Video transcript

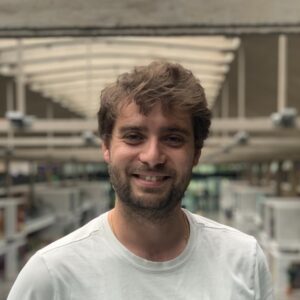

Anthony Rose (00:00) **Anthony Rose**: Hello, and today I’m talking to Andy Budd. Now Andy, I’ve been following on Twitter for ages and late at night he tweets things that always seem to resonate, the exact subconscious thing that I’ve been thinking about, fundraising, product, that I haven’t yet articulated Andy writes about, usually in a slightly more acerbic way than I would have. So when there was the opportunity to talk to Andy, I thought that was amazing. Andy’s written a book that’s taken all of his knowledge over the decades.

**Andy Budd**: so that you can grow your startup faster. So Andy, tell us about yourself, tell us about the book, and then we’re gonna dive in and talk about fundraising product and more. Well, if you’ve ever seen the movie, The Lives of Others, where they have a secret star agent sat above the sort of the proletariat kind of characters in the movie, listening to every word they say, it’s basically what I’ve got with you. So I’ve got a little bug in your room and every time you have a brilliant idea.

**Anthony Rose**: I’m just able to get there and tweet it earlier. So I really appreciate all of the great inspiration you’ve been giving me. Yeah, so I’m Andy. I’m a design founder, as you know, turned investor advisor and coach. So I’ve spent a bit of my time doing a bit of angel investing. I do some advisory work for startups. My main thing is working two days a week at Seacamp, who are very well known, well regarded, preceded and seeded state funds in Europe. All your audience will know them very well.

And I spend an awful lot of my time coaching and advising our early stage sort of portfolio companies. And a lot of this comes from my previous career as a designer. So I’ve got a lot of design backgrounds, sort of 20 years of design background. I founded one of the first, if not the first UX agency in the UK. I founded the first UX design conference. And so I’ve got a real kind of product and designs for heritage. And so, you know, I know enough about fundraising to be dangerous, but really when I’m working with founders. It’s helping them figure out that kind of early sort of two years journey. It usually starts with figuring out the product. Obviously, you need a team to build the product. So spend a lot of time helping them then shape that team. Obviously, that doesn’t happen in a vacuum. So there’s a culture, know, the business and stuff. And then at the end of the day, like as the company and the product starts growing, I help to coach the founder because often a lot of the founders I work with are first time founders, they’ve never **Andy Budd**: run teams before I’ve run teams of 30, 40 people. And so that’s where I sort of come from and what I do on a day-to-day basis. I’ve been doing the of the venture investing for about four years now. And so I’ve talked to dozens and dozens and dozens of founders and I started sort of find myself, repeat myself all the time, know, different people, different situations, but the same kind of core problem, the same route was going on. And obviously as a designer, as a product person, a lot of my time is sort of…

**Anthony Rose**: using the scientific approach to get to the bottom of what’s going on with those founders. And I just started turning these patterns into a bit of a thesis, a bit of a book, and 18 months later out popped the growth equation, is launched recently and people seem to be loving it at the moment. So that’s the genesis of that book. All right, so you should get the growth equation from Andy Budd on Amazon right now. But Andy, so.

**Andy Budd**: you obviously with your investor hat on and as your startup coach and UX design coach, you speak to a lot of founders and at Sea Legal’s, I talk to a lot of founders. My goal is to help them on their fundraising and you on product and design and so on. And I guess you’ve turned it into a book and I haven’t got that far. I’ve turned it into a lot of podcasts, webinars and articles and a platform. So.

Let’s now, to help people watching this, dive into the biggest problems we think that startups are making and how to help them avoid those. So should we start at the beginning of the journey? You’re a founder, you’ve met a co-founder, you have an idea. How do you validate that? you start building it immediately? The problem you’ve got, of course, is you know everyone’s read the mom test and the agile books and so on, but still you know you can’t **Anthony Rose**: go to someone with a piece of paper and go, please validate this or ask them, is this a good idea? You still think you kind of need to build something. So how do you help people? What’s the first step before you go off and raise money and give up your day job and so on to decide it’s a good thing to do? I mean, how do the of the earliest stages of the product form, I think is a really interesting question. And I think there’s one angle, which is like what the right way to do it is, which 95 % of people don’t do.

