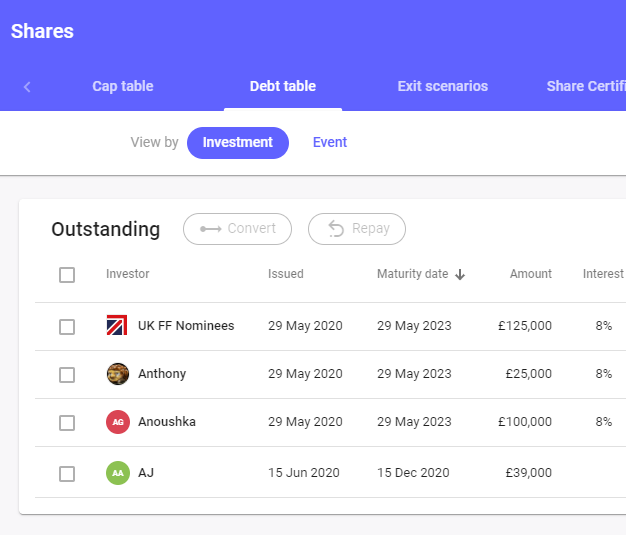

We’ve all heard of Cap Tables, that’s the place to manage shares and shareholders. Similarly, a Debt Table is the place to manage your SeedFASTs and convertible notes. See at a glance the total amounts outstanding. When the time comes to convert them, just select any number of SeedFASTs and convertible notes to add them to a current funding, or – new! – convert them all immediately with Instant Conversion, which will create a Deed of Adherence to join them as parties to your last Shareholders Agreement, creating all the needed approvals, share certificates and SH01 form for Companies House.

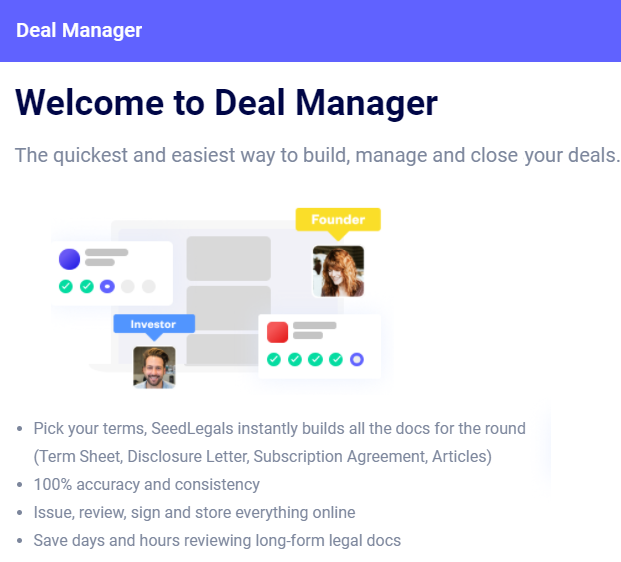

To go with our new features we refactored the site navigation:

When we started SeedLegals our focus was on helping founders. But that was just the start. It’s now time to take the next step towards creating a more efficient investment ecosystem by helping investors create and send investment proposals more easily, manage their portfolio in one place, and close deals faster. And, by doing that that, helping to standardise and streamline startup funding rounds from both sides, for the benefit of everyone.

Our first Deal Manager release is designed for VCs and funds rather than angel investors – that will come soon. Anyone can enable Deal Manager, once you’ve created a company on SeedLegals you’ll find it in Company Details -> Display Options.

