Read Transcript

Emily Wu (00:00)

Hello everyone.Anthony Rose (00:00)

And hello, I’m Anthony and welcome and meet Emily. Now, if you’re a founder and you’re looking to fundraise in the US, you need to do some SEC filings or SEC exemptions. Many founders know nothing about this. I’m sure many founders skip what they legally should be doing. So today we’re going to be talking to Emily, who’s an expert in this to understand when you need to file with the SEC.before a fundraise or when you need an exemption and you can post afterwards, which are the different rules that might apply to you and importantly, who to talk to as an expert to make sure you stand on the right side of the SEC requirements. So Emily, tell me a little bit more about what you do first, how you help startups and then we’ll dive into the details of different company types.

Emily Wu (00:53)

All right, so my name is Emily Wu and I run a law firm called Lumia. So we are based out of New York City. Our boutique law firm that specializes in corporate insecurities law. recently we were ranked in the top small to medium sized law firms in corporate insecurities law in New York by Chambers and Partners. So I’m excited to talk to you here about what makes an SEC filing work and also the types of SEC filings, when and where and how you should file, et cetera.Happy to be discussing more with Anthony here today.

Anthony Rose (01:24)

All right, amazing. So let’s start by the different rules that might apply. Some apply to big companies, some apply to crowdfunding, some are about public and private ones. So maybe talk us through the four or five different categories and then we’ll dive into each and see what applies for each category.Emily Wu (01:46)

Alright, yeah, so the main ones in the US are Regulations A, CF, D, and S, and there are subcategories of each, but those are the four main ones in the US.Anthony Rose (01:57)

Okay, so let’s say which ones would rig A apply to?Emily Wu (02:02)

So Reg A’s are kind of like mini IPO’s in that they allow securities to be freely traded as if they were kind of shares on a stock market. You can buy and sell how you want. There are no restrictions really. And so because of this similarity to an actual IPO, but just on the private markets, take up to six months and they’re quite expensive. But they are most applicable to companies that are blockchain, for example, crypto companies.They are intended for companies that have a massive volume of sales such as if you want to if you have a crypto trading platform and this volume would be Presumably over 10 million. So regulation a has two tiers With one of them has a maximum of 75 million. The other one is 25 million. So these are meant for big volume trading

Anthony Rose (02:48)

Okay, so if you’re a small startup, that’s probably not you. So let’s then turn to the next one, which is Reg CF, and I’m guessing CF stands for crowdfunding. So when would that apply? And can anyone just do this themselves, or do you have to go through one of the crowdfunding platforms to use that?Emily Wu (03:07)

Yeah, so there are several parts of this regulation CF, which is indeed regulation crowdfunding. So first of all, the platform that hosts these crowdfunding deals, they need to be registered as a funding portal. So this is one type of registration from the part of the online platform. The other part is that the company, when they list on these platforms, they need to get registered under regulation CF. this is noteasy to do by oneself because the document that needs to be submitted can be between 30 and 100 pages. It’s a detailed document that highlights your business model, the risks of the investment, et cetera, et cetera, the types of securities being sold, the nature of your management team. You also need potentially audited financials or unaudited financials depending on the size of the deal. I think generally speaking, if you are trying to raise

more than one million, then you should have audited financials, which can also be costly. Unaudited financials would be for smaller deals. but I think crowdfunding is a great way for companies to raise money in the sense that they can access a really broad range of people they potentially don’t know they potentially need if they run social media campaigns, they can have they can have really good outreach if you know, the idea is popular. So and also the platforms offer

They offer usually a bit of accounting support in the sense that they keep track of who’s invested, the distributions, et cetera, et So regulation CF is also a great way for companies to raise money.

Anthony Rose (04:35)

So that’s going to be applicable if you want to raise from lots of crowd platform investors and go through a crowd platform. So let’s now take the next scenario, is you want to, you’re raising, let’s say a couple of million and you want to reach out to some angel investors and some VCs. You’re not yet in this example, you’re not putting it on LinkedIn or on the internet, you reaching out to people you know.You’re cold calling people, whatever it might be. So we’ll call it, it’s private is the important thing. What do you need to do to check your investors? you contact your parents and ask them to invest? you contact friends and family? What do you need to do in terms of any SEC filings and what do you need to do with any checks on your investors?

