Saving sanity setting up share options: Investa’s journey with SeedLegals

Founder Alec Beasley shares how SeedLegals saved him time, stress and guesswork when setting up a share option scheme fo...

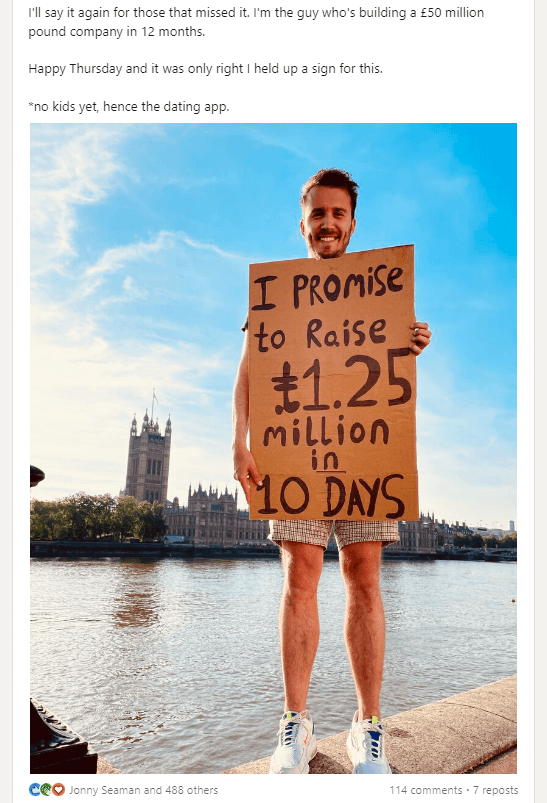

Dating app and expert guerrilla marketers Thursday set a tough deadline for themselves, promising publicly to raise £1.25M in 10 days. They met that milestone – and more! – raising a total of £2.5M in just 19 days, made possible with SeedLegals agile funding documents and expert support.

This cash injection not only grabbed attention and built up a healthy cash reserve, it also allowed Thursday to invest in the long-term growth of the company by setting up option schemes for employees.

You’ll have come across Thursday already. It’s the dating app taking over your feed – the one that swaps endless swiping for use-it-or-lose-it meet-ups once a week.

Their mission is to make Thursday the most exciting day to be single. Thursday believes people are spending too much time on dating apps and getting an underwhelming experience in return. With Thursday, everything people want from online dating happens on just one day.

The company was founded by Matthew McNeill Love and George Rawlings in 2018. It started as Honeypot Dating, a more traditional dating app where you could check into venues and see who else was around and ready to mingle. After successfully crowdfunding, the team realised that usage spiked on Thursday so they pivoted to capitalise on the opportunity they identified.

Through viral PR stunts and guerrilla marketing, the company achieved millions of impressions and downloads on a tiny marketing budget. “Thursday’s perceived as an overnight success,” says George. “But that’s not the case – we got ourselves on the map as we had a clear direction. It has taken us a long time to get to this stage.”

Thursday came across SeedLegals after their first crowdfunding round, looking for support with fundraising.

“We didn’t really know where to start with lawyers and didn’t want to pay extensive legal fees for anything, but we couldn’t do it ourselves.”

They quickly raised a follow-on round of £165,000 within a month, and added top-up funding of £300,000 through Instant Investment. Then, they raised their seed round on SeedLegals using super speedy SeedFASTs.

“We couldn’t have done any of the funding rounds (after crowdfunding) by ourselves without the help of SeedLegals”.

When kickstarting a new business, especially with a consumer app where it takes a while to generate revenue, cost is critical and saving money makes the difference between the company surviving or failing. With SeedLegals, companies get what they need without spending £££££ on lawyers in those early days – all with unlimited expert support.

When the fundraising was complete, Thursday’s next priority was to set up share option schemes for their rapidly growing teams, and secure a good EMI valuation from HMRC.

Thursday needed to carefully invest the money they raised on developing the app itself. Because the market for developers is highly competitive, extra incentivisation is key to hiring and retaining the best team. But when cash is tight, it’s tricky to offer the super competitive salaries and expensive perks that the big-name tech companies can.

That’s where a well-designed share option scheme comes in. High-performers can be attracted to the idea of taking home a direct cut of the company they help to build. The problem is that option schemes have a reputation for being expensive and complicated to set up and run.

For Thursday, SeedLegals was already a trusted provider and having everything in one place made sense. SeedLegals doesn’t just deal with one piece of the puzzle. We know how to make sure that everything works together – from SEIS/EIS and fundraising to share options. We make sure that founders know how a decision in one area could affect your company in the future.

We helped Thursday navigate the terms their investors requested, and supported them to understand what’s standard and what’s uncommon based on our vast data.

“The word ‘legals’ scared me a little bit. I have learned so much because the SeedLegals workflows help you understand everything about the process – from fundraising, share transfers and share options. It’s almost like an online course or an incubator for being a founder”.

Expertise is also key when it comes to unravelling the complexity of EMI share option schemes. At SeedLegals, we work with you to make sure your EMI valuation application is successful and the lowest it can be – so you can offer the biggest discount possible to your employees. We’ll guide you through all the rules you need to follow and help you set up an employee option scheme that delivers the most value to your company, as well as your team.

Thursday’s option schemes played a big part in bringing in a new CTO, which helped the company grow to the next level.

SeedLegals helped Thursday raise their seed round of £2.5M via 52 SeedFASTs in just 19 days. Famously, George was that guy who told LinkedIn he was going to build a $50M company in 12 months. He vowed publicly to raise £1.25M in 10 days and actually managed it.

The speed of SeedFASTs was instrumental in helping George and the team raise so quickly. With a SeedFAST, you can set your terms and send out your documents in a few minutes, and get everything signed and the funds transferred in less than 24 hours. Thursday were among the many companies who went from investor meeting to funds in the bank in just a few days.

At SeedLegals, we don’t believe in billable hours. We’re here to make sure you get it right – in the most efficient way possible. This was a major factor in why Thursday chose us over a traditional lawyer or accountant. When you team up with us, help is only a click away. Our excellent support has earned us five stars on Google and Trustpilot.

“I like the speed of it – you want to be able to process a document instantly. With SeedLegals you know there’s no waiting around for lawyers to come back to you, and there’s none of the business of being charged for time when you just want to speak to someone for five minutes and get a quick answer – you just get on the chat and someone instantly comes back to you.”

Thursday has used SeedLegals to raise millions from an impressive roster of experienced angels and VCs.

Ascension kickstarted the round, along with Best Nights VC, the investment arm of Jägermeister, and Connect Ventures (early backers of Citymapper, Typeform and Fiit). Notable angels who invested in Thursday include:

Thursday has put the investment to good use, with part of it going towards share option schemes to incentivise, motivate and retain staff members, allowing them to retain a talented team that has grown to 35 employees.

Thursday plans to scale, with an eye on launching in more cities.

“There’s nothing wrong with failing. It gets you to the point you’re trying to reach. No business is perfect from the start and you just have to test things and not be afraid to fail.

“I believe a lot of people don’t start businesses because they’re worried about what other people will think if it doesn’t work out straight away. Don’t be afraid to fail, because that means you’re only one step closer to success.”

Check out Thursday’s website 👉getthursday.com

When it comes to fundraising, we’ve helped over 35,000 founders raise a collective £1.5B+ in investment and 1 in 6 early-stage funding rounds in the UK are closed on SeedLegals. Our investment experts work with you to understand what your company specifically needs and help you decide what’s best in terms of fundraising methods, timing and terms.

Book a call with one of our experts to get started.