Shares vs options: what’s the difference?

The important difference is that if someone owns shares, they are a shareholder immediately. With options, they have own...

1% is the most popular amount of equity for startups to give a General Advisor who works less than two days a month and is paid only in equity.

The amount of equity startups give individual advisors varies according to the advisor’s expertise, role in the company, and the stage of the company. In this post, when we refer to equity we’re talking about ownership of your company as either shares or share options.

So how do you decide exactly what percentage of equity to give your advisor? First, decide what type of advisor they are…

We find that startups advisor roles usually fall into one of three categories:

Advisory shares, or advisor shares are shares (or stock, in US English) that you allocate as compensation to advisors in your startup. By giving an advisor shares, you’re giving them equity in your company.

Normally, startups give advisors a salary, equity or both. (In this post, where we say ‘equity’, it’s either shares or share options.)

Just as you wouldn’t pay someone in cash upfront for an entire year of work, if you give shares or share options to an advisor, they should always have a vesting schedule. This means that if your advisor leaves or is terminated early, they don’t get all their shares or options. With shares, the company has the right to buy back the unvested shares. With options, your advisor would only get the options that have vested up to that point.

Vesting is what makes advisory shares different from investor shares – investors put money into your company and immediately get their full allocation of shares.

Tax reasons, voting rights, shareholder approval, vesting – there are many factors to consider. To help you decide which type of equity to use, take a look which at our article: Shares vs options: what’s the difference?

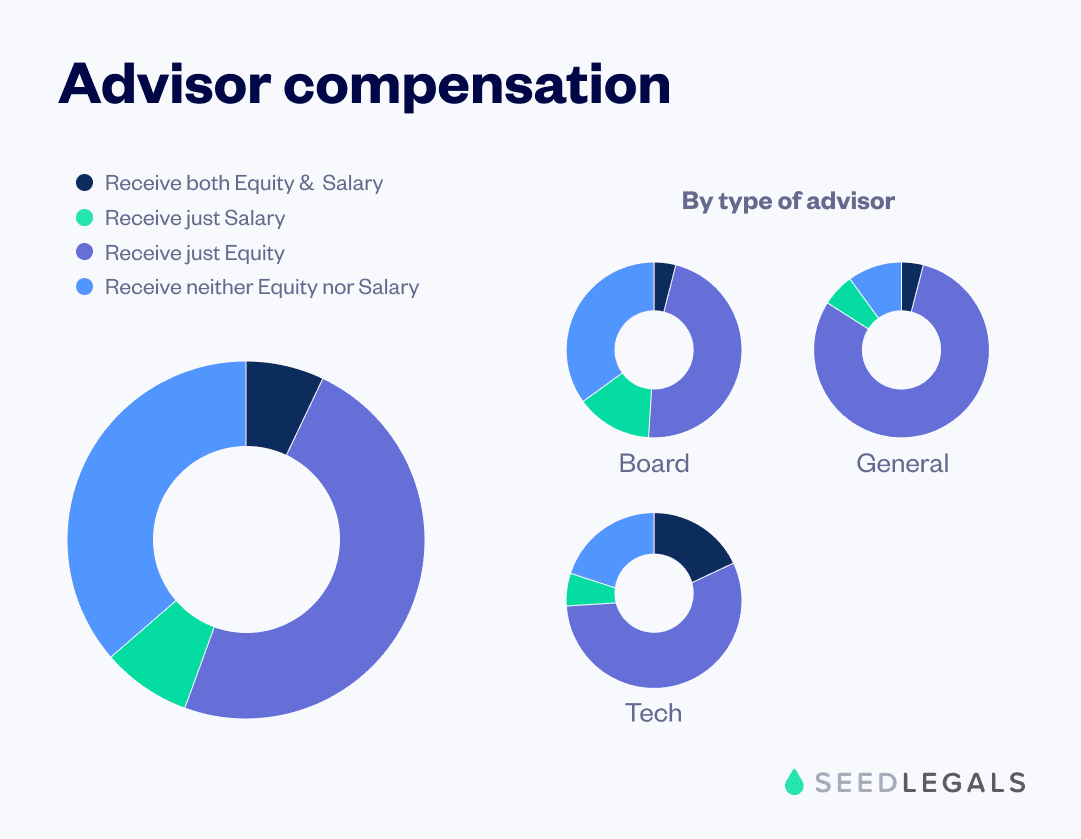

Using the data we hold from tens of thousands of UK startups, our analysis shows that the type of advisor you hire influences their compensation:

Often how you decide to compensate an advisor – salary, equity or both – will come down to the preference of the advisor. But we’ve noticed some striking differences in how different types of advisors are compensated:

Overall, 48% of all advisors in our data set are compensated with equity only. We took a closer look at this 48%…