Emily Wu (05:27)

So in this case, the most applicable filing would be regulation D, which is also one of the most popular ways for companies to raise money because it’s a bit more automatic than the other filings in the sense that regulation A is a very customized, very, very, long filing. Regulation CF is shorter, but also very customized. Regulation D is more of an online form thing. So potentially you could do it yourself if you know how to manage, navigate the form.It’s not something that needs very long customized drafting by an attorney. However, a lot of first time entrepreneurs do go to attorneys for the reason that navigating the form can be a bit complicated at times. But you can take a look to see yourself if you can navigate it without attorneys like me. And so it’s very straightforward, unlike the other filings, which can take months. This one just takes a couple of days at most. And there are a couple of subcategories that you can look into to see which one would apply to you best.

Number one would be rule 504. And this is a subcategory under regulation D. So the restrictions of 504 are that you can raise a maximum of 10 million in a year. But the upside is that you can raise from both accredited and non accredited investors with no restrictions on marketing. So accredited investors are considered generally high net worth individuals, but in the United States, they’re

Individuals, for example, with a salary of 200,000 or more a year. As a couple, 300,000 more a year. So it’s not as high net worth as people often like to think. You don’t have to be reaching out to Bill Gates for money in order to have him qualify as an accredited investor. can read, doctors would generally qualify in the United States. A lot of attorneys would as well. And so, but the main rule of 504,

that it has in terms of restrictions is just the 10 million cap. you can think about what your fundraising goals are and how these rules would fit for you. The second rule is 506B. And 506B is another subcategory. The restrictions are that you can only reach out to and fundraise from a maximum of 35 non-accredited investors for the round. And also,

there is a restriction on marketing. by that, what I mean is that you can only reach out to investors through broker dealers who have already worked with those investors in the past. But the upside is that there is no restriction on the maximum amount that can be raised in a year. So this is a different type of restriction than rule 504. And the last subcategory that

is actually the most popular in the United States in terms of regulation D is 506C, which restricts the fundraising round to accredited investors only, but there’s no cap on how much you can raise and there’s also no restriction on marketing. So a lot of startups like 504 because 200,000 a year in terms of salary is not unattainable and they’re generally people you would reach out to.

for investment anyway and so 506c oftentimes is the best fit but if you’re working on a smaller deal where you’re maybe just looking for I guess a wider range of people to invest in then maybe 506c would not be a fit but it is the most popular filing under regulation D.

Anthony Rose (08:45)

Okay, amazing. So tell me what work you have to do to apply. these things before you go fundraising or these things afterwards? And 504 sounds more appealing, but is it more work than 506?Emily Wu (09:01)

Yeah, so there are several steps to making the filing online. So first of all, you have to register for an, it’s called a form ID, which is registering an account with the SEC filing system. And then after that, you have to fill out the form D when your registration with the SEC is approved. So that would be an official form. And then in the course offilling out that form, have to get it notarized and you have to get it signed and filled basically and then you submit it online and usually it’s approved in a day. And then the registration part is also approved usually within a day. So added together two days at most and you have to spend time getting it notarized. So it’s a very simple and short filing.

Anthony Rose (09:42)

Now I understand, I think, that you only have to do this within 14 days or some number of days after taking investment or is there anything you need to do before you take investment?Emily Wu (09:54)

Right. So form form D, which is the form that you file under regulation D, it’s something that needs to be filed within 15 days of receiving investment. And so a lot of times this is very great for founders because they don’t need to pay attorneys for anything until they actually get the money. So, and when they’re talking to investors, they just simply say, we need to put a part of this for, you know, attorney fees for potentially filing the form D. And then that’s that. So they don’t have to pay a cent out of their own pockets until they actually get money.Anthony Rose (10:02)

Okay.Emily Wu (10:23)

And so I also want to note that investors who are residents of the US, they may need to pay a fee for blue sky filing as well. So this is an exemption at the state level, which is giving notice to the state that money has been made and there’s a filing fee associated with it. But this is, it ranges from 300 to a thousand usually in terms of government filing fees, but usually it’s more so around 300 based on the size of deals that startups incur.And so, but this is even simpler than the form D. It’s just you make an online account with the blue sky system and then you just check the boxes and what size of investment you got, who it was that made the investment, where they were a resident of, when they made the investment, et cetera.

