Can you flip your UK company to the US and continue to raise SEIS/EIS from UK investors?

Every day, 2-3 founders call me asking about the Delaware flip. They’re finding it hard to raise from UK investors...

When we launched SeedFASTs back in 2018, founders would usually create a couple of SeedFASTs to raise smaller amounts ahead of their next funding round.

But that’s all changed. We now regularly see founders creating dozens of SeedFASTs, sometimes 100 or more.

So we’ve released an all-new SeedFAST workflow designed to make it even easier to create and manage lots of SeedFASTs.

Before we dive into the new improved SeedFAST workflow, a quick background for those not familiar with SeedFASTs.

SeedFASTs (our brand name for an Advanced Subscription Agreement, the UK equivalent of a SAFE that’s popular in the US) allow you to raise investment from individual investors ahead of a future funding round.

When we launched SeedFASTs back in 2018 the concept of raising ahead of a future round was a rarity. The majority of fundraising was still done in funding rounds. The founders and the investors had to agree a valuation, and the founders had to round up sufficient investors to make up the minimum amount needed for their funding round.

But that’s all changed. Over 70% of investment raised on SeedLegals is now not in a funding round. Instead, founders are using SeedFASTs to raise ahead of a round, and Instant Investments to top up existing rounds.

The funding round has become the exception rather than the rule. SeedFASTs are the new Seed Round.

The other thing that’s changed is that rather than raising from a small number of investors, many founders are now using SeedLegals to do what is effectively a private crowdfunding round, raising from dozens, or even 100 or more, smaller investors.

A good example is dating app Thursday that raised £2.5M in 19 days from 52 investors using SeedFASTs.

Okay, so here’s how to raise with one, or many, SeedFASTs using the new workflow:

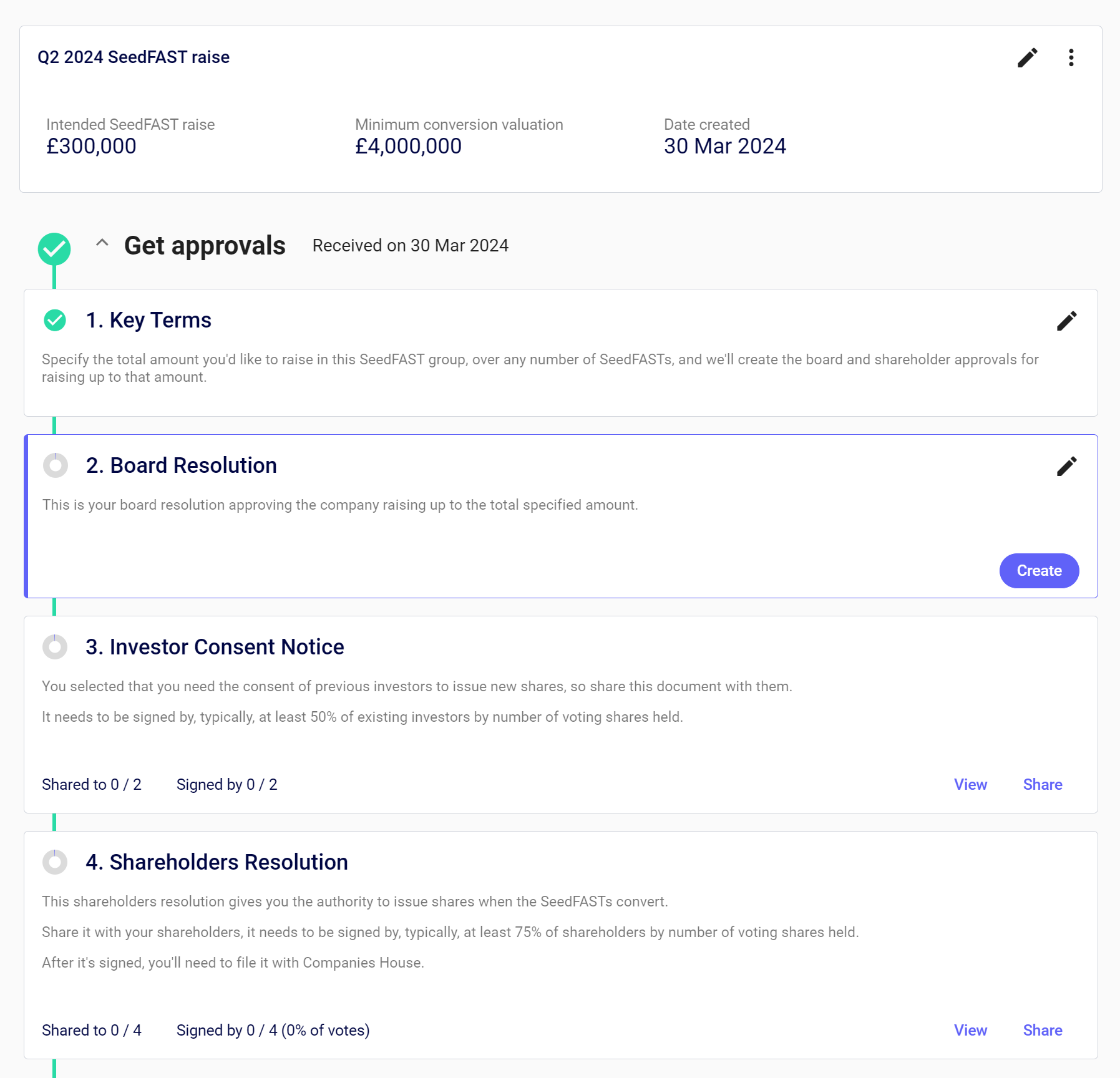

Before you enter into a contract for your company to issue shares you’ll need a board meeting and a shareholders resolution to approve the issue of those shares when the SeedFASTs convert.

Not sure what that means? No problem, the platform walks you through everything.

When you go to create your first SeedFAST, the platform will prompt you to enter the total amount you intend to raise, over any number SeedFASTs. You’ll also be asked to enter the minimum valuation that those SeedFASTs will convert at if you don’t do a new funding round before the SeedFASTs have to be converted at the longstop date (which is 6 months max if the investor is to get SEIS or EIS).

Once you’ve entered that information, the platform will build all the approval documents for you, ready to share and sign.

Once you’ve completed this, you can go on to create any number of SeedFASTs, up to the maximum amount you specified here.