And then there’s the argument around, well, looking at how people do do things and how do you help them along the path. From my designer hat on, I would say, yeah, do really good customer discovery, talk to people that have the problem that you have and listen to them, understand and fall in love with the problem, not your solution, and fall in love with the sort of the people that are struggling with the problem and just have that real curiosity. I think one of the challenges is partly, partly to do with the funding. Effectively what happens is you come up with an idea first, normally. Normally you see a problem and immediately come up with an idea. And then you fall in love with that idea. And then you pitch that idea around a whole bunch of VCs and four of them fall in love with that as well. And you raise a whole bunch of money based on delivering that idea. Then what you do is you go, yeah, I’ve read the mum test. I’ve been told that I should speak to people. So you go out and talk to people that have your problem. But now, rather than really doing inquiry and trying to understand what they need, **Andy Budd**: You’ve already got a thing you’re kind of selling and you are wanting validation, you use that term. I think looking for validation is really difficult because if you’re looking to validate an already existing thing, you’re going to find it. Humans, we’re really great at pattern spotters. know, really actually sometimes bad at pattern spotting because we see patterns that don’t exist. We see patterns in clouds, we see patterns in the stars. I mean, make massive assumptions based on those things we see that might not even be there.

**Anthony Rose**: And so a lot of the time founders will go and talk to customers and they’ll want to queue into anything that says that they’re on the right track because often it’s really scary and lonely being a founder. So if someone says something that makes you go, yes, we’re on the right journey, you kind of double down. And anything that they say that might make you feel that you’re on the wrong path, rather than go, that’s interesting, tell me more, we often blank them out or we often try and convince them. I’ve seen so many founders talking at…

**Andy Budd**: people say, no, no, no, you don’t understand. No, no, no, you’re not getting it. Which is hilarious and sad at the same time. And so one of the big problems I see is a lot of founders, they build the products in their mind. They then try and sell the product to people using their language and their knowledge of the situation. And it just doesn’t click for users, doesn’t click for customers because it’s not using their mental model. It’s not using their frame of language.

**Anthony Rose**: it’s not understanding the problems and the pain points they have and be presented in the way that they get. And so you sort of find these things where founders keep going, well, okay, I’ve told all these users time and time again, I’ve listed out all the features and yada, yada, yada, and they just don’t get it. And often in the early stages, people think they don’t get it because they’re not smart enough, they’re not brave enough, they’re not clever enough. But then after you’ve had the same conversation a dozen times, two dozen times, three dozen times, eventually the penny starts to drop, eventually people go.

Hold on, maybe it’s not them. Maybe it’s something we’re doing. Maybe we haven’t got the framing right. So two things from that. Number one is how ballsy you should be as a founder and believing your own mission and so on and how much you should take criticism. And I think when I talk to founders, if you’re an investor, One of the things that makes founders investable is they’ve got this amazing vision that they’re super passionate about and believe they can execute. But at some point it crosses over into delusional where they don’t take criticism. And I think one of the things, know, when someone’s pitching to me, for example, particularly if they’ve come to me for feedback, they’ve got this web three proposition of an island powered by blockchain something. You got that pitch as well, did you? **Andy Budd**: And the problem is it doesn’t solve any real world problem. There doesn’t have to be that. So the founder is now fixated with this idea. And the challenge is the founder, if you listen to every naysayer who tells you it won’t work, you’d never build anything. We’d never built seat legals. If everyone told me, no, you have to go to a lawyer. have people been going to lawyers for hundreds of years. Never do that. Of course the world’s going to change. That’s what technology is about. But so if you listen to everyone who says no, you’ll never build this.

**Anthony Rose**: On the other hand, if you reject every bit of information you’re getting, because you’re so fixated on what you want to do, then I think you’re lot, I mean, you might get lucky and have a success. I think the person with the intermittent windscreen wiper who sued the major car companies for 20 years, you know, for his patent, and he won. I would have given up like way earlier. It’s insane, 20 years of your life suing the car manufacturers.

But that person was so dogged and obviously there was something real there. So the question is how dogged to be? And we’ll get back to that in a moment. My take by the way is once you’ve got enough data points to indicate that you may be on the wrong track in you solving a problem that people don’t need solving, you really should change it. But the other really important point is investors will often challenge you. Anytime you’re going to talk to investors, they’re going to ask you, your competitors, why will people want it? **Andy Budd**: And here it’s really important that you don’t come across as too defensive. You don’t come across as belligerent, because then nobody is going to want to work with you. They’re not going to invest, because they know you’re going to be belligerent to your customers or your team when they tell you it’s not working. So you want the right optimism. Take on board their feedback. If five investors are saying the same thing to you, whether it’s right or wrong, you probably have to listen to it, because otherwise they won’t invest in you, and then you won’t get anywhere.

Okay, so that’s one thing. The other thing which we touched on, which is solving a real world problem. And here’s my challenge, and I’d love your thoughts, which is, I see founders who want to solve a problem that’s good for the world. Something, something, the world would be better off if we had more recycled this or less carbon. The challenge is, while we agree that it’s good, **Anthony Rose**: No one’s actually trying to solve that problem for themselves. know, food is wasted, ergo, I’m going to use an app every time I have dinner. So how do you deal with, you know, you can’t tell a founder, well, it’s hard to tell a founder. Your mission to be good for the world is going to quite possibly fail because no person is looking to solve that problem. Really, when they get up in the morning, they’re going to change their behavior. So let’s dive into, you’ve got this mission.

