Marketing to win: What VCs expect (but no one teaches)

York Effect’s Tova Feldheim joins SeedLegals CEO Anthony Rose to unpack how storytelling, user research and smart market...

Qualified Small Business Stock (QSBS) can offer amazing tax benefits for founders and investors – potentially giving you a 100% exemption on federal capital gains taxes, up to $10 million or 10 times your original investment amount, whichever is greater.

But to fully benefit from QSBS tax relief, you’ll need to have set your company up as a C corporation and held the stock for at least five years before it’s sold.

Only C corporations can issue QSBS, but a company can convert from another structure (such as an LLC or an S corporation) to a C corporation and issue QSBS (as long as the other criteria are met).

That said, if you were issued stock before conversion to a C corporation, you could still benefit from QSBS on that. The gains on that stock before the conversion won’t qualify for QSBS. But gains on the stock after the conversion can qualify for QSBS (provided the company meets the other requirements).

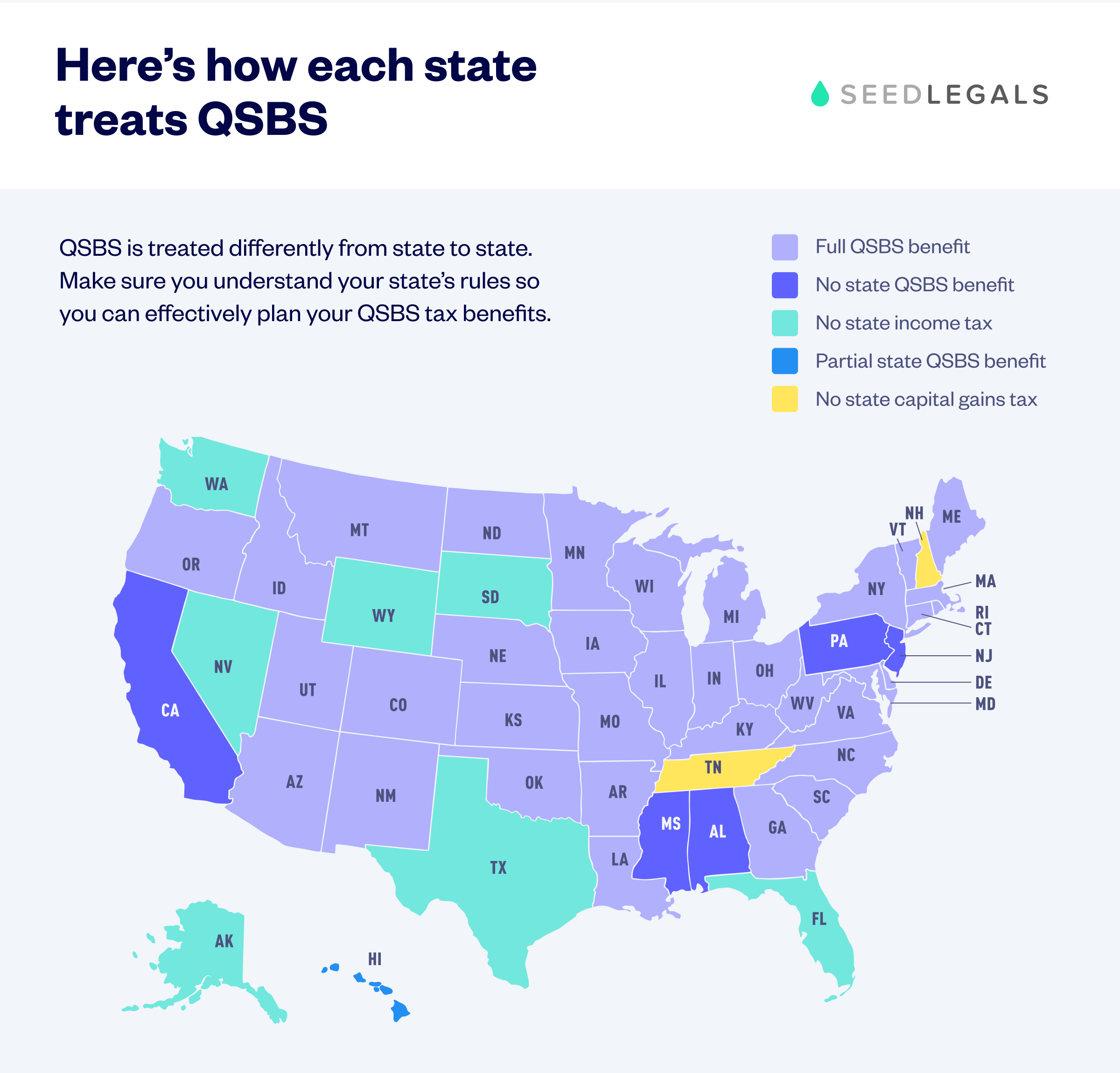

The rules for QSBS are in Section 1202 of the Internal Revenue Code. But at state level QSBS can be treated differently. So, it’s important to know your state’s rules to plan your QSBS tax benefits. In this article, we’ll cover how QSBS is treated in each state.

