- Talk to us your way – chat, phone, email, video call

- Get unlimited help – no billable hours, no extra cost

- Ask us anything – we’re here 9am to 6pm Mon – Fri

The ultimate guide to R&D tax credits

Download our free ebook to learn what R&D tax credits are, the projects and costs that qualify and how to make a successful claim.

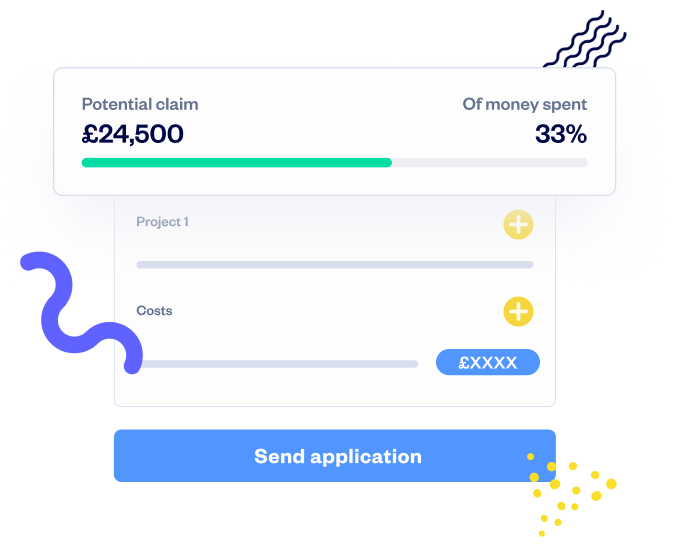

Did you invest in R&D? Find out if you qualify for tax relief and let’s get your money back.

Many companies aren’t aware that they’re eligible to claim tax relief from the R&D tax credits scheme, which is an HMRC incentive to boost innovation in the UK.

If your company is contributing to research and development in the fields of science and technology, you could be eligible to claim back a percentage of your R&D-related expenditure.

Are you put off by the thought of spending your valuable time wading through paperwork to make claims?

We get it. That’s why we’ve created this ebook to give you the lowdown concisely. You’ll learn what you need to do to make your R&D tax credits claim, how to make it easier, and how to optimise your claim so you can successfully claim as much as possible.

No claim, no gain.

Don’t leave money on the table. R&D tax credits are an easy way to boost your cash flow. Learn how it works and if you qualify.

Download the ebook to learn:

✔ What R&D tax credits are

✔ How it works

✔ The two types of R&D tax relief schemes

✔ What makes you eligible for R&D tax credits

✔ The costs you can claim back

✔ How to calculate R&D tax credit

✔ How to claim R&D tax credits

✔ How to decode the lingo, with our R&D jargon buster

Our expert team is here to help

Unlimited support for members

We’ve helped over 60,000 companies

From food to FinTech and beyond, join thousands of startups who use SeedLegals to start, raise and grow faster.

More customer stories