Read transcript

Anthony: In today’s Founder Interview, where we talk to amazing founders, we’re talking to Fraser from Lyfeguard. So Fraser, tell me about Lyfeguard. What is it? What’s the problem you solve?

Fraser: So Lyfeguard is a solution to empower individuals and families to manage their life’s information, whether it be personal information, financial information, but also their end of life plans as well. So our mission is all about empowering individuals and families to take back control and ensuring peace of mind and lasting legacies as well.

Anthony: Okay, so who’s your typical customer? Is this an elderly relative? Is this you when you’re getting old? Is it you when you’re young? And then do I upload photos? What sort of things do I put into Lyfeguard?

Fraser: We’ve got two approaches to market. One is direct-to -consumer, and we’ve got two core audiences there. One is the 30 to 50 age group, and one is the generation above that. And the whole point behind Lyfeguard is it’s an intergenerational solution, ie both generations are involved in sharing information between each other.

So families have complete access and understanding that should anything happen to anyone, they know exactly where to look for that information. But we realised that in the UK, people don’t like speaking about death or confronting it whatsoever. And therefore we’ve made sure that we can flip the solution on its head.

We still want to get information there for family and friends when that time comes. But actually we want to create a portal that is useful on a day-to-day basis. It’s a place that you can go and organise and access your information. You can connect your finances to a whole array of financial accounts for real-time financial insights. And you can also get timely reminders on expiry dates because life’s busier and it’s more hectic than ever. And actually having access to these reminders can just help take the stress load off a little bit as well.

On the go-to-market side, we’re actually looking at the wealth management industry because actually, financial advisors need all of this information about their clients. And post COVID, they’re seeing their clients a lot less than they were before in person. And therefore, actually retrieving some of the client information on a day-to-day basis can be more challenging. They’ve got other strong tailwinds in the market as well. You’ve got consumer duty that’s just come out, which is all about understanding your client in much more detail than they have previously.

And finally, a massive trend at the moment is the wealth transfer that’s taking place right now all the way up until 2050. This is where five and a half trillion pounds of assets are passing down between generations, which makes the solution of both generations understanding what they have more important than ever before.

Anthony: Okay, so this is a problem. i mean, literally 100% of people are going to have, hopefully not too soon. Yeah. Once upon a time, most of your asset was in a property, which is the land registry owns and knows all about that. But now it’s in a Bitcoin wallet or, you know, it’s your Facebook login and the other things.

So how does Lyfeguard help on these? And when should I start inputting information into Lyfeguard?

Fraser: So we’ve got features for different stages of life. So on a day-to-day basis, actually, our information is scattered across so many different locations. You’ll have cloud platforms, and physical documents, in different devices as well. So just having somewhere you can organise and know where your information is and find it when you need it is massively helpful. And that’s kind of, that’s not age dependent.

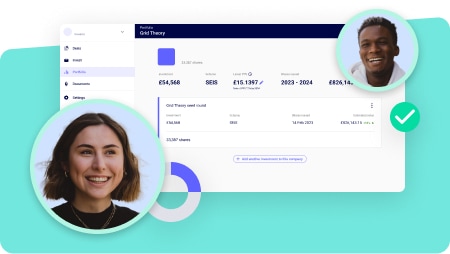

Further, you’ve got the financial aspect of Lyfeguard. So you’re connecting all your financials in real time to open finance. So you can begin to understand certain insights about it. So it’s not just a depository of information. We help you learn from it as well. So you can begin to see your spending analysis, your month-on-month income versus your spending, your transactions across all your accounts, but also your long-term financial indicators like net worth or investment growth over time and all the underlying assets and liabilities.

And then, crucially, what we say with Lyfeguard is, you know, you don’t want to do everything at once. It’s bite-sized chunks of each part of Lyfeguard and making sure that over time that you’re filling this out as it makes sense to do so. So it can be anything from an information storage platform and understanding your finances, all the way through to creating end-of-life plans and inputting your wills and LPA into the platform so people know what it is when they need to find it.

Anthony: Okay. So let’s say hypothetically, I’m going for a trip up Mount Everest. I’m not actually. What should I put in and what should I share with my wife before I go in case things go horribly wrong?

Fraser: I’ll take you back to where we started with Lyfeguard, because I think that will bring that to life a little bit. So I’ve co-founded Lyfeguard with my dad, Gary. And in 2021, he had two friends who passed away. And their families turned to Gary, he’s seen as a sensible person in the friendship group, to help with the estate settlement. And to be honest with you, he didn’t realise how big that task would be because he’s having to manage his own grief with the estate administration. And the biggest problem with that was incomplete or missing information.

