10 essential legal documents for UK startups

Learn what these essential documents are for and why you need them to start, run and grow your business.

As a startup, a lot of your value is bound up in being able to do something another company can’t. Maybe you’ve developed an idea that will revolutionise an industry. Or you’ve invented proprietary technology that outpaces all your competitors.

It’s essential to your company’s survival to keep that information confidential as you get established. But you can’t grow without buy-in from potential investors and employees. And you can’t raise funds or run your business under a shroud of secrecy.

An NDA is the tool you need to negotiate that balance. It allows you to have confidential discussions with the people who need to know while preventing sensitive information from falling into the wrong hands.

In this guide, we’ll explain what exactly an NDA is, when to use one, when not to use one and how to work out which free NDA template is your best option.

It’s quick and easy to create your NDA on SeedLegals. Try us free for 7 days.

Create your NDAAn NDA stands for non-disclosure agreement. You might also hear them called confidentiality agreements. It’s a legal contract that establishes confidentiality between two parties during discussions about commercially sensitive information.

In effect, it stops the person receiving sensitive information from disclosing it publicly or using the information for their own benefit.

NDAs are designed to protect your company’s intellectual property and proprietary information. They protect the types of information and knowledge that are exclusive to your company, essential for you to carry out your business and would materially damage you if competitors had access.

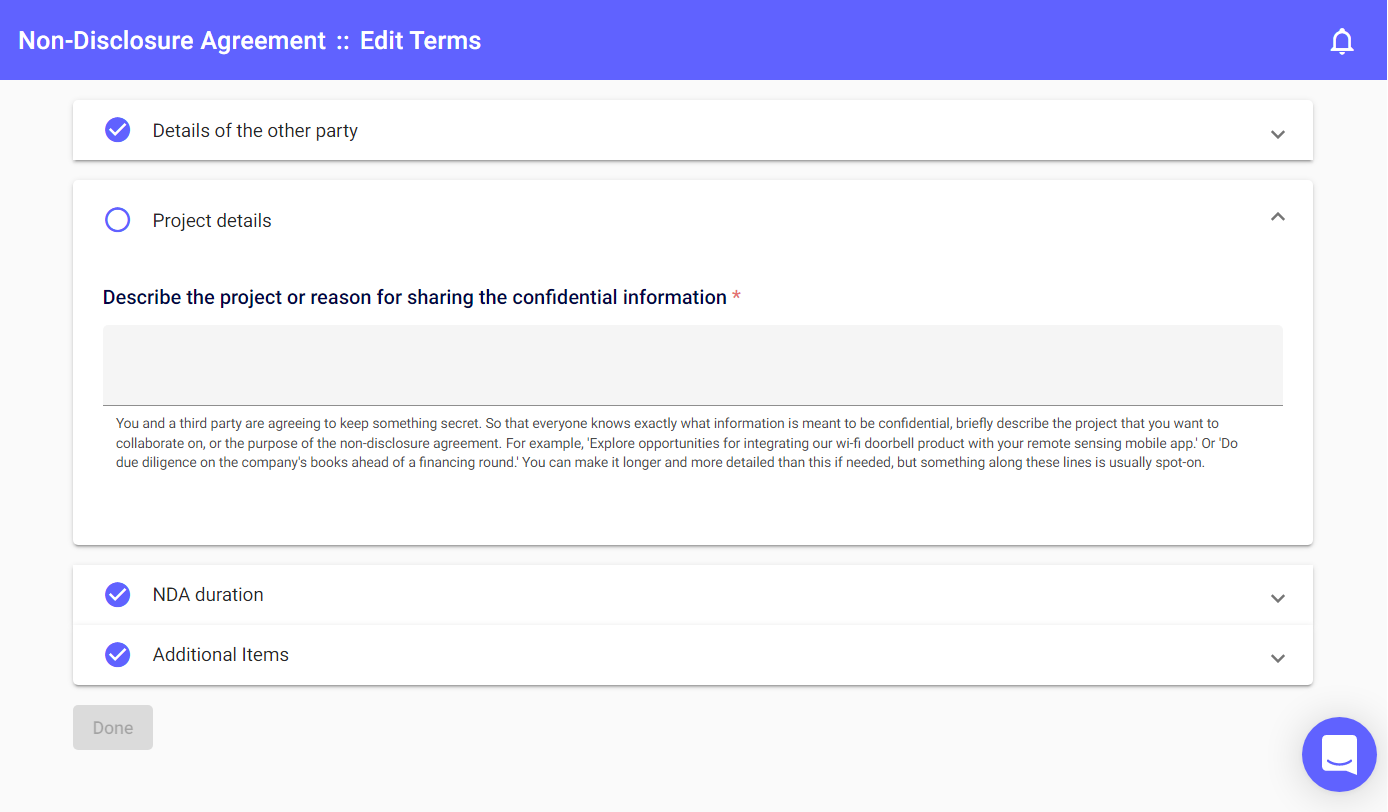

When writing an NDA, it’s important to narrow your scope and be very specific about the type of information you’re protecting. If your terms are too vague, your NDA might not be enforceable.

A well-drafted NDA is legally binding, assuming that you’re willing to spend the time and effort needed to pursue legal damages in the event of a breach.

Even if you know you’re unlikely to take the other party to court, NDAs are still helpful in setting the expectation of confidentiality in your discussions. Bear in mind that you won’t want to be heavy-handed with NDAs during discussions with investors.

