How to get investment-ready, with Nina Raab

What does it actually take to go from founder dream to investor-ready? It’s more than just polishing a pitch – it’s abou...

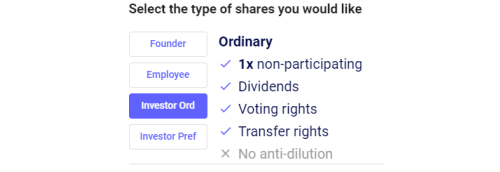

Broadly, there are two types of shares that are applicable to a startup: Ordinary shares and Preference shares.

Each may have a variety of attributes – voting rights, dividend rights and liquidation preference being the most common. In this article we’ll focus on the last of these.

A liquidation preference is, as you might expect, related to what happens when a company is wound up. But it’s not all bad news, “liquidation” is wider than that, it includes what happens on a sale of the company.

Now of course every investor would, given the choice, ask for Preference Shares, and indeed in the US preference shares are very common in funding rounds.

But, and this is good news for founders, preference shares are incompatible with SEIS/EIS, so if an investor has preference shares, they can’t get SEIS or EIS tax deductions.

The reason is that in order to qualify for SEIS or EIS, the investor has to incur the “normal risks of an investor”, i.e. they can’t get a better deal than any other shareholder.

As a result, preference shares are almost non-existent in UK angel and seed funding rounds which are completely dominated by SEIS and EIS investors. It’s only when you get to Series A rounds of £1M and above with VC and non-SEIS fund investors that you’ll start seeing preference shares.

Early-stage UK startups are all about Ordinary shares:

Well, almost..

When an investor puts their money into your, they’re taking a significant risk. They even agreed to your crazy £1M valuation for a company with no product, no customers and no revenue! So naturally in the 5 years since SEIS/EIS became available, the finest minds have been working on finding a way for the investors to get their money back first on an exit, without being disqualified from SEIS/EIS.

And the answer they came up with is a Liquidation Priority.

Broadly, what this means is that the investors get a different class of Ordinary shares to the founders, they’re usually called A Ordinary shares. And those A Ordinary shares don’t exactly get their money back first, the proceeds actually get shared between all shareholders, except that until their investment money is repaid, the proceeds are split 99.99% to the A Ordinary shareholders, 0.01% to the Ordinary shareholders. Once the investors have received their money back, then any remaining assets are distributed pro-rata, i.e. to each shareholder proportional to the number of shares they have.

This all needs to be worded extremely carefully in the Articles in order to be SEIS/EIS compliant. The good news is that at SeedLegals we’ve done all the research and the hard work for you, and so if an investor requests a liquidation priority on their SEIS/EIS investment you can set this up in a few clicks, confident that the wording will be correct.

1. The investor will ask you for something like a “1X non-participating liquidation preference”, or “A Ordinary shares with a liquidation priority” or “an SEIS/EIS compatible liquidation preference”.

2. Now, you need to think carefully about whether you want to give this to your investor or not. By doing so, you (i.e. the founder) giving the investor their money back first, so on a sale of the company you will receive less yourself. If it’s your first £200K round chances are it won’t be a big deal either way – either the company will fail and nobody gets anything, or you’ll exit for a few million pounds, and that £200K won’t make a huge dent in the 70% or whatever share of the proceeds that the founders will receive.

But, when the investment amounts are larger, giving your investors a liquidation preference can make all the difference in the world. For example, popular eSports site FanDuel was recently sold for around $500M. The problem is they had raised $500M, with those VC investors getting Preference shares, so when the company got sold the founders got precisely zero. So, think carefully before agreeing to give your investors a liquidation preference… though realistically if an investor asks for this they’re an astute investor who knows the game, and they’re likely to only invest on that basis.

3. Next thing to know is that if you give A Ordinary shares with a liquidation preference to one investor, pretty much guaranteed you’re going to have to give it to all. The reason is that the other investors will clearly see on the cap table in the Shareholders Agreement they have Ordinary shares while someone else has A Ordinaries with a liquidation preference. And then it’s going to be a short sharp conversation till they get the same. So, remember that as soon as you give this to one investor, assume you’ll need to give it to all.

4. Now that you’ve decided that you want to do this, actually setting up this quite complicated mechanism turns out to be very simple on SeedLegals, as we take care of all the behind-the-scenes work for you.

a) Go to your Cap Table -> Actions button -> Edit Share Classes

b) Click to create a new share class, then select Investor Ord

c) SeedLegals will suggest “A Ordinary” as the name, and you’ll see that those shares have a liquidation priority. Perfect.

c) SeedLegals will suggest “A Ordinary” as the name, and you’ll see that those shares have a liquidation priority. Perfect.

d) Now go to your funding round, click to add/edit the investments, click Add Share Class, and add the newly-create A Ordinary shares.

e) Lastly, add all your investors, giving them A Ordinary shares.

f) If you had already added those investors in the round with Ordinary shares, just edit all those Ordinary investment amounts and set them to 0, so that they disappear, leaving the investor now with A Ordinary shares.

SeedLegals platform will have automatically created the exact set of wording to use based on the different type of shares (Ordinary, A Ordinary, Preference) that all the shareholders and investors have, and whether anyone has SEIS/EIS requirements.

Finally, the article above implies that a liquidation preference is something that an investor wants, and a founder is reluctant to give, because it gives the founder less value on an exit of the company. That’s certainly the case, but of course you could spin this around and intentionally offer this to your investors as a way to sweeten the deal. Few investors know that an SEIS/EIS-compatible liquidation priority is possible, and by telling them about it and offering it to them you may be positioning yourself as both an expert on this and sympathetic to their needs. At a price to yourself, alas.

Want to know more? Hit the chat bubble to speak to the experts or book a call with a member of the SeedLegals team.