Unlock the full power of your options subscription: a complete how-to guide to options on SeedLegals

Your option scheme is much more than just admin – it’s one of the most powerful tools you have to reward your team and f...

Share options a.k.a. stock options, are a fantastic way for startups and other high growth companies to incentivise their teams and achieve high performance.

In essence, they align employee interest with the company’s interest, allowing employees to benefit from a rise in the share price of the company that they work for.

They are very typical in the U.S, where a major part of your compensation in a high growth company will be in options. However, in the UK – it’s nowhere near as common.

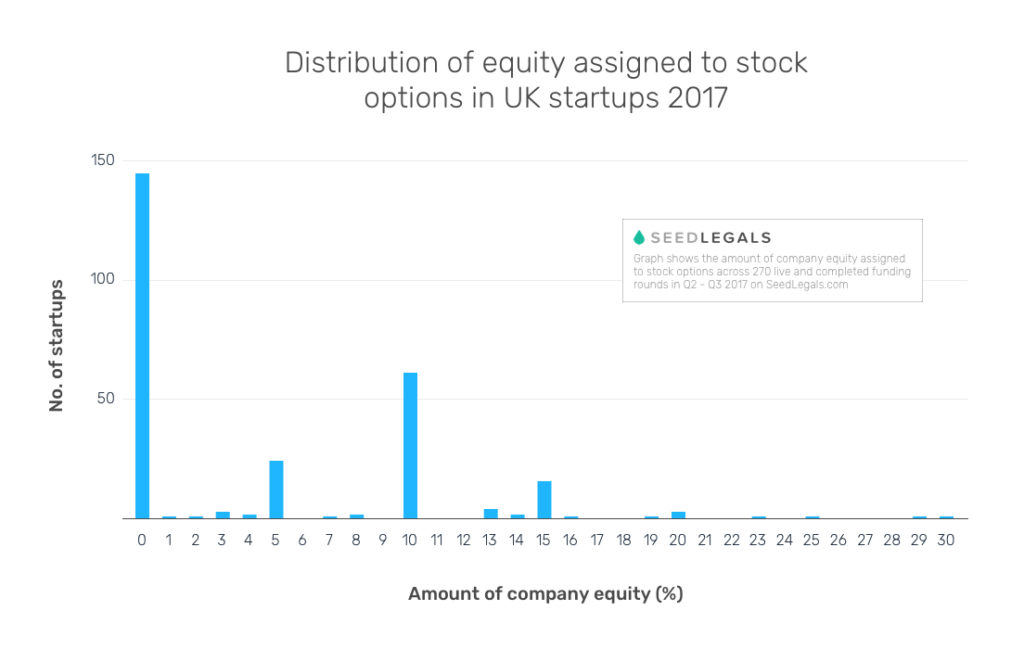

Data from the SeedLegals platform taken from over 200 funding rounds in 2017, shows that only 47% of high growth UK companies are offering stock options to their employees.

And for those that do offer team options, 10% is the median amount of equity assigned to the employee options pool.

The result? Well, according to Index Ventures research, Silicon Valley tech workers receive double the ‘reward for risk’ of their European counterparts – where 20% equity is the median sized pool.

UK employees are simply not aligned to the same extent and this lack of motivation for risk could be a crucial factor in explaining the difference in the number of ‘unicorns’ (privately owned startups with a valuation of over $1bn) between the two markets.

Differences can’t just be explained away by access to capital and talent, as especially in London both of these factors are in good supply.

Culture plays a big part, where UK employees expect their primary remuneration to be in cash, with stock options being a nice bonus. They’ll likely trade off a lower salary compared to a corporate job for the lifestyle and freedom to innovate, but it will take a lot more stories of UK employees cashing out for a lot of money on big exits before their appetite for risk changes.

In fact, it’s a bit of a chicken and egg situation. Employees don’t want their primary compensation without seeing the success that comes with massive exits, but those massive exits are much less likely to happen without employee alignment.

At SeedLegals we’ve just made it that much easier than ever for startups to set up and manage their employee share option pool. Our new EMI Share Scheme product lets founders set one up from scratch in minutes, and track vesting and ownership easily over time.

We’re playing our part in aligning employees and startups, so we can build the next generation of unicorns in the UK (and beyond!).

Click here chat to a member of the SeedLegals team about putting an options pool in place.