Anthony Rose (11:06)

And this is something that the company needs to do or the investor does.Emily Wu (11:09)

Usually the company does it. So Form D and Blue Sky Filings are considered part of one group in terms of what they do for investors. Blue Sky Filings are also, the timeframe is also similar to the Form D. So it doesn’t need to be filed beforehand. It just needs to be filed within 15 days after. So this is plenty of time to fill out a simple online form. again, so entrepreneurs don’t need to pay a cent until they actually get the money.Anthony Rose (11:39)

Okay, all right, so that’s great, you do it afterwards. So now the next question is checking that the investor meets the necessary requirements. So this is something the investor can write to you and say, yes, I meet the requirements. I think the rules are that they have to have reasonably checked or something like that. So is it self-certified? Do you need to see their tax statement? What’s sort of the minimum you can do? Because obviously it’s a bit intrusive to ask the investor.Emily Wu (12:05)

Yeah, so in standard subscription agreements, there are tons and tons of questions asking the investor which type of accredited investor they fall under. And the investor is supposed to check the boxes and represent and warn that they are able to provide proof of their income if the company would ask. And so then the company would typically request some kind of proof from the investor. Alternatively, it’s also possible to ask forverification directly from the investor’s attorney, the investor’s accountant, or the broker dealer, because all three of these types of professionals are licensed and bound by their licenses to make accurate statements. if the investor’s attorney, accountant, or the broker dealer states that the investor does meet a category and signs that they have attested to it, and usually in that kind of document, they would say their license number, for example.

This also qualifies as well.

Anthony Rose (13:01)

Great. So and as a founder, you’re saying that you need to ask for this or you just need to get the investor to sign to say that they will provide this if you ask for it. But actually, you don’t need to ask for it unless the SEC asks you one day.Emily Wu (13:16)

Yeah, well, in the United States, a lot of the fundraising platforms, for example, they would have a KYC service, example, anti money laundering, and they or they would integrate this kind of service into the platform, or they would have their internal team kind of perform this kind of check. So it’s actually more automated than people would think. You there are people in working on these types of deals who are handling this and andSo this is a very widespread and very common system actually that would kind of ensure qualification in an easier way than for founders to kind of have to go one by one on their

Anthony Rose (13:52)

Okay, all right, great. So now, last question, I think, from me, which is, I’m a founder and I’m looking to raise, let’s say, 3 million. Guide me through which of 504, 506B and 506C I’m going to want. And I think that I’m not going to want to go to broker dealers. I want to do mostly an angel round. There are some people I know. I want to post some things on the internet.and I’m going to talk to some funds. I want to run the funding round myself. And for the most part, I’m happy that I will check that my investors are accredited, but maybe I’ll take some friends and family who don’t need to be accredited. Which one of these three might I want to go for?

Emily Wu (14:38)

All right, so to start with, a lot of times entrepreneurs might be asking themselves whether it’s even necessary to go through this at all. And especially since it takes time and energy and then you have to potentially find an attorney if you have never made a Form D filing before. And so the answer that I would give is yes, because so in the United States, everything is super transparent. All of the filings, Form D, Form Cs,and the regulation A filings, they’re all actually listed online. So you don’t want to be marketing that you’re making, that you’ve raised so much money from investors. And then people look online and they can’t find you. So that would be, that would get you in big trouble potentially from competitors. So I would say that definitely look into regulation A’s, CF’s, whatever applies to you, no matter what. And you would definitely have to make a filing.