So to answer your question, if you’re going up Everest, it’s all about the things that the person who was administering your state would need to do so. So it’s all of your financial records, who to call to close utility bill providers and things like that as well. It’s your will, any lasting power of attorney that you’ve got, any of them really crucial elements, but also the more personal elements of your end of life plans. What’s your funeral wishes? What do you want to be done with your body? Are there any letters that you’d like to leave with your loved ones? It’s a not very nice thing to think about, but actually the stress and confusion that families can face when that time does come is unnecessary if it’s all planned for in advance.

Anthony: Okay. So how do you enable others in your sharing circle to access this now versus later?

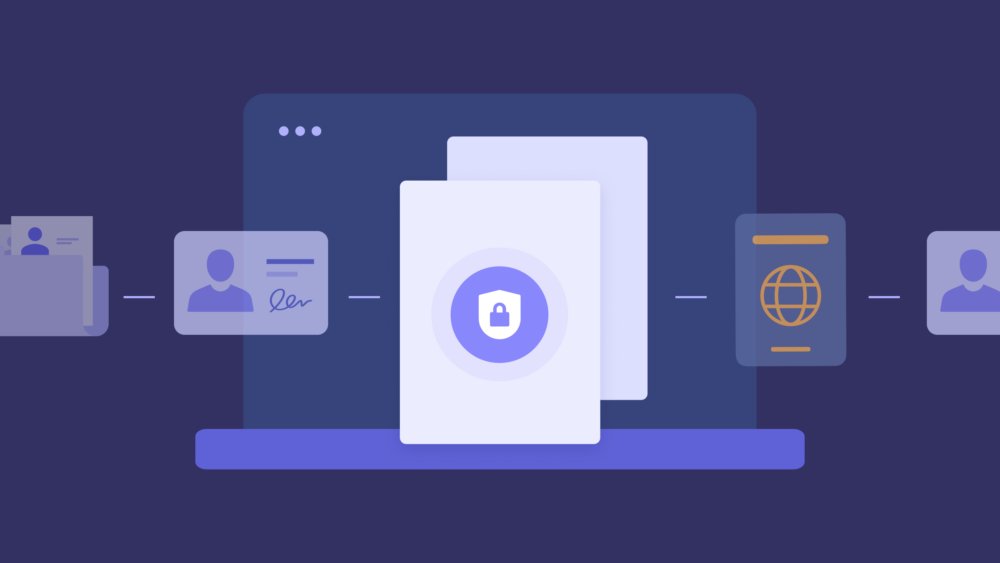

Fraser: So we have the functionality called trusted users, and this is the ability to share the information onwards with family, friends, or trusted individuals. And we give the ability for customers to be very granular in what they’re sharing. It can be just a passport or just a will, or it can be everything.

But they also have the ability to share it at a point in time that suits them. So it can be straight away or it can actually be after they pass away. So if they only want to share that information at that point in time, they still nominate that trusted user and then we go and verify the death once it’s happened with the local registry office.

So there’s complete flexibility control over what information is shared at a point in time that suits the user.

Anthony: Tell me about the traction so far; how many in the team, what stage are you at?

Fraser: Yeah, so we’ve got a very small team. It’s Gary and I at the moment. We’re early stage. We launched to the wealth management sector back earlier this year. And we’ve seen some really good encouraging signs so far. So we’ve got our early adopters on the platform. We’ve signed some strategic partnerships and had some really good widespread press coverage as well. And I think crucially, we’re seeing some early signs of product market fit too.

And I think the best thing about our early adopters is that they’re with us for the ride and they’re giving us great user feedback for us to, you know, shape the proposition and propel us into the coming years.

Anthony: So how would somebody use Lyfeguard? Walk me through the signup process and what are the most common things that you’ve seen people upload and when, what’s the trigger for them to do that?

Fraser: So you’d go on Lyfeguard.com and sign up. We’ve got two types of accounts. One’s a free account and one’s a premium account.

And you can go on and you can upload – I think the most popular thing to do straight away is connect your bank accounts or credit cards to the open finance integrations that we’ve got because you instantly get a bit of the graphical views of your spending, your income, your net worth building over time. So there’s instant feedback from connecting those accounts. And also you can have the transactions where a lot of your life’s information come through from. So you can use that as a little bit of a guide to what you may need to put into Lyfeguard if you’ve forgotten the complete list of your life’s information.

I think the other bit is just the ease of going in and finding the information quickly. I think my best example of it is quickly going in and finding a passport scan. I can’t tell you why I keep needing passport scans, but I just seem to on an ongoing basis. And the time it saves me just going in quickly, downloading the document and being able to send it onwards is really useful.

And I think finally the trusted user element of it, sharing it with someone close to us. It just instills that peace of mind that should anything happen to you, you just know they’ve got the information they need. So it reduces any stress or pain that they would feel on top of the grief, obviously, when that time comes.

