How to raise from US investors: Guide for UK startups

Want to attract US VCs? US legal expert Daniel Glazer of Wilson Sonsini explains what US investors look for, when to do...

More and more UK startups are looking to scale in the US. Whether you’re setting up a US subsidiary or doing the Delaware Flip, SeedLegals is here to help with the legals for raising from US investors.

Great news – we’ve landed in the US! Discover SeedLegals US

Setting up your US base can feel like a minefield, but our friends at Doola can clear the path. From incorporation to hiring strategies and tax management, they’ll guide you safely through every critical decision.

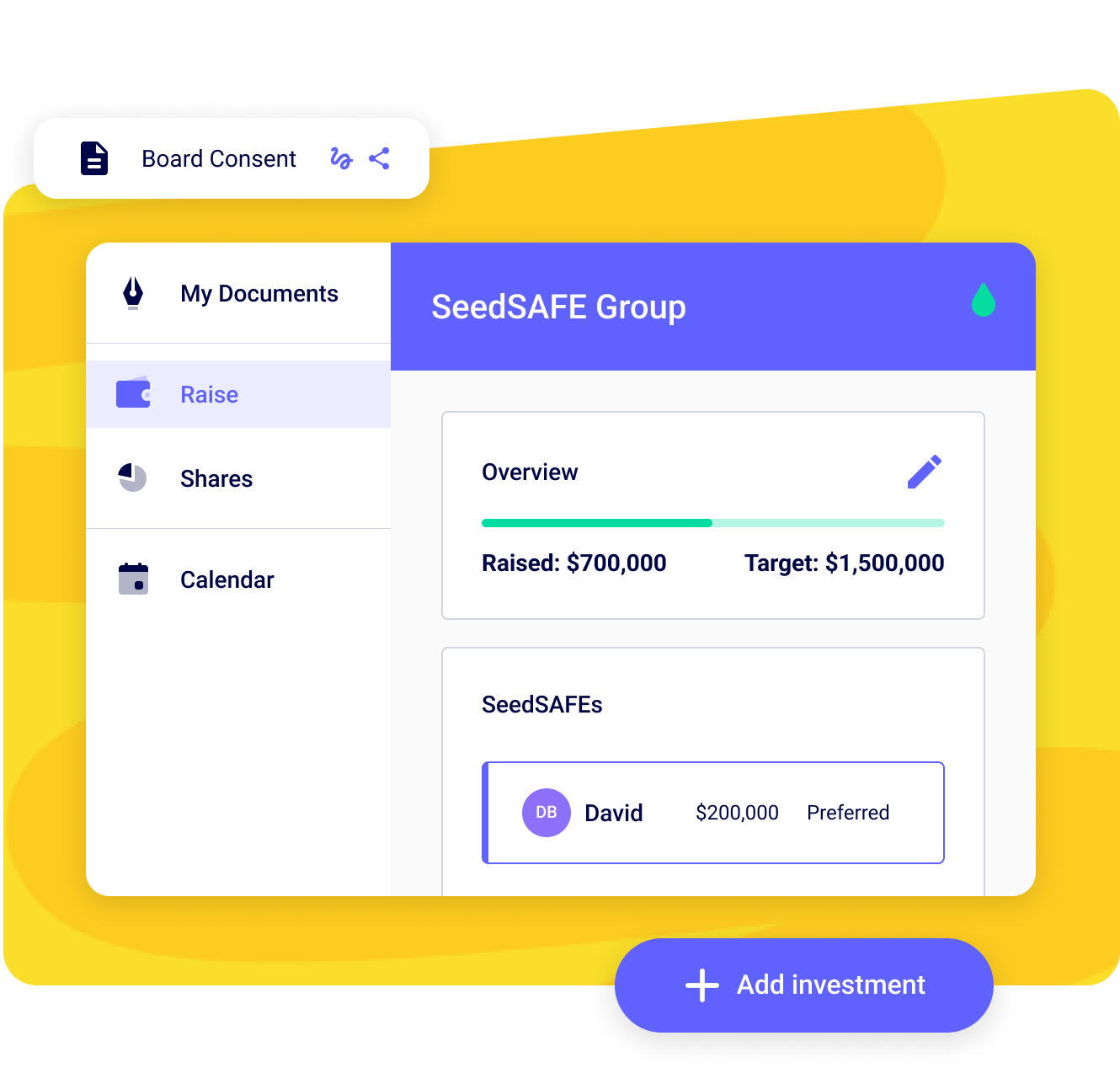

In the US, startup funding runs on SAFEs, which work similar to SeedFASTs. With SeedLegals, you can create an English law version of a SAFE – ideal for raising capital from US investors for your UK company.

Any questions? Get answers from experts fast

Any questions? Get answers from experts fast Read: How to create an English-law version of a SAFE

Read: How to create an English-law version of a SAFE Read: How to raise from US investors

Read: How to raise from US investors

The Delaware flip means restructuring your company so a new US entity becomes the parent, and your UK company becomes its subsidiary. Whatever your US structure, we’re here to help with the investment legals.

SeedLegals has landed in the US 🌎

SeedLegals has landed in the US 🌎 Build your cap table, speed up legals, fundraise faster on SeedLegals US

Build your cap table, speed up legals, fundraise faster on SeedLegals US 1 log in – 2 countries – same standout support

1 log in – 2 countries – same standout support

So are we! Visit our US site to explore how to manage your cap table and raise investment through a funding round or through SeedSAFEs.

Build US lawyer-approved legal docs the fast and affordable way

Build US lawyer-approved legal docs the fast and affordable way Understand QSBS, the underrated US tax break for founders and investors

Understand QSBS, the underrated US tax break for founders and investors Raise capital seamlessly, with features built for the US market

Raise capital seamlessly, with features built for the US market

SeedLegals CEO Anthony Rose sat down with Parshwa Metha, Head of Sales at Doola and expert in helping entrepreneurs take their business to the US. They discussed everything founders need to know about launching in the US, from choosing the right company structure to navigating ongoing compliance.

Want to attract US VCs? US legal expert Daniel Glazer of Wilson Sonsini explains what US investors look for, when to do...

We explain what US companies need to do to offer SEIS/EIS to investors - and how to use the SeedLegals SEIS/EIS compatib...

Make your company more attractive to UK investors - startups from France, Germany, Spain, the US or anywhere can qualify...

How can SeedLegals help with my US expansion?

Why do companies incorporate in Delaware?

Can I employee US individuals without a US entity?

Can I raise from US investors?

Is it possible to get US investment without doing a Delaware flip?

If I do a Delaware flip, will my current investors lose their S/EIS relief?

Our team of legal and funding experts have helped thousands of entrepreneurs raise money and grow their businesses.

Your company's core agreements, all in one place

Share and collect signatures online via SeedLegals

Create the exact documents you need at every stage of growth

Your information stays safe and confidential in our secure system

Talk to one of our friendly team anytime on live chat

Don't worry, our insurance covers claims related to our platform

From food to FinTech and beyond, join thousands of startups who use SeedLegals to start, raise and grow faster.

More customer stories