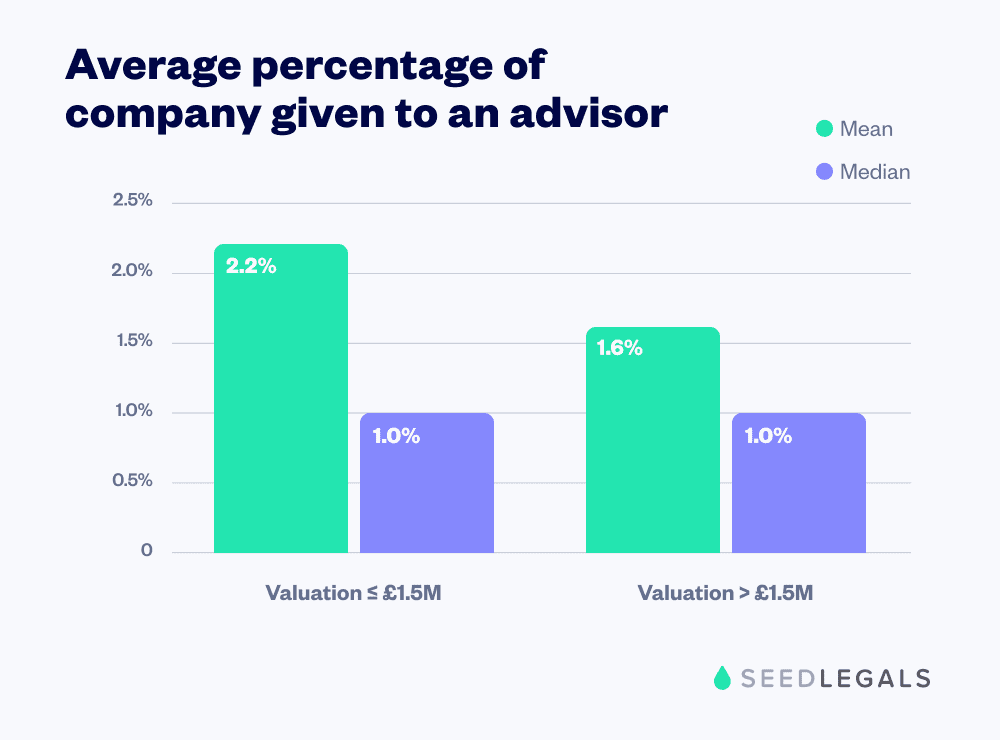

For advisors who get equity only as compensation, as you might expect, the higher the valuation, the lower the percentage of equity an advisor should expect to receive – see chart below.

However, although the percentage given to advisors is lower on average for companies with a larger valuation, the median (the midpoint) is the same for both data sets: 1%. It seems the neat round number of 1% is a popular amount of equity to give advisors, regardless of your valuation.

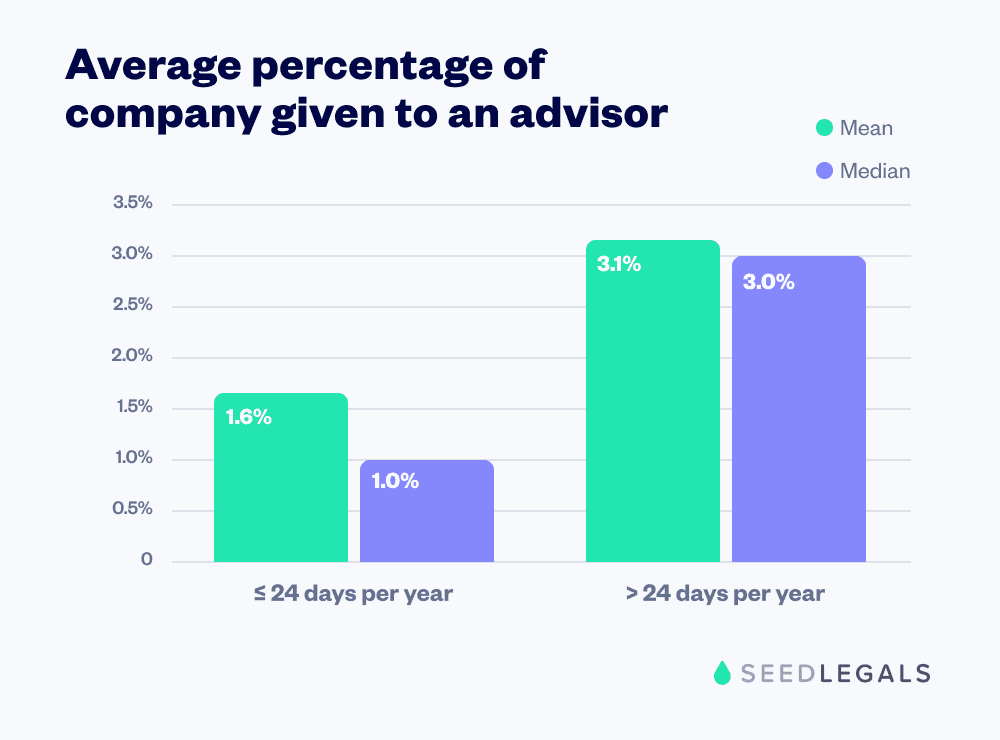

According to our data about advisors who get only equity as compensation, advisors who work more than two days a month get significantly more equity than those who work fewer than two days a month – see chart below.

If your advisor is working fewer than two days a month, it might be that they’re more of a figurehead, someone who looks impressive on your pitch deck or website but who doesn’t contribute much of their time to your company. Conversely, if your advisor is doing more than two days a month, this suggests a ‘real’ time commitment, worthy of suitable reimbursement.

Again looking only at advisors who get only equity as compensation: companies on SeedLegals give General Advisors less equity than Board or Technology Advisors – see chart below.

This could be because Board Advisors have a defined position as a director, with corporate and legal obligations. And Tech Advisors work on average 43 days a year, which is more than the other advisor roles.

Or it could be that General Advisors are simply chosen as figureheads for the pitch deck and website, rather than truly ‘working’ for you.

With every advisor you appoint, you’ll need to negotiate to find a compensation package that works for both of you. You could also suggest to your advisor that they invest in your company – with an experienced advisor as an investor, your startup will look more attractive to other investors.

As with any decision you make about giving away equity, it’s important to discuss it with experts. Talk to our team about what’s possible, and seek independent legal advice before you sign a contract.

We hope these data insights will help you make a more informed decision about what to offer or accept. And if you’re an advisor, we hope this post helps you decide whether the compensation a startup is offering you is fair.

Got a question about hiring an advisor? Not sure how much equity to offer? Book a free call with one of our experts.

Create your option scheme on SeedLegals in just a few clicks, with support from your dedicated options expert.

Explore options