Anthony: All right, so I’m going to get an immediate value from financial planning today, in addition to any benefits that my relatives or others would get when I’m not around. That’s really clever.

Fraser: Exactly. And that’s what we’ve tried to do. We’ve tried to make this very useful on a day to day basis, something that you can quickly go and find stuff.

You can learn from your information. We’ll also remind you on upcoming expiry dates. So a driving license is a great example of this. A million people in the UK are driving with an expired driving license. We’ll remind you a month before that’s due to expire for you to go and get a new one. Same with a passport, same with the utility bill. And we all know what happens when we go on to out of contract dates with utility providers, the price goes up. So with Lyfeguard, you can begin to understand this information, save money in that instance, and also through your transactions in the financial element of it, the amount that we will spend on unused transactions each year is gigantic. We give you the tools to be able to start identifying these things and just be able to manage these things.

We don’t think about that much in life, much better to save time, to save money, but also instill peace of mind.

Anthony: All right. So this sounds really interesting. And it of course is using technology to replace what would have been an executor or someone with a world where a person now being replaced by technology, which of course, at SeedLegals I very much love. So Fraser, thank you very much. That was really, really useful. Thank you.

Now where can people get in touch with Lyfeguard and how do you spell Lyfeguard?

Fraser: You spell Lyfeguard, L -Y -F -E -G -U -A -R -D and Lyfeguard.com is where you can find us.

Anthony: All right. Excellent. Thank you very much. Great talking. Thank you.

Lyfeguard is redefining how we organise and share life’s most important information, making it easy to manage everything from daily finances to end-of-life plans – all in one secure platform. By bridging generations and removing the stress of scattered documents, they’re bringing peace of mind to families and transforming how we plan for the future.

SeedLegals Co-founder and CEO Anthony Rose chats with Lyfeguard Co-founder Fraser Stewart to uncover how this innovative platform is simplifying life today and easing the burdens of tomorrow.

Watch more founder insights

ExploreKey takeaways

The problem: missing information makes a tough time even harder

- Disorganised life information: People’s critical information (financial, personal, and legal) is often scattered across physical documents, cloud storage, and devices, making it hard to access when needed.

- Stress during life events: Families face significant stress and confusion when managing a loved one’s affairs due to incomplete or missing information, particularly during grief.

- Lack of financial visibility: Without a centralised platform, individuals struggle to track their financial health, manage spending, and identify unused subscriptions.

- Cultural avoidance of death discussions: In the UK, many avoid conversations about end-of-life planning, leading to unpreparedness and additional challenges for loved ones.

- Generational wealth transfer: The ongoing transfer of £5.5 trillion between generations up to 2050 amplifies the need for clear, accessible information across families.

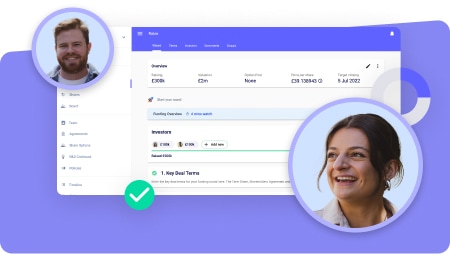

Lyfeguard’s solution: a secure digital vault for everything that matters

- Centralised life management

- Store and organise personal, financial, and legal information in one secure platform.

- Access information quickly, whether it’s a passport scan or financial record.

- Use open finance integrations to connect bank accounts and get real-time financial insights.

- Day-to-day utility

- View spending analysis, income vs expenditure, and long-term financial indicators like net worth.

- Set reminders for important dates like passport renewals, driving licence expiries, or utility contract renewals to avoid unnecessary stress and costs.

- Manage subscriptions and unused transactions to save money.

- Peace of mind for life and beyond

- Share critical information with family, friends, or trusted individuals using the “trusted users” feature, with granular control over what is shared and when (eg immediately or after passing).

- Plan for the future by uploading wills, lasting power of attorney (LPA), and funeral wishes, ensuring everything is prepared for loved ones when needed.

What you can do with Lyfeguard

- Organise your life

- Upload personal and financial documents.

- Centralise and access everything from utility contracts to investment details.

- Improve financial health

- Track spending, income, and investment growth.

- Identify unused subscriptions and reduce waste.

- Prepare for the unexpected

- Create and store end-of-life plans, including wills and funeral wishes.

- Assign trusted users to ensure your loved ones have access to essential information.

- Save time and reduce stress

- Set reminders for important dates to avoid lapses or penalties.

- Access documents instantly when needed, like passport scans or utility details.

SeedLegals events

Connect with fellow founders

Sign up to our newsletter and get the best of SeedLegals events delivered directly to your inbox.

Sign up