**Andy Budd**: but it’s really a vanity problem or a do good problem. Thoughts? I mean, there was a lot of stuff there that was lovely, a lovely kind of sort of journey that you took me on. I just want to kind of quickly come back to one thing, which is I think ideas are these precious little flowers that sort of founders carry around, I agree. And they go to their family and friends and the family and friends often say that’s a really crazy idea, that’s a really scary idea, don’t do it. And they talk to 50 VCs and 48 of them will say, this is a terrible idea, don’t do it. You have to become very, very thick skinned.

**Anthony Rose**: So I don’t blame founders for them not listening. I don’t blame founders for them keying into the things that give them energy. know, from my coaching perspective, we all need to have that energy to drive us forward. So I’m not suggesting that people in any way are doing the wrong thing. But at the same time, also have to be, again, I think if it’s a binary thing, if you’re focusing on the idea, you’re always gonna be protective, which is why I said you kind of want to focus on not delivering the idea, but solving the problem.

your idea might be the first idea you came from, but it might not be the best one. If you fall in love with the problem, then if you figure out your first idea isn’t working, you’re much more likely to put it to a second or third or fourth. And I think my experience and going back to the thing I said earlier, which was, you know, there’s a right way of doing it and then there’s the actual way of doing it. And what typically happens in my world is, you know, there’s no point trying to talk a founder down off a ledge of a particular **Andy Budd**: approach if they’ve got their heart set on it. But what you need to do is you need to kind of warn them of the obstacles and the things that might come up. And then if those obstacles do come up, they’ll remember you and you go, I should talk to Andy because he warned me that this would happen and it has happened. And the way I like it is like, if you tell your kids over and over again, don’t touch the hot plate, they’ll probably still touch the hot plate. The one time they touch it and burn themselves and they suddenly think, know, mommy and daddy know about this stuff, I’m not going to do that anymore, hopefully, unless they’re kind of a masochist and then who knows.

**Anthony Rose**: But so I think what my focus is, is being there for the founders, helping them deliver that first version of their vision. And who knows, I might be wrong. Most VCs are, like we’re not preeminent. We don’t know the answer to everything. So it’s the founders journey. I’m betting on them. And I want to support them to get that first version out. But if that first version isn’t right, I want to be there to help them iterate towards that second, third, fourth, fifth version. And it might be just an incremental improvement. It might be a complete pivot.

**Andy Budd**: And so that’s why being there is important. To your sort of follow on question around, you know, the likelihood of success. mean, we all know that sort of 19 out of 20 startups that are venture investable startups fail. That also should tell your audience something about the knowledge and smarts of VCs. don’t know any kind of other business where you get 19 out of 20 things wrong and people like you are a genius. know, so, you know, we’re very, very bad pickers.

If I play poker at that kind of, that loss rate, I would be bankrupt. So we’re wrong most of the time. But what we do do is we look at things. Because we’re wrong most of the time, is a size and shape of startup that we have to bet on in order for it to be a success and for it to make our fund a success and pay back our LPs. And so we’re looking for venture investable businesses. We’re looking for businesses **Anthony Rose**: that we think can at some stage in the next 10, 12 years be worth a billion dollars or more. So let’s dive into that, because that’s really, really important for any founder, because most founders just don’t understand this. And so let me outline the spectrum. So on the far left, we’ve got a cheese shop. So a cheese shop, you buy some cheese, you go to the bank to borrow some money to buy some cheese, you sell cheese, and the business grows slowly.

At the other end of the spectrum, there’s that moonshot, which is some newfangled technology, there’s a high chance it’ll go bang, but if it works, it’s gonna be huge. So what happens is VCs, what most founders don’t know, is their investments obey a power law. So they might invest in 10 companies knowing that five of them will lose money or return less than their investment, two or three of them will make a 3X return, and one of them, **Andy Budd**: will make a 50X return and will return the fund as they call it. So VC, their power law distribution has them treat each investment as if it’s going to return 100X the amount. And that creates an unfortunate thing where VCs want to get startups often on a treadmill of raising a lot because there’s no point in them investing if the outcome will be modest. Angel investors are different.

because as an angel investor, you’re only doing a few investments a year. If you’ve got a one in 20 chance of it being a moonshot, dude, you’re out of money. You’ve lost all your money before you get to one. So for an angel investor in the UK with SEIS and EIS, if you’ve got a 3X or a 5X return on investment in three or five years, that’s awesome because the bank’s giving you a few percent. So with angel investors, I think that often aligns more with the founder. So now with the founder, **Anthony Rose**: If you get home and you go, honey, I’ve spoken to investor and there’s a one in a hundred chance we’ll be billionaires and a 99 % chance we’ll be out of business, your partner’s gonna go, dude, get a proper job. Whereas if you go home and say there’s a 50 % chance we’ll have an exit for 20 million pounds and 50 % won’t, you probably are more likely to be able to say, great, keep going on your founder piece.