And so now going into the type of filing. So you want to ask yourself what the fundraising strategy is and the type of securities that are being sold. So for example, as we discussed earlier, if you have a massive trading volume and you have many investors and you want the shares to be kind of freely tradeable, then maybe regulation A would be best. And this would apply, for example, if you have maybe a crypto trading platform. If you’re looking to kind of raise money in smaller amounts,

through a platform like a crowdfunding platform that’s a bit more public. You may consider Regulation CF. And finally, if you want to keep things very private, you’re just reaching out to your network. Regulation D would probably be the best way to go, which is what Anthony seemed to suggest in terms of your goals. You would just want to reach out to friends and family, angel investors, et cetera. So now going into the subcategories of Regulation D. So this would depend on your strategy as well. Anthony said no broker dealers.

506B is off the table, 504 or 506 then, 506C. So Anthony mentioned that you want to reach out to maybe friends and family who are potentially not making the amount to meet the accredited investor requirements, in which case, if your goal is to raise less than 10 million in a year, which is the case for actually the majority of startups.

early stage startups, mean, not the ones going into Series C, for example, then 504 would actually be the best fit.

Anthony Rose (17:06)

All right, that was amazing. For all the complexity, we’ve gone through the different decision gates and we’ve come to, you know, for most people in an early stage startup not doing mass round, 504 is the answer. All right, so now, thank you so much. Now, tell me how you can help companies get their 504.Emily Wu (17:25)

Yeah, certainly. So 504 is a filing under regulation D and we help companies make those filings. We also help them take care of the blue sky filings as well. basically once you have the your documents in place, which SeedLegals provides as well in terms of templates for term sheets for investment agreements, et cetera. So once you’ve raised your money within 15 days, come to us and we can help you make the filing. So a very simple and straightforward andAnthony Rose (17:28)

ThankEmily Wu (17:52)

Once we make the filing, we’ll send the confirmation to you. It’ll be listed online. So all your competitors can see that once you say you’ve raised money, they can actually find the information online. So that’s that.Anthony Rose (18:06)

All right, so that’s interesting point because once you do file it, then companies that, you know, spy to the SEC or the Edgar site to look at these listings may reach out to you. Congratulations, you’ve raised. Can we sell you insurance? Do you want to hire people? Whatever it might be. So maybe you’ll get some marketing material or or maybe competitors or maybe the press, depending on the size of your raise. All right, that was fantastic. Emily, thank you so much. And of course, anyone needing any help?Emily Wu (18:14)

youAnthony Rose (18:34)

Tell us where they can find you.Emily Wu (18:37)

Yeah, sounds amazing. And what you said was definitely true. So if I make the filing on behalf of clients, I’ve gotten frequent advertisements from broker dealers, offering their services to help companies raise even more money. So they do find contact information and then new filings online. So it is true. But yeah, it was wonderful speaking to you today, Anthony. And I hope this information is helpful for startups looking to raise capital.Anthony Rose (19:00)

Alright, fantastic. And if you want to find out more, go to lumia.com company. Is that correct?Emily Wu (19:06)

Yes, Lumia. company.Anthony Rose (19:08)

Amazing. Thank you.

Raising money for your startup takes more than just finding the right investors and negotiating a term sheet – you also need to understand and follow the Securities and Exchange Commission’s (SEC) regulations.

Why? When you’re fundraising, the stock you’re offering counts as ‘securities’ – financial assets that give investors a stake in your business. The SEC regulates the sale of securities to protect investors, and selling them usually requires you to go through a long and expensive registration process – something most startups want to avoid.

That’s why some exemptions have been introduced, which mean you don’t have to fully register (saving you time and money). Depending on how you’re doing your fundraising, you’ll need to know which rules apply and what filings are necessary to comply with the law.

In this article, we’ll walk you through the main SEC exemptions that apply to fundraises, so you know which option best suits your startup’s goals.

🎥Watch: A discussion with Emily Wu

SeedLegals Co-founder and CEO Anthony Rose sits down with, Emily Wu, a partner at Lumia, to discuss the various SEC fundraising rules.

Watch the webinar below to find out more and check out the slides here.

Which SEC exemptions apply to fundraises?

The SEC offers four main types of exemptions for private companies looking to raise money in the US:

Regulation A,

Regulation CF,

Regulation D, and

Regulation S.

Each has different requirements, costs, and investor eligibility rules. Here’s an overview to help you determine which is right for you.

What is Regulation A?