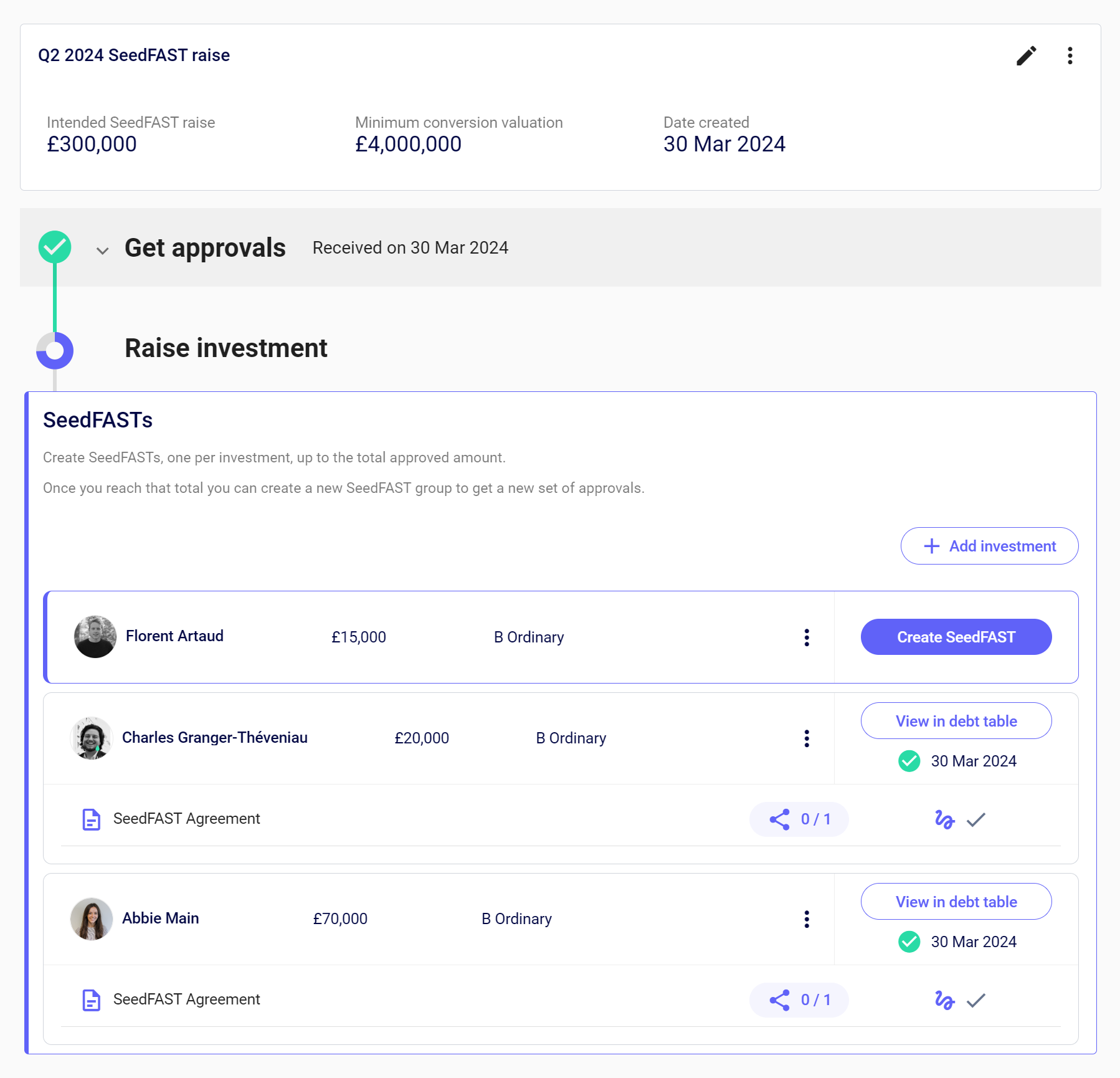

Now that the approvals are done you can go ahead and create as many SeedFASTs as you want, up to the total approved amount.