The reason I’m mentioning all of this is it’s really important that a founder realizes when their aspirations and goals and success for them aligns or not with the VC. And as soon as you’re talking to a VC, you should be prepared to be on that VC treadmill. Whereas if you’re raising from angel investors, it might align more. And this also means when you pitch to VCs, you have to sell them the big dream. And then you have that catch 22 where you’re now expected **Andy Budd**: to do everything to get the big dream. I there’s a couple of things I would say that I I agree with pretty much everything you said, I would say that you’ve couched it in somewhat unmotivated language. So being on a treadmill, like I don’t think it’s necessarily being on a treadmill. I think there are certain businesses that if you get a fair win, they have an opportunity to go really big. And if your goal as a founder is to be on a company that grows really big, only, not the only way to do it, but the best way to do it.

**Anthony Rose**: is to get the right kind of capital that will allow you to take the opportunity because a lot of the time you need that capital investment to build the platform, build the team, raise and scale. there’s no, for a lot of companies, there’s no way of doing that unless you’re independently wealthy, most of this aren’t. So I don’t see it as a treadmill, but I think there are certain classes of business that are designed to scale. I think the problem occurs when, because there is a gap in the middle range of funding.

And so a lot of people that could build wonderful businesses that are a 5X scale business don’t have access to that kind of capital. They maybe don’t know angels or can’t find those angels. You mentioned the cheese shop with taking money from banks, but actually like 20 years ago, banks were very willing to invest in a cheese shop. Now, I bet you if you started a cheese shop, you might struggle just to get an account, let alone 200,000 pounds to set up your shop. And so a lot of companies that are not really **Andy Budd**: appropriate for VC, but see no other option, decide to go for VC. And then the problem isn’t that your, the VC’s belief isn’t aligned with yours, it’s that your vision isn’t necessarily aligned with them. And you talked about like, we have to sell this big vision. I think you’re only selling big vision if you don’t believe in it. If you’re saying, well, look, you know, in order to get that VC money, we need to make this look like it could be huge, but we don’t really believe it’s going to be huge.

**Anthony Rose**: Then there’s kind of a delta there. And what VCs are mostly looking at is trying to figure out who are the people that are just saying that the TAM is 500 billion because they read it in some advice around how to secure this sort of secret VC money versus who are the people that actually genuinely believe that. And I spend most of my time, if I’m honest, trying to encourage people not to take VC money because you alluded to it there. Like if you don’t really believe your company is going to be that VC scale, but you get VC money.

then you’ve already made a kind of a deal or an agreement that that’s the direction you’re going to go in. And you might be able to become a 5, 10 million a year business with 30, 40 people, but you’ve sort of decided and agreed that that’s not where you’re going to go. And that’s exactly the point I was making. Not that it’s good or bad or making a value judgment, but that it’s a pact you’re making. So if you are taking money from a person who’s success is getting to a unicorn, then you should **Andy Budd**: at least aim to do that. think a lot of this is just around kind of, well, two things. think some of it’s around literacy of investment classes. But also I think the big problem is that there’s not enough investment available for people in that middle ground. If was more, if banks were willing to invest more in younger businesses that want to build a 5, 10 million business, and that’s all they’re looking for, then we’d be in a much better position. But because there’s this massive gap, private equity has had to fill it.

And there’s a lot of amazing people who are being forced into a route that just isn’t in their best interest. So let’s dive into sexing it up for an investor. Because for you, the problem is you’ve got a small team, you haven’t raised much money yet. There are only so many things you can do in a day. And so you think I’m going to do a B2C product, for example, but it doesn’t look very enticing. And so what you do is in your pitch deck, you explain you’re going to do B2C, you’re also going to do B2B and you’re going to build a data warehouse and you’re going to use AI and you’re going to put on the blockchain. And you’re thinking that the more stuff you do, the more enticing the market’s going to be bigger. And for a naive investor, that might be the case. But whenever, this is one of my top things that I see in a pitch deck, if the company is trying to do many things, I go, great, how many developers do you have? And if they go 50, I go, awesome. And if they go three, **Anthony Rose**: I go, well, why are you just spreading yourself too thin? While you’re trying to do these four things, your competitors picked one and is outpacing you. So the irony is often the things I see that people put in pitch text to make it look like the market’s larger and they’re to be more enticing for a VC, I read as negative. So the takeaway point is for me, pick one thing and do it well, and then figure out which type of money you should be taking.

**Andy Budd**: potentially for that. idea of having a really kind of exciting dynamic deck, I kind of get that. But actually some of the most successful businesses I’ve seen, some of the ones I’m really interested in, are in quite boring categories. But they’re boring categories, like that actually makes it interesting to VC because you look at this thing and say, this is not an exciting category, so there’s going to be low competition. Actually, the current incumbents are doing a really, really poor job.

**Anthony Rose**: There’s a complexity in the delivery or complexity in the legal financial areas around this. If you can solve this, you have the opportunity to capture a really, really big market from people that don’t care. And no one’s going to be really excited about, I don’t know, like, you know, e-commerce returns. the perfect example. So we’re launching seed legals in the US. And as part of that, I’m researching what you need. And it turns out you need SEC filings for many things.

