R&D tax relief has changed – here’s what you need to know about the new merged scheme

Big changes are coming to R&D tax relief. For accounting periods starting from 1 April 2024, a new merged scheme replace...

Research and Development Tax Credits are a great way to make the money raised in your last round last longer. We spoke to founders in industries ranging from technology, energy and education to furniture and found that many did not know about R&D Tax Credits and that they were eligible to claim up to 33% back on their expenses that qualify as R&D. Many also thought that R&D Tax Credits were only available to technology companies, which is a very common misconception among founders, but is certainly not true.

In this article we’ll show you how your company could qualify for claiming R&D Tax Credits and how a project qualifies as an R&D Project.

Let’s start with the fact that if your company is participating in any kind of R&D (and R&D is a very broad definition, far from being only software or deep tech), under the SME scheme for R&D Tax Credits you’re very likely eligible for claiming back up to 33% of your expenses on R&D in the form of corporation tax deduction or cash payments from HMRC.

HMRC aims to check claims within 40 days. Once your claim is approved, it will then take around one to two weeks for the money to arrive in your bank account.

The amount claimed back through the scheme, where companies claimed on average approximately £57,000 (2018-19 stats), which can then be used to grow your team, invest in technology, secure sales and do many more things you need to scale your business.

Under the SME scheme for R&D Tax Credits, you can get relief of 33% on your qualifying R&D costs if you’ve worked on projects that advance overall knowledge and capabilities in the field of science or technology and faced technical uncertainties while doing so in the last 2 years.

To qualify for the R&D Tax Credits under the SME scheme, your company must have:

If you do not meet the criteria for the SME scheme, you may be able to qualify for the Research and Development Expenditure Credit (RDEC) scheme. Larger companies who are undertaking eligible R&D activities can claim cash payments if they are loss making or a deduction in their corporation tax liability if they are profit making. However, this scheme is not as generous as the SME scheme and you can only claim back up to 13% of your qualifying R&D expenditure.

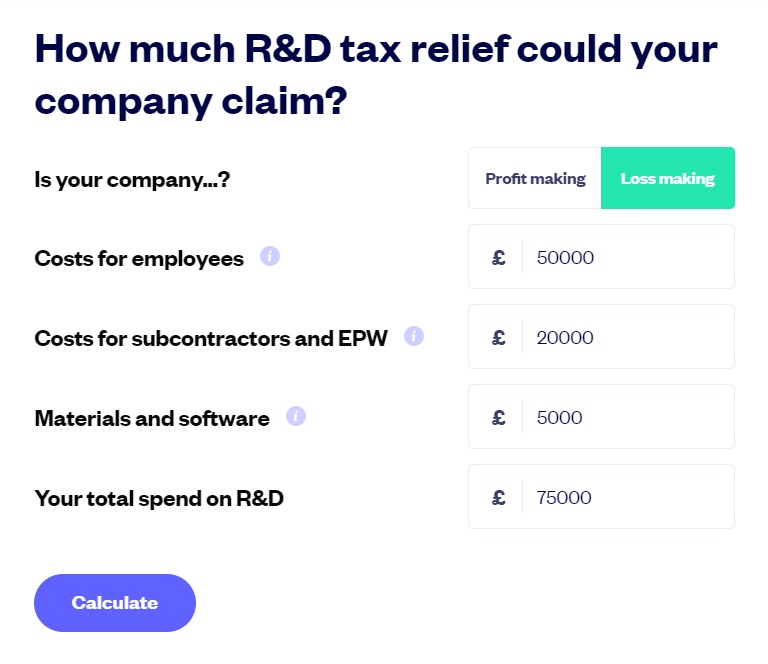

How much R&D tax relief could your company claim? Find out with our calculator.

Calculate R&D cashback

Costs which you usually will not be able to claim under the scheme are those associated with the production and distribution of goods and services (such as sales and marketing), capital expenditure and payments for the use and creation of patents and trademarks. Dividends paid out to Directors also do not qualify as R&D expenditure, even if the Directors have participated in R&D activities on behalf of the company. However, if the Directors have contributed to R&D projects and are paid salaries, a proportion of their salaries would still qualify as R&D expenditure.

The reason why these costs do not qualify as R&D expenses under the scheme is that they do not involve significant risks and technical uncertainties.

It might look complicated to navigate the rules about what you can and can’t claim for. But when you choose to build your R&D claim with SeedLegals, we make it easy to import your eligible costs and give HMRC all the information they’re looking for.

Here’s how it works:

To see how we can help you claim the money you’re due, book a chat with an expert.