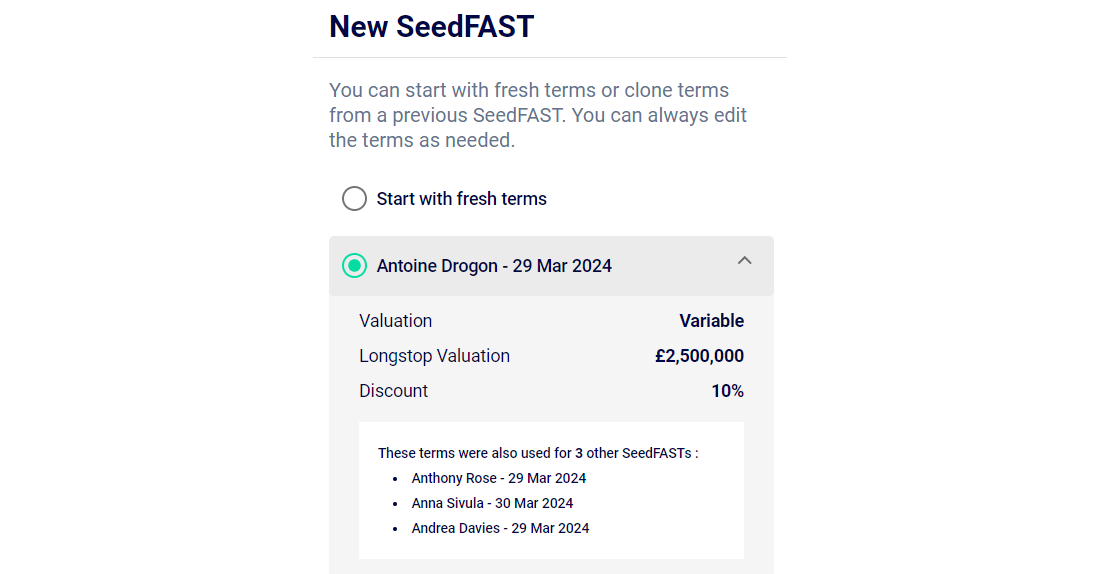

If you’re creating lots of SeedFASTs you can even clone the terms from a previous one, so the time to create an investment is under a minute.

To clone the terms of an existing SeedFAST, when you create a SeedFAST we’ll show you all the previous ones you created, just click the down arrow to see the terms you used for any, and select that one to clone it. Easy.

Anyone who has had multiple investments in play knows that it’s a bit like herding cats… you need to chase your investors to sign their documents, then send funds.

Our new workflow makes that easier, you can see at a glance the state of play of each SeedFAST.

You may have heard the term clean cap table. Most people take that to mean having a small number of larger shareholders, rather than lots of small shareholders.

We don’t think having lots of small shareholders is a problem – in fact it can be beneficial, as we explain here.

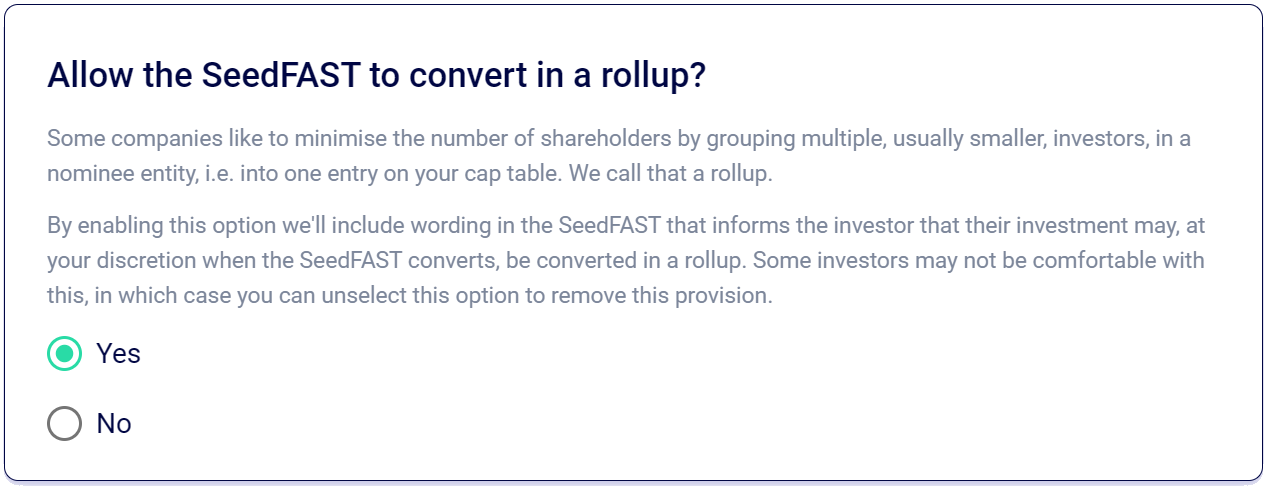

But, if you are raising from lots of small investors – a brilliant use case for SeedFASTs – we’ve added an option to allow the SeedFASTs to be converted in a rollup later.

You’re not committing to anything by enabling this provision, you’re just adding wording to the SeedFAST that has the investor agree that their investment can be converted in a rollup later, at the discretion of the company.

So we recommend enabling this option for smaller investors, unless an investor pushes back on this and insists that their SeedFAST directly.

When you’re ready to convert those SeedFASTs in your next funding round on SeedLegals, it’s just a few clicks to add a Rollup to your round, we made that super easy too.

Need more information on raising with SeedFASTs? Hit the chat bubble, we’re here to help!