**Andy Budd**: I’ve looked on the SEC, the EDCA website, which has to be one of the world’s worst websites. I remember 30 years ago, I looked at it, it hasn’t changed since. And the way you file stuff is terrible. There’s an opportunity. So I looked at how many things are filed, 5,000 of just one type of form are filed per month. And lawyers charge between two and $10,000. That seems to me like $5 million per month at minimum, you know, opportunity for this one form and there are 27 different forms.

But if you go to VC going, we’re automating SEC filings, they’ll go, love what you’re doing, come back later. So it’s super boring, but actually, it’s the exact thing that solves the pain point. Everyone who’s doing it’s going, this is idiotic. I have to get a notary to sign this before submitting it. So interestingly, it’s often the boring things that turn out to be the most successful. And if you look at the things you use on a daily basis, **Anthony Rose**: You’re not using that 3D blockchain web 3 island. You are using some platform to help you file things or do expenses or insurance better and so on. Yeah. And this is, I love those boring, complicated spaces because if you’re somebody that is really excited about solving that and have fallen in love with that, then that is a massive potential opportunity there. Whereas if you’re just doing another kind of AI based kind of co-pilot and there’s dozens on the round already.

**Andy Budd**: How and why is yours going to succeed? What’s the moat you’re going to create? What should go to market, et cetera, et cetera? So this is all the stuff that I look at as a VC is trying to understand like, why is this team and this idea going to thrive now rather than six months ago when I probably saw the idea before, or in six months time when the next company will come around here trying to solve this. And so, yeah, I think that it’s wrong to try and like, you know, sex up a deck. It’s trying, the goal is to try and clearly communicate what the opportunity is.

**Anthony Rose**: and why you’re the right people to solve that and how you’re going to do it. And if you can just really paint a picture of like, there’s this mode, there are these channels that we can approach, yada, yada, yada, and the VC gets it, then they’re much more likely to listen than if you kind of put a whole bunch of jumbled buzzwords in. Like I see so many founders where their deck is like, I’ve listened to you for half an hour, I’ve read the deck, I’ve looked at the demo, I’ve been to your website, I still don’t understand what it is you’re trying to do.

**Andy Budd**: because I don’t think they often understand as well. Or like you said, they’re to too many things at once. So that to me is a key passion, which is you talk to a founder, you’re walking down the street, literally the elevator pitch, you are going to level 39 at Canary Wharf, which is a good time to do an elevator pitch and actually you get what they do. And then they send you the pitch deck and it makes no sense because it’s got blockchain, this, this, this distributed and it’s lost the essence of it.

And so explaining it in a way that is appealing for a consumer. But let me jump to investor feedback, because that’s a real pain point. Now there’s a fantastic founder Slack group called Anonymous Founders. If you’re not a member of Anonymous Founders, Google Anonymous Founders Slack group and you can join us. And because everyone’s anonymous, people might post things that are more ranty. And the most common rant by a long way **Anthony Rose**: is being ghosted by investors or being given useless feedback by investors. They don’t understand what they’re doing and so on. And I think many investors have learned that it’s better to give no feedback or something, know, anodyne like, I love what you’re doing, come back later, than trying to give feedback. So as an investor yourself, you sit on both sides, both the coach and the investor, let’s dive into that, because this is really a problem for founders.

the investor might say, love what you’re doing, come back later, which means one of several things. It could mean I’ve no idea what you’re doing. And so I’m going to wait for other people to understand it. It might mean I know exactly what you’re doing, but it won’t work. And so I’ll wait for you to prove it. It might mean I’m kind of not sure. Or it might literally mean I get it completely. It’s going to be amazing, but our check size is just way bigger than the stage you’re at, we can only invest a minimum of 10 million at 100 million valuation, and you’re not there yet. So when you are there, back. So let’s talk about your thoughts on investor feedback, providing it and decoding it. mean, I come from sort of more of a founder background rather than a legal or finance background. And I actually, when I talk to founders, I feel very much kind of on their wavelength. And so whenever someone asks me for feedback on a deck, **Andy Budd**: or if I pass on a thing, or it’s not interesting personally, I will let them know and I let them know why. Now there is a reputation risk there. You’re absolutely right. I mean, think this is why lot of investors don’t do this. Because if I say, look, I don’t think this is working with XYZ. And that person then goes and starts complaining on a secret forum to a whole bunch of other people. Suddenly your position as an angel investor or working at a VC company, people are going to talk to Andy, he’s an idiot. He didn’t get why.