Once you’ve enabled Deal Manager you’ll be able to easily create and send investment proposals to any company, and track the status of all your proposals in one interface:

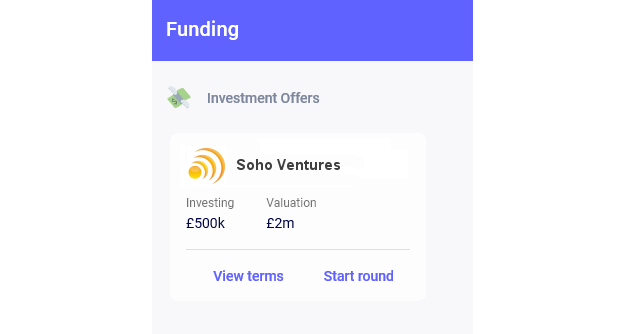

When you send a company an investment proposal, the founders will receive a SeedLegals invite. After they’ve clicked the invite and created their SeedLegals profile, your investment proposal will be waiting for them:

When the founders click to start their round, it will default to using any deal terms in your Investment Proposal, but they’ll be able to set their preferred terms, as well as being prompted to specify all the things that only they know (their cap table, founder salaries, other investors in the round, etc.).

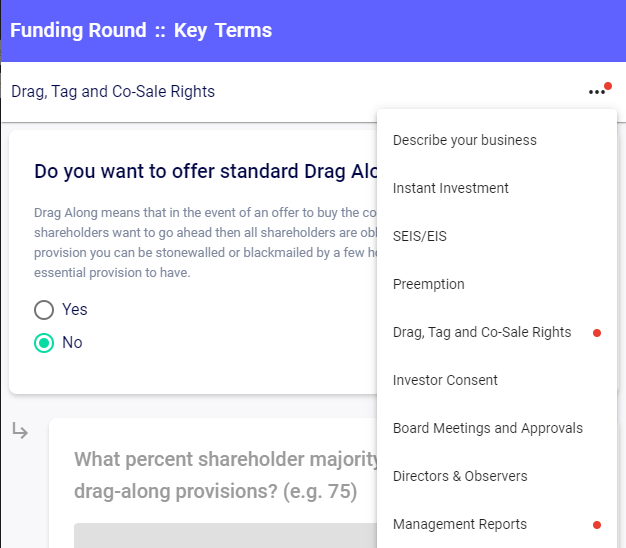

If the founders choose deal terms that differ from the ones you’ve proposed, we highlight that, so you can see at a glance any misaligned terms:

If you’re looking to transform the way you do your investment, hit the web chat now and we’d love to get you started with Deal Manager, it’s totally free for investors. Right now it’s our first step in enabling both sides of the market, more coming soon!

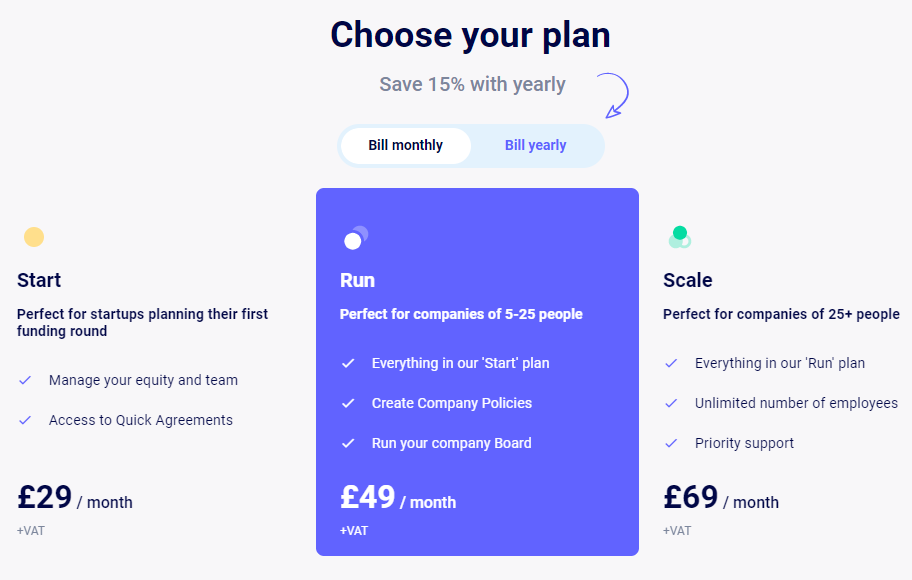

Last, but not least, we’ve updated our subscription pricing, you’ll get more, for the same or less, read all about it here.