The map and table below show how each state treats QSBS.

Full QSBS benefit: These states follow the federal QSBS rules. This means you’ll get the same QSBS federal tax benefits at state level too.

No state income tax: This means QSBS gains are not subject to any state income tax. If you receive capital gains from QSBS, you won’t pay state taxes on these gains.

No state capital gains tax: This means there’s no state tax on capital gains for individuals. If you receive capital gains from QSBS in these states, you won’t pay any state taxes on the gains.

Partial state QSBS benefit: This means you may receive some state tax benefits, but they won’t be as favorable as states that fully conform to federal QSBS.

No state QSBS benefit: This means you won’t receive any tax benefits for QSBS at state level.

| State | How QSBS is treated |

| 1. Alabama | No state QSBS benefit |

| 2. Alaska | No state income tax |

| 3. Arizona | Full QSBS benefit |

| 4. Arkansas | Full QSBS benefit |

| 5. California | No state QSBS benefit |

| 6. Colorado | Full QSBS benefit |

| 7. Connecticut | Full QSBS benefit |

| 8. Delaware | Full QSBS benefit |

| 9. Florida | No state income tax |

| 10. Georgia | Full QSBS benefit |

| 11. Hawaii | Partial state QSBS benefit |

| 12. Idaho | Full QSBS benefit |

| 13. Illinois | Full QSBS benefit |

| 14. Indiana | Full QSBS benefit |

| 15. Iowa | Full QSBS benefit |

| 16. Kansas | Full QSBS benefit |

| 17. Kentucky | Full QSBS benefit |

| 18. Louisiana | Full QSBS benefit |

| 19. Maine | Full QSBS benefit |

| 20. Maryland | Full QSBS benefit |

| 21. Massachusetts | Full QSBS benefit |

| 22. Michigan | Full QSBS benefit |

| 23. Minnesota | Full QSBS benefit |

| 24. Mississippi | No state QSBS benefit |

| 25. Missouri | Full QSBS benefit |

| 26. Montana | Full QSBS benefit |

| 27. Nebraska | Full QSBS benefit |

| 28. Nevada | No state income tax |

| 29. New Hampshire | No state capital gains tax |

| 30. New Jersey | No state QSBS benefit |

| 31. New Mexico | Full QSBS benefit |

| 32. New York | Full QSBS benefit |

| 33. North Carolina | Full QSBS benefit |

| 34. North Dakota | Full QSBS benefit |

| 35. Ohio | Full QSBS benefit |

| 36. Oklahoma | Full QSBS benefit |

| 37. Oregon | Full QSBS benefit |

| 38. Pennsylvania | No state QSBS benefit |

| 39. Rhode Island | Full QSBS benefit |

| 40. South Carolina | Full QSBS benefit |

| 41. South Dakota | No state income tax |

| 42. Tennessee | No state capital gains tax |

| 43. Texas | No state income tax |

| 44. Utah | Full QSBS benefit |

| 45. Vermont | Full QSBS benefit |

| 46. Virginia | Full QSBS benefit |

| 47. Washington | No state income tax |

| 48. West Virginia | Full QSBS benefit |

| 49. Wisconsin | Full QSBS benefit |

| 50. Wyoming | No state income tax |

Some states don’t offer the same QSBS exclusions that are available at federal level, (specifically California, Pennsylvania, New Jersey, Mississippi, Alabama, and Hawaii). If you live in one of these states the only way you can benefit from the full exclusion is to move to a tax-friendly state before selling your shares – it’s the state you live in at the time of sale that matters. You could also transfer your shares to a trust based in a QSBS-friendly state, but there are additional complexities in doing this.

Book a free call with our team to find out how we can help with your fundraise.

Want to try SeedLegals for free first? Start your 7-day free trial.

Bring all your questions - we’ve got the answers! We’ll match you with the right specialist.