you know, putting pets on the blockchain was the best idea in the world. And so I think there’s a real nervousness around kind of like giving direct feedback. But I still do it because I want these I want to help these people. Like I’m not giving feedback because I’m saying that your idea is rubbish. I’m usually saying these are the challenges and the problems that VCs will see with your deck. And if you want to get over these, these are the things you need to answer. Most of the time, people are really, really appreciative of this. But, you know, the problem is like, you know, **Anthony Rose**: founders are like proud parents. They believe that their kid is the smartest, most talented, most intelligent kid in the school. And if the teacher tells them that they’re not, then they’ll go, well, you don’t know anything. You don’t know my kid. You don’t know what they’re like. You’re an idiot. And why are all the other parents not thinking that mine is the best? It’s clearly the best. So it’s really, really difficult if you start sort of being critical and saying, well, actually, you know, your kid doesn’t put effort in school and…

**Andy Budd**: that their piano isn’t quite as good as the others, then you run the risk of kind of upsetting them and having a negative emotional feedback. And so I think a lot of the time people just don’t do that. But I think it’s important. I think it’s useful. think one of the reasons why people don’t do that, apart from having the negative backlash, most of the time we don’t know. Like it would be arrogant to say, your idea is terrible. Don’t darken my door. So what we go is like, hey, look, I don’t get it. I don’t get it yet.

**Anthony Rose**: I’m not saying it’s me, I’m not saying I’m a genius. Often I don’t get it because I didn’t feel like it’s necessarily been communicated properly. If you go away and do X, Y, Z, I might have a better idea. But also you could go and you could raise money and you could launch the product and it will probably be slightly different in six months time. And of course I want to keep the door open because you might come back to me in six month time and you’ve solved some of those problems. You’ve got better positioning, you’ve got some traction. And so I don’t want to call you an idiot.

**Andy Budd**: Or I can understand why VCs don’t want to call you an idiot or call you a baby ugly. And so it’s often safer just to go, I’m not sure. The other thing, sorry, just with that is I think there is an element of people not understanding the volume that VCs have to deal with. this is not me sort of saying, we bought poor us boohoo. But you might as a fund get 100 pitch decks a week. You might get 6,000 pitch decks a year.

**Anthony Rose**: That’s an awful lot of things to draw people through. so, you know, I definitely don’t, you know, if somebody is not suitable, I definitely want to kind of contact them back. Sometimes it slips through the cracks and that’s unfortunate because you’re dealing with lots of other things. But I definitely do my best to try and sort of go back to people and say, this is what’s happened, yada yada yada. But what you might not have the ability to do is every 6,000 one of those, you might not have the ability to write back to everyone and say, hey, look, these are the, you here’s a…

**Andy Budd**: know, two hour essay on why you were not successful at this stage. And so there was a bit of a balance there, but it is tough. And I think I can understand why people feel a little bit upset if their beautiful baby isn’t immediately understood. And actually that’s exactly the point I was going to make, which I think sometimes founders are bit unfair because unsolicited outreach to an investor and then expecting the investor to spend a great deal of time to tell you why it wasn’t right. And often as you say, they don’t know or they just don’t have time.

**Anthony Rose**: Maybe they only invest in one class of area and you get this deluge of random things and there are endless numbers of things. mean, it’s a combination of head and heart. And then just the other thing, I this is the other thing which I found really fascinating is you assume that VCs are these big, powerful, huge companies. Most of the VCs I meet are two people in an office above a mini-camp, know, or a fancy kind of restaurant or whatever, but they’re small.

**Andy Budd**: And they often invest in eight companies a year. if they’re getting thousands of inbound inquiries, they might not have the capability. Seekham are quite lucky because we’re a bigger firm and we invest in quite a lot of companies at 40 or so a year. But if you’re just two people in a room doing it two, three days a week, it can be really tough. All right, let’s switch to valuations. So one of the common problems is how to value your company.

**Anthony Rose**: And I was in the audience at a panel session a few years ago, and there were two VCs, and the question came up from the audience, how do you value the company? And one of them said, well, I look at the business plan, I look at the TAM, the SAM, I look at the customer acquisition costs, the lifetime value, the recurring models, I make a spreadsheet, I map the net present value, and I work out valuation for myself, and will invest if it’s lower than that.

And the other said, well, if I like the founder and the idea is good and the valuation doesn’t look insane, I’m in. So I realized at that point, there’s no one way of doing this. Investors are all different. So how do you, as a founder, come up with a valuation and importantly justify it with particularly a VC is low balling you, you you don’t want to raise a 10 and they go, well, five. Or how did you come up with 10? What techniques might there be? and you again sit on both sides of the table. Thoughts? I mean, again, it’s a really interesting question. I would say that most early stage startups, if they were to take their current product to some kind of existing software marketplace and actually sell it, the valuation they would get from somebody in the market buying like a two-year-old SaaS company **Andy Budd**: that’s doing less than half a million or quarter million ARR a year, they are probably going to get a fairly low multiple. Somebody might be willing to buy it for 4x or 6x their revenue. So I would argue that most of the valuations you see in the really early stages of the startup are much, much lower. The valuations that VCs give them are much, much higher than actually their present value of their property.