Regulation A is sometimes called a “mini-IPO”. It’s designed for larger, high-volume fundraises and allows for the sale of freely tradable securities.

This option is most relevant for companies that need to raise large amounts of money (up to $75 million) from the public – and the securities can be freely traded. But the registration process can be time-intensive (up to six months), and costly, making it a better fit for companies with high transaction volumes.

For example, a crypto trading platform aiming to raise $50 million and seeking tradable securities would find Regulation A a suitable choice. For smaller startups, though, this route is often excessive due to the lengthy and expensive process.

What is Regulation CF?

Regulation CF (or Regulation Crowdfunding), is aimed at startups that want to reach a broad range of investors through crowdfunding sites like SeedInvest, InfraShares, FlashFunders, Republic or WeFunder.

These are ideal for consumer-focused companies aiming to raise funds from their user base as it lets companies reach a large audience and run public campaigns, which can build brand loyalty and expand reach.

But the filings can be complex, especially for raises over $1 million (which may require audited financials). Also, all the funding must go through a registered crowdfunding platform.

What is Regulation D?

Regulation D is by far the most popular option for startups raising private funding from friends and family or even angels and VCs.

It has three main sub-rules, each with its own investor limits:

Rule 504: Allows up to $10 million to be raised in a year from both accredited and non-accredited investors, with some restrictions on marketing publicly and the requirement that you comply with the securities laws of each state in which your investors reside.

Rule 506(b): Allows unlimited fundraising with up to 35 non-accredited investors but limits advertising to established investor relationships (so, you can’t advertise publicly).

Rule 506(c): Doesn’t impose any cap on fundraising amount and permits public advertising, but only accredited investors can participate.

What is Regulation S?

If your startup is only raising funds from non-US investors, Regulation S allows you to do so without registering with the SEC. If you’re relying on this, it’s essential you still check specific international laws that may apply in your investors’ countries.

