Sunbathing or scaling? Founder tips to beat the quiet season

Summers can be slow for startups but Ava Shoraka and Yanki Kizilates are here to help founders gain momentum during thi...

When you incorporate a company on Companies House you have to pick an SIC code. In this video we explain what an SIC code is, its history, what it’s used for and – most importantly – why you probably don’t need to spend more than 30s picking one. Although there are over 700 SICs, just 10 of them are used by 50% of all startups.

SIC (standard industry classification) codes came about in about the 1930s to help government statisticians better understand company activity for planning purposes.

The problem is that back in the 1930s when most of these codes came about, the world was very different to now. Although the SIC codes have been updated a couple of times since then, and the next big update apparently is planned for 2025 if it goes according to plan, the reality is most of the codes are for a bygone area. There are more codes for knitting machines and weaving machines than for the entire internet!

So when you create your company on Companies House, you might be thinking… how should I pick an SIC code, and what if you get it wrong? How much time you should spend in us?

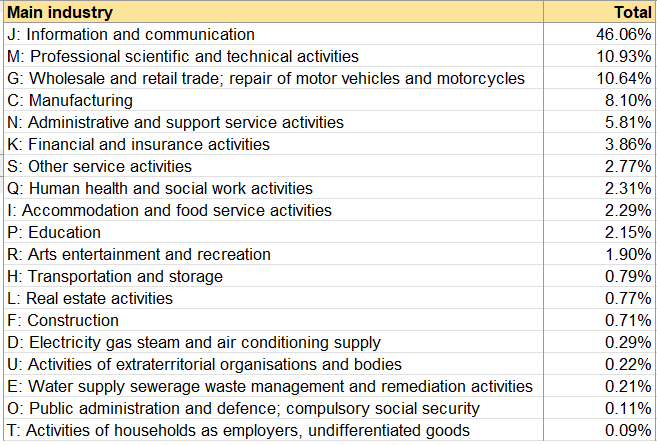

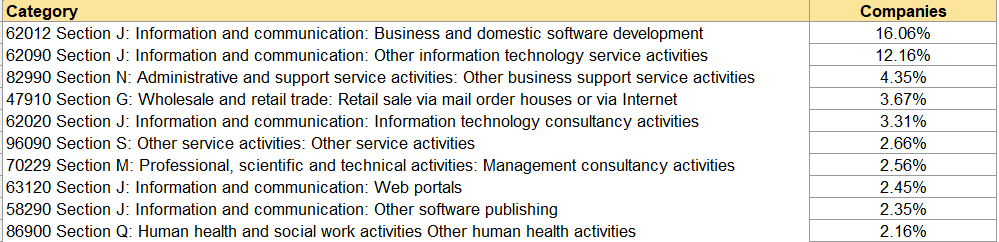

The answer is, we’ve looked at the codes, we’ve run the numbers on all companies on SeedLegals, and we see that even though there are 700 SIC codes, more than half of all companies are choosing just 10 or 15 codes. In fact 50% of all companies are in the top category of information technology. Unless you’re doing nuclear power or fishing, you’ll likely be picking just one of these SIC codes:

Top-level SIC codes used by startups on SeedLegals

Top and subcategory codes use by startups on SeedLegals

Which means when incorporating your company, don’t fret, just pick one of the information technology ones… if you’re in that space, of course.

By the way, you close your company and you create a new company and you’ve raised SEIS in the old company, one of the things that HMRC might look at is whether your new company in the same sector as your old company, in which case they might investigate that the new companies a continuation of trade, as it’s called, of the old company. If your old company made pizzas and your new company’s all about drones, there is no problem.

But if your old company was called Pizza Papa, and the new company is making pizzas and called Pizza Mama, and you’ve written off SEIS in the old company, you should assume HMRC will notice when you do your SEIS Advanced Assurance or compliance for Pizza Mama, that Pizza Papa was pretty similar.

And they’re going to inquire as to whether you closed the last company to make a new company in order to get SEIS all over again. So be aware that if your old and new companies have got the same or very similar SIC code and they’re doing the same thing, you may well HMRC inquiring about that when you apply for SEIS or EIS. If the company’s genuinely are different, there’s no problem.