**Anthony Rose**: I think that’s really difficult. think a lot of founders get used to the idea that, I’ve got a deck and I’ve got a bit of software running, it should be worth 10 million. And I think a lot of VCs understandably will buy at that rate because that is the current sort of going rate. And also a lot of it is actually based on how much they need and the ownership criteria of the fund. Most rounds of funding, you don’t want to…

**Andy Budd**: as a VC buy or acquire more than 20 % of that round. If you acquire 30, 40, 50, 60%, there’s no way that they’re going to get any follow on funding. And so really, and if you’re looking at this company, you’re thinking, well, might get seven or 8 % and we know that they need a million pounds to deliver what they deliver, that sort of automatically sets the valuation, even if that valuation might be three or four times higher.

**Anthony Rose**: than what they could sell if they went to a micro acquire and sold it today. And so one of the challenges I think a lot of VCs might have is they are already buying properties, products that are overvalued, which is another reason why if you buy something that’s four times worth its value at the time you buy it, then of course, like at the time you sell it, not only does it, it needs to get up to that four times just to break even, and then it needs to do the multiples of whatever you need to see a return. So I think valuation is really challenging.

**Andy Budd**: But I think often it is really just looking at how much you need to deliver on your goals, understanding ownership criteria. it becomes, for the first couple of stages, it becomes a made up number. Eventually, once you start actually doing revenue and you’ve got a journey, the later stage series ABC companies will go through your finances with a fine tooth comb and will have associates and…

counters or whatever, look at it and work out a value based on their model. But pre-seed and seed, it’s more around typical local valuations that are happening in that quarter. And it goes up and down. And when we saw it, over the pandemic, there was lots of capital going around and valuations bumped up. Valuations now have come down. I would argue they’ve come down to probably maybe a more reasonable level. And if you look at 2019 in today, **Anthony Rose**: they’re pretty much level pegging. A lot of people, they only look at the last few years, will go, well, we’ve had a massive drop, the sky is falling. But actually it’s because your sample sort of size or your sample date range is skewing you towards thinking that pricing in 2001 was normal. Actually, I think we’re back at a point where it’s a little bit more understandable. I think the other thing is I would personally say that startups in…

in Europe are slightly more sensibly priced. I would probably think that in the US you can get a lot more money for much higher valuation. But then you are definitely setting yourself up to kind of then have to deliver on that. And that can be really tough. And so I think raising money from European funds are a little bit more reasonable with evaluations also means they’re reasonable with the expectations. It gives you a bit of a room to then go and deliver. And then maybe for series A or series B, then you can sort of go and **Andy Budd**: get the massive figures that you hear and you see on TV shows like Silicon Valley. But yeah, that’s where I would stand. OK. So to wrap up, a couple of quick-fire things. From your book, any favorite sections? What was the thing that inspired you the most or the biggest pain points that you see? Well, even though the book is about early, say, startup growth, it’s really that first two, three years journey getting to product market fit, getting your first million and on revenue.

Like it’s not about fundraising, but a lot of the kind of the impetus of why you would do this would be to fundraise. And some of the things in the book I talk about that we’ve touched on in the conversation are around positioning and being able to tell that story and that growth journey. And so there’s a lot of really good stuff there, but the bit of the book that I really enjoyed writing the most, which doesn’t necessarily mean that it be the most useful, the one that people enjoy reading the most, was a section on behavioral science. And that might seem like where does behavioral science, why is that? **Anthony Rose**: something to do with growth. a lot of the history of behavioral science, if you look at classic economics, we always used to think that people were rational actors. If I give you an offer of a pound a day or five pound in a month’s time, a rational person would take the five pound because it’s five times more than the one pound a day. But most of us aren’t rational. And in all the research studies, people are much more likely to take the pound a day because I don’t even know if I’m going to get the five pound in a month’s time.

**Andy Budd**: I could go and use it today rather than. And so this plays out in all kinds of things, but it plays out a lot in kind of how you design products, understanding people’s behaviors, understanding the heuristics that they use to make decisions, allow you to better lay out a pricing page, to design a pricing policy. They’re better to kind of understand how you get people coming back to use your product time and time again. So it bakes into their workflow. It’s useful to…

**Anthony Rose**: understand how you do onboarding. So you said, let’s be onboard people properly. And actually, I would argue that the cornerstone of the kind of the new fad of product-led growth, you if you’ve got a product, if you’re wanting your product to be the driver of growth, then it has to be understanding human behavior. And so it’s no surprise that I go through a whole bunch of kind of like typical kind of funnel stuff, acquisition, activation, retention, and then I move into behavioral science.

**Andy Budd**: because that kind of keys up the next phase of the book, which is product-led growth. And so I think that was the most fun part to write because I’ve always been fascinated in psychology, fascinated in human behavior because I’m a product person at heart. I’m a designer at heart. And those are the things, those are the material that we have to turn a good product into a great product. I love that. And, you know, it’s in a sense parallels my learnings at Seed Legal’s when we started, I thought it was about the documents.