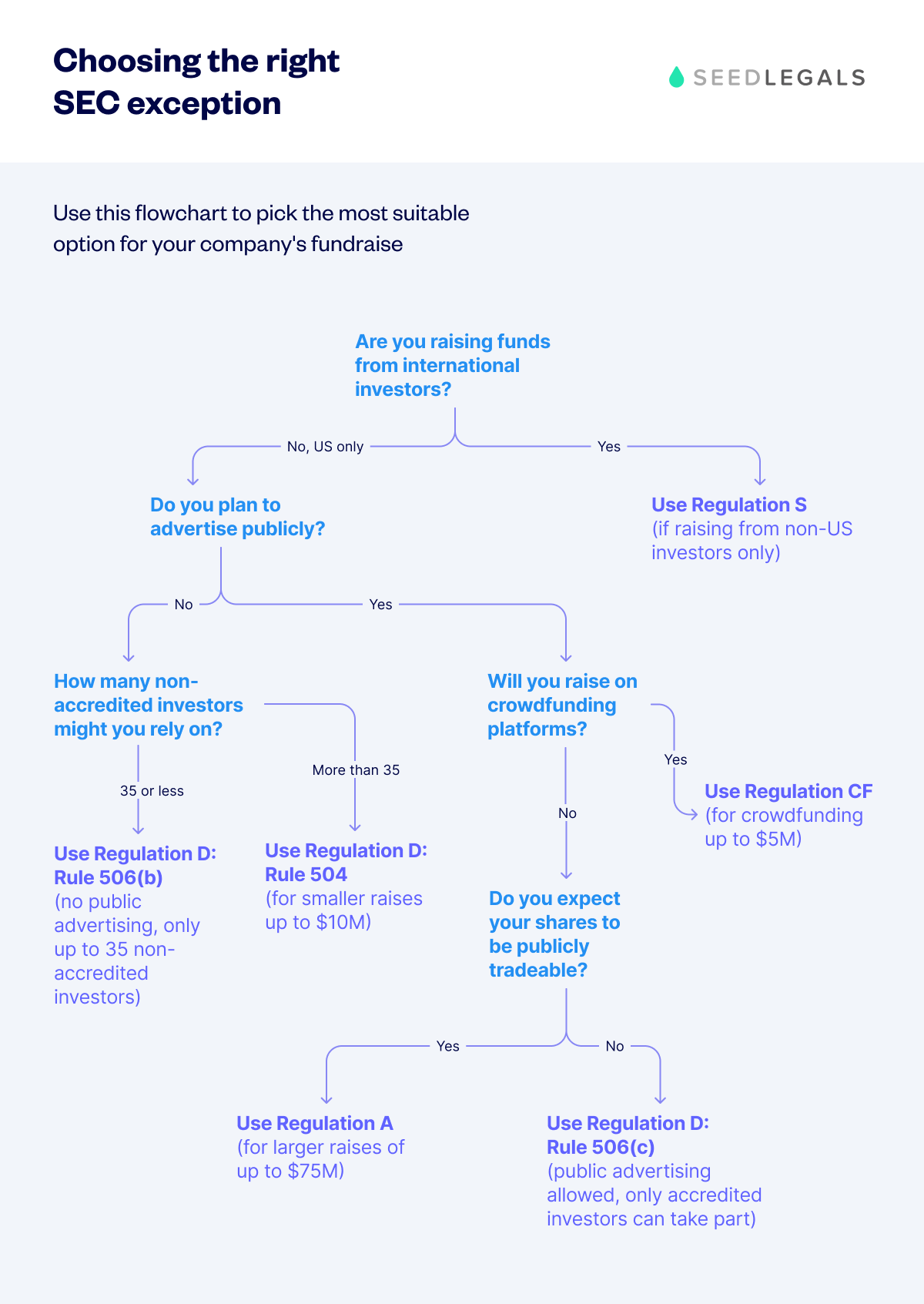

Which exemption should I use for my fundraise?

For most companies, one of the three sub-rules within Regulation D is going to be the best option. You can use the flowchart below to help you pick the right one for you.

An overview of each exemption

| Regulation | Best for | Investment Limits | Investor Eligibility | Filling Requirements | Marketing Restrictions |

| Regulation A (Mini-IPO) | High -volume fundraises, like those for crypto or blockchain projects with tradable securities | Up to $75M per year | Accessible to public investors (no accreditation required)

| Form 1-A plus substantial additional filing (the process may take up to six months) | Publicly advertised and traded securities |

| Regulation CF (Crowdfunding) | Crowdfunding on platforms, ideal for consumer-focused startups

| Up to $5M per year

| Open to all investors, with limits tied to income or net worth | Form C, plus platform-based filing, with audited financials needed for raises over $1M | Restricted to registered crowdfunding platforms |

| Regulation D Rule 504 | Smaller raises from friends and family, open to both accredited and non-accredited investors | Up to $10M per year | Both accredited and non-accredited investors allowed for SEC purposes | Simple Form D filing plus state-specific compliance and filing requirements in each state in which your investors reside | Flexible on marketing, with limited restrictions |

| Regulation D Rule 506(b) | Private offerings with close investor network | Unlimited | Allows up to 35 non-accredited investors, with unlimited accredited investors | Simple Form D filing plus significantly heightened disclosure requirements for any non-accredited investors | No general solicitation allowed |

| Regulation D Rule 506(c) | Larger raises with public outreach | Unlimited | Accredited investors only, with “reasonable steps” to verify accredited investor status | Simple Form D filing | Allows general solicitation and marketing |

| Regulation S (International) | Non-US investors | Unlimited | Only non-US investors | Filing requirements vary by country | No US-based marketing (limited to foreign investors) |

Do I need a lawyer to help with this?

While you might be able to handle some SEC filings on your own, first-time founders will benefit from working with a law firm like Lumia – they’re experts in identifying and making the right filings for you.

Plus, they can help with things like checking investor eligibility, which is key for keeping your exemption status. Plus, since these filings are public, there’s a chance competitors or the press might see them, so you want to make sure they’re accurate.

Got any questions? We’ll get them answered

Book a free call with our team to find out how we can help with your fundraise.

Want to try SeedLegals for free first? Start your 7-day free trial.

Get answers fast, for free

Bring all your questions - we’ve got the answers! We’ll match you with the right specialist.

for free

Bring your questions - we got the answers