What is a clean cap table? And why it's probably not what you think it is.

Thinking about setting up a nominee or SPV to reduce the number of shareholders on your cap table? Our CEO Anthony expla...

If you’re a new founder, it won’t be long before you come across the phrase ‘cap table’. Or maybe you’ve joined a startup or have entrepreneur friends who throw this phrase into conversations and you’re wondering what it means

Sounds like a place you store your hat collection, doesn’t it? Or a DIY woodwork project involving bottle-tops and resin. In fact, a cap table is simply a way to display key information about who owns a company.

In this article, we explain what a cap table is, why companies need one, and how to create and maintain one.

‘Cap table’ is short for capitalisation table. But exactly what is a cap table? A company’s cap table is a data table (or spreadsheet) that shows allocated shares in the company and any share options.

In business, ‘capitalisation’ has several meanings and this can be confusing if you’re new to running or working at a startup. You’ll have heard of ‘capital gains’ – in accounting, capitalisation is when you record an expenditure as an asset rather than an expense (so the thing you bought counts as ‘capital’). And, if a company is on the stock market, ‘market capitalisation’ means the market value of all of a company’s shares (price per share x total number of shares).

But in the startup ecosystem, capitalisation is simply the process of getting the funding you need to start or grow your business. The cap table is a visual representation of this: who’s put in money, how much, and what shares they own.

The cap table shows – in particular, to investors – who owns the business and how the founders have organised ownership and financing, and prepared for possible exit strategies.

Your company’s cap table needs to show:

and if applicable for your company:

If you’re the only shareholder and you’re not planning to take investment, then you don’t need a cap table right now.

Why do startups need a cap table? Because you need to be able to show who owns what equity in your company. Initially, you’ll have only a few shareholders – the founders, maybe friends and family. When other people invest in your company – angel investors and VCs – it becomes much more important to keep track of the shareholdings. Potential investors will ask for your cap table so they can view who currently owns your company, and what they’ll get for their investment.

As your startup grows and you take investments from more angels or VCs, you’ll update the cap table after every funding round and Instant Investment. (It doesn’t change after a SeedFAST or SeedNOTE because you won’t allocate shares to those investors until your next funding round). The percentage of the company that you own will be ‘diluted’ as more people own shares – your cap table makes it easy to view at-a-glance all of your shareholders, what type of shares they hold and how many, and their percentage ownership of the company.

Before you approach potential investors, your cap table must be ready and up to date because investors will ask to see it.

You can use the cap table to project the number or percentage of shares to offer investors, based on how much they invest. You’ll also be able to view how potential investments would dilute existing shareholders.

There’s no universally-agreed standard format for capitalisation tables. You’ll find all sorts of cap table templates online but the best are simple to set up, and easy to read.

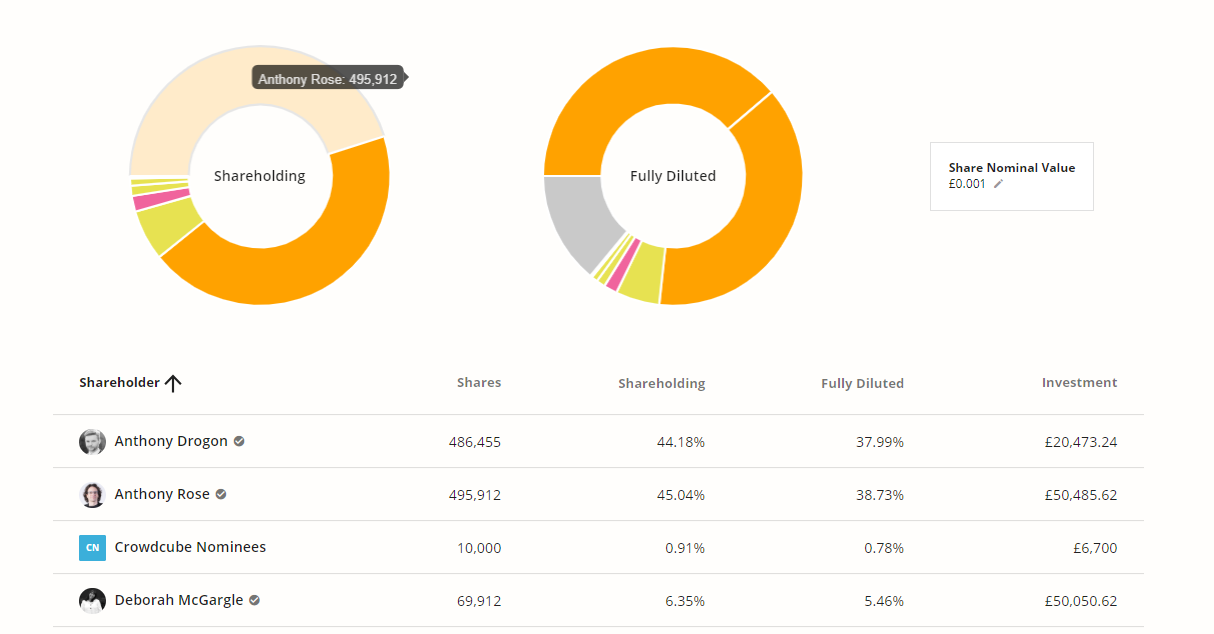

Here’s an example cap table:

In this example, you can see the shareholders, their shareholdings and investments in the table, with the data represented in the charts above. This combination of the charts and the table means anyone viewing your cap table can easily find the information they need.

So what’s the best way to set up a cap table? Let’s take a look at the different ways to create a cap table, starting with the worst:

The worst ways to create your cap table are in your head or on paper. If you’re the only shareholder, that might do for now. But when your business gets to the stage where you need to show others who owns what shares in your company, you’re going to need your cap table drawn up properly.

What about a spreadsheet? Sure, you could use spreadsheet software to create your cap table. Every time the shareholdings change, you’ll need to update the table. And it needs to look clear and neat so it’s ready anytime you need to show it to an investor. If you have several people with access to the cap table spreadsheet, you could end up in a mess with errors and out-of-date versions. Because it can get tricky, some companies pay an accountant or lawyer to maintain their cap table as a spreadsheet.

The better alternative to spreadsheets (and cheaper than hiring a lawyer) is online cap table management. These solutions create your cap table for you in a neat, easy-to-read format, which you can share with investors. You’ll need to do the data entry manually, and every time you change the shareholdings, you’ll need to update the cap table – it can be time-consuming.

What if there was a way to build your cap table once, and then have it automatically update when you change the shareholdings? SeedLegals Cap Table does exactly that – it’s an auto-updating cap table. Because it’s time-saving and fool-proof, we think it’s the best way to create and maintain a cap table.

As far as we’re aware, SeedLegals is the only service that integrates your cap table with your legals. This means that when you use SeedLegals to change your shareholdings, your cap table is automatically updated – you won’t need to do anything. Easy.

The names of option holders aren’t shown in a company’s cap table. When an option holder exercises their options and becomes a shareholder, then the name of that person will appear in your cap table as the legal owner of those shares.

The option pool is shown in a cap table as a number of shares and as a percentage of the total shares (the total of all shares is the ‘fully-diluted total’) – but the cap table doesn’t list how many of these options are granted or who holds option grants.

You can create an option pool as a step towards preparing to offer share options in the future – it’s only when you set up an option scheme that you’ll be able to grant any options.

You’ll need to update your cap table whenever there are changes to your company’s shares. For example:

If you use SeedLegals to create your cap table and make these changes to your shareholdings, then the cap table is automatically updated – you don’t need to do anything.

We do the maths, so you don't have to.

Set up your automated, future-proof cap table with the UK’s #1