**Anthony Rose**: And I realized zero people wake up in the morning going, you know what I need is a contract today. They say I need to get investment money or I need to hire somebody or I need to give incentivize my team with share options. And there’s fear and there’s trust and there’s misunderstanding. Like legal stuff feels like it’s gonna be really expensive. If I go and use this backstreet legal person, I don’t know if they’re gonna be any good or not. And so you’ve created a environment where people know that you are trustworthy and that is a human behavior and you’ve designed that. Maybe you didn’t know you were doing that.

**Andy Budd**: But I’m sure now going through the processes, understanding the importance of trust, understanding the importance of working with the grain rather than against the grain, you’ve built a really, really great tool that a lot of people has really benefited the UK startup ecosystem. So thank you for doing that. That’s very kind. You lost me completely. Backstreet legal thing. always imagine like study a good contract for you. Barely legal.

that I’ve learned it was all about empowerment. And it’s also about storytelling. And interestingly, you know, by productizing things and making them a name. So Seedfast is an advanced subscription agreement. People don’t look for advanced subscription agreements, but if you can go to an investor, hey, I’ve got a Seedfast. And investors know about a Seedfast and the Seedfast, can push the buttons and get this document that lets you send me money. And I know you’ll get your SEO, ISE tax benefits, suddenly it transforms things. So if you can take whatever you’re doing, a complicated workflow and a complicated set of things you’re doing and turn it into something that your audience, your user or customer in their mind, it immediately solves this top level problem that they’ve got in an elegant way. think that’s the winner. I’m going to do a little, apologies to the audience, I’m going to do a little kind of just last sort of pitch for the book because the whole reason the book is called the kind of growth equation is because I’ve sort of **Anthony Rose**: I’ve identified sort of seven factors which I think have an outside impact on growth. And one of them is friction. know, so many existing products are full of friction, it slows people down. The legal system is very, very friction-filled. Sometimes it makes sense to have friction because you want to slow people down to focus. But actually, if you are going to lose a deal because you’ve got to spend a week or two navigating contracts where they can just go and use your tool, that friction has kind of delivered value. Value is another one of the…

**Andy Budd**: the arguments of the growth equation. And so what I’ve tried to do in the first chapter of the book is like point out things like friction, value delivery, of stickiness, all of these kinds of things that have a really outsized impact to just give people a different lens of how they can look through their product. And then obviously I use things like the pilot metrics and kind of loops and funnels and all that kind of stuff. But that is a really, really nice sort of framing. so, yeah.

**Anthony Rose**: It was lovely that you use that kind of friction element as an example, because I think it’s huge. All right, Andy, we could talk forever. Thank you. I’ve hugely enjoyed the conversation. I hope it was useful for everyone watching. Where can people get your book? If you go to thegrowthequation.info or Amazon or any good and probably several bad bookstores. But yeah, come to my website, thegrowthequation.info, and you can also find out a lot about me and my background.

**Andy Budd**: coaching stuff as well. And that will point you to all the bookshops or a bunch of bookshops.

**Anthony Rose**:All right. And follow Andy on X for acerbic late night things that tap right into your consciousness and the thing you’re thinking he’s articulating. Andy, it was a pleasure. Thank you. Thank you very much.

Meet Andy Budd: designer-turned-investor, coach, and author of The Growth Equation.

SeedLegals co-founder & CEO Anthony Rose caught up with him to explore the nuances of building successful startups, from ideation and validation to fundraising and scaling.

With decades of experience as a product designer and wide exposure to the startup landscape from an investor’s perspective, Andy shares actionable advice for founders, while Anthony brings his own expertise in helping startups raise funds and grow.

Key Takeaways

The winning founder mindset

- Fall in love with the problem you aim to solve, and the people struggling with that problem.

- Shift your focus away from delivering the idea to solving the problem.

- Be open to pivoting if early feedback reveals your solution isn’t resonating with customers.

Validate first

- Before you quit your day job and start coding, talk to potential customers to deeply understand their frustrations and needs

- Learn about their pain points so your solution solves real problems.

- Avoid “confirmation bias.” Validation isn’t about forcing a yes – it’s about listening.

Landing investment

- Angel investors vs. VCs: They have different growth ambitions, expectations and timelines. Know who’s a better fit for your stage and goals.

- Be realistic about how valuation aligns with your long-term goals, particularly if engaging with VCs who expect exponential growth.

- Focus on one key problem and how your solution is uniquely positioned to solve it.

- Simple, clear communication is often more impactful than flashy decks.

Growth = behaviour + design

- Understanding customers’ behaviour and behaviour science is your secret weapon to design products that keep people coming back for more.

- Reduce friction. The easier your product is to use, the more people will love it.

- Focus on perfecting one solution at a time.

- Sometimes the boring things turn out to be the most successful – because they’re really useful.

SeedLegals newsletters

Get interviews to your inbox

Stay on top of our latest content and events for founders and investors.

Sign up for our newsletter