If the NDA is not written correctly and its scope is too broad, it might not be legally enforceable. You need to be very clear about exactly what information you’re protecting from disclosure. That’s one of the reasons why it’s important to use a good legal template for your NDA.

Anna SivulaNDAs are a very valuable tool for startups who want to protect their confidential information, but startups often don’t have the time or money to bring legal action to enforce them. There are practical steps you can take to supplement your NDA to make sure your confidential information stays secret:

– Restrict access to confidential information – your counterparts can’t disclose information they don’t have

– Disclose information in stages – limit disclosure to a high-level overview without any sensitive information in early-stage discussions

– Make sure all parties know the information they receive should be treated as confidential

Senior Legal Associate,

NDAs are not a way to implement a blanket ban on everything to do with your company. You can only protect specific pieces of information that aren’t already in the public domain.

You can use an NDA to protect commercially sensitive information and your company’s intellectual property.

Some examples of what you could protect via an NDA are:

Anything that’s already in the public domain. You won’t be able to retrospectively make information confidential after you’ve talked about it openly. So if you’ve disclosed it yourself in a public setting – like a panel discussion or networking event – you won’t be able to protect that information from going public via an NDA.

It probably goes without saying that you can’t stop someone disclosing illegal activity, so an NDA won’t prevent information reaching the police or a regulator.

A well-drafted NDA will set out:

You should define an end-date as part of the non-disclosure agreement.

That end-date could be when the professional relationship between you and the other party naturally finishes, or when the information being shared is likely to be in the public domain anyway.

Theoretically, you could specify that the confidentiality obligations in the agreement continue indefinitely. But courts are highly unlikely to enforce an NDA in cases where the confidential information has become a part of public domain, or is out of date or has ceased to have any commercial value.

While technical information (like research data and software specs) can have commercial value almost indefinitely, business information is usually only valuable for a short time. You should set a realistic length of time for the duration of the NDA, depending on what type of information you need to protect. In practice, it’s common to specify a term of between two to five years.

In general, angel investors and VCs are unwilling to sign NDAs at the pitch stage. They’ll see many, many pitches, often from companies in the same sector – and there’s no incentive for them to expose themself to legal liability without getting anything in return.

So when pitching, it’s important to find a balance between talking credibly about your expertise without giving away proprietary secrets.

After you and your prospective investor are past the pitch deck and business plan stage, it’s reasonable to ask them to sign an NDA. As part of due diligence, you’ll share lots of information you don’t want to go any further, including detail in employment and commercial contracts.

So investors are a delicate subject, NDA-wise. But you’re on firmer ground with people who join or work inside (or alongside) your company. To protect your proprietary information, you should ask the following groups of people to sign an NDA.

You don’t have to create a brand-new NDA each time. It’s sensible to have a standardised agreement that you can update with specific terms as and when you need to. That means you’ll be able to send it out quickly.

Team members, like employees, consultants and advisors

You might not need an NDA if your team member is already covered by a contract that includes confidentiality terms, such as an Employment Agreement, Consultancy Agreement and Advisor Agreements. Often these types of contracts will already contain confidentiality clauses which will cover the information your team member comes into contact with as part of their role.

If you have any concerns that these terms aren’t strong enough, or your team member’s role gives them more access to sensitive information than originally planned, you can ask them to sign a separate NDA.

Co-founders

In theory, you and your co-founders are working towards a common goal and wouldn’t do anything to hurt the business. In practice, co-founders can part ways with companies they’ve built. And the risk is that they take valuable information to their new venture or even a competitor.

While Founder Agreements usually include strong confidentiality clauses, it’s worth making sure your company is protected from founder fallouts with a specific NDA.

Interviewing candidates

During the hiring process – especially for a senior role – you might need to discuss sensitive information. You can require interviewees to keep that information confidential by asking them to sign an NDA before the interview.

Suppliers and partners

If you’re working closely with another company, you should make sure there’s an NDA in place to protect your IP and proprietary information they might have access to.

There are two types of NDA, unilateral and mutual.

Unilateral NDA

This tells the person or company receiving information that they must not divulge, share or release that information. By signing the NDA, the receiving party is obliged to keep the information protected. Both parties sign the same document.

Mutual NDA

To allow two parties to share information freely with each other, you’ll want a Mutual NDA. This binds both parties in an agreement to keep each other’s information confidential. If your company is exchanging confidential information with someone or another company, then each party can create a Mutual Non-Disclosure Agreement for the other to sign.

At SeedLegals, when you create an NDA, it’s a Mutual Non-Disclosure Agreement because usually both parties share confidential information with each other.

Here’s why we offer Mutual NDAs: we often see parties sending out unilateral NDAs that heavily favour that party’s interests. In most cases, the other party will simply ask for the NDA to be made mutual without bothering to read any further. It’ll save you time to use a mutual NDA in the first place.

The easiest way to write an NDA is to start with a template and customise it so it’s right for your company.

On SeedLegals, it’s simple and speedy to generate the agreement, choose exactly the terms you need and send it straight to the other party to be signed online.

Our legal documents are written and reviewed by experts, so you can be confident what you’re sending is legally compliant. Plus, all templates feature handy tutorials to help you define your terms – and help from our specialist team is only a click away.

We store your documents securely for as long as you need, so you can access them again whenever you want.

Create your NDA for free with your SeedLegals seven-day free trial.

Our checklist explains 10 essential legal documents for UK startups: what each document is for, and who needs to sign it. To get the free checklist, fill in your details: