How Irish business can use the SEIS and EIS to attract investors

If you're looking for UK investors, make your Irish startups more attractive with SEIS and EIS Advance Assurance from HM...

The Enterprise Investment Scheme (EIS) is a government initiative that rewards private investors for taking a risk by investing in early-stage UK businesses.

The rewards come in the form of generous tax breaks for EIS investors. These tax reliefs are so attractive to investors that EIS, along with its sister scheme SEIS, now effectively fuels the UK’s startup system. As many as two-thirds of UK angel investors only consider SEIS/EIS-eligible companies.

So if you’re a medium-sized startup planning to raise a funding round, it’s essential to check whether you qualify for EIS. And to help you navigate your way around the scheme, we’ve put together this guide to cover:

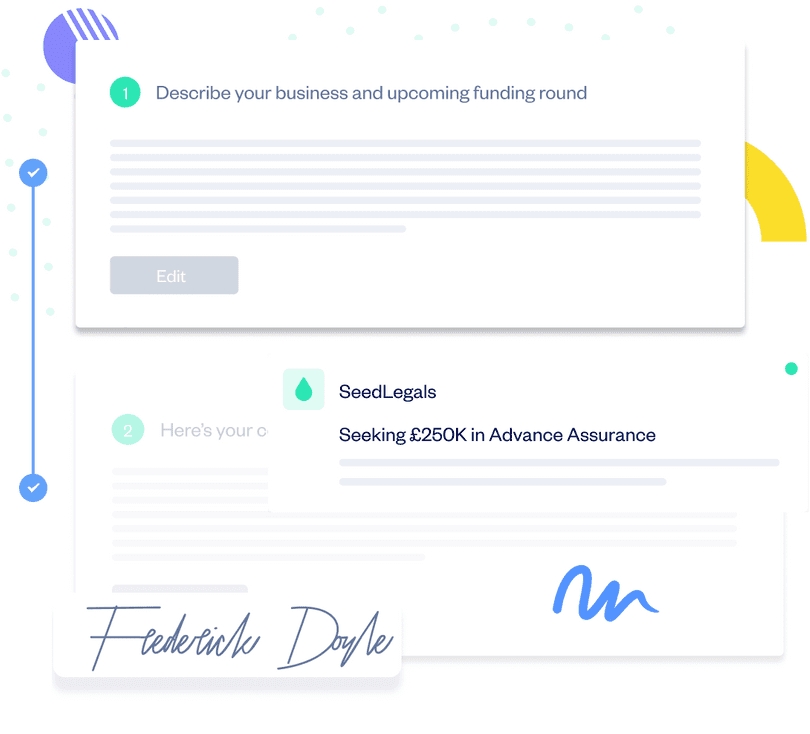

On SeedLegals, it’s simple and speedy to apply for EIS Advance Assurance.

Get started

The UK government introduced the Enterprise Investment Scheme (EIS) in 1994. EIS is a tax initiative that incentivises private investors to support UK innovation and stimulate the growth of the economy. EIS provides tax relief for investors who invest in young, medium-sized and high-risk companies.

The scheme has been hugely successful, with over £20 billion raised in total by almost 40,000 companies since its introduction (gov.uk).

There are certain rules companies must meet to qualify for EIS investment, and restrictions on the amount and type of investment.

In 2018, even more generous terms and a relaxation of some rules were introduced for Knowledge Intensive Companies.

Here’s why EIS is the holy grail for medium-sized companies looking for funding: your investors get generous tax breaks as a reward for risking their capital in a less established business.

EIS investors receive the following benefits:

To take advantage of EIS, the investor must be a UK taxpayer. An individual can invest up to £1 million per tax year under the scheme. At the time of investment, they cannot be an employee of the company. In most cases an investor can become a director of the company after the shares have been issued. Usually this position will have to be unpaid to qualify for EIS tax relief. For more information, see our article on SEIS/EIS rules for investor directors.

An EIS investor cannot hold more than 30% of the company’s overall shares, and normally they would be disqualified from holding a liquidation preference. However, because A Ordinary Shares provide a loophole here, the investor might ask you to issue these to give him or her priority. You can find more about how to give EIS investors liquidation preference in this article on SEIS/EIS tax relief facts.

Here’s how EIS works: If your company qualifies, you can raise up to £12 million total in EIS funding – capped at £5 million in any 12-month period.

Be aware though that the top limit of £12 million also includes funds raised through SEIS and other venture capital schemes, social investment tax relief, and some kinds of state aid.

EIS is designed for medium-sized businesses. To qualify for the scheme, your company must:

The EIS rules state that your company can only have been trading for less than seven years to qualify for EIS. Actually, that restriction only applies to the first time you raise funds through EIS.

So long as you raise some EIS funds during that period, you can then carry on indefinitely until you hit the £12 million limit. This loophole is called Condition A: for more information, see What to do if you have been trading for longer than seven years.

Additionally, if you’re over the time limit for EIS you can ‘reset the clock’ by introducing a new business activity that counts as a ‘pivot of trade’. This is called Condition B.

To qualify for EIS, your company must not fall into the category of one of HMRC’s excluded trades. These include:

The good news is that you’re only disqualified from seeking EIS funding if a ‘substantial’ proportion (20%+) of your trading activities falls into one of the excluded categories. Also, if your company provides support to one of the excluded trades (for example, you’ve developed some software that will support online banking) without being directly engaged in it, then you could still be eligible for EIS.

Your company needs to have less than £15 million in gross assets at the time of your funding round. You’ll need to calculate the total value of the company’s assets just before the EIS shares are issued.

Your assets include:

Crucially, the EIS funds themselves (if they’re paid just before the shares are issued) don’t count towards your current assets. But funds from a standard, non-EIS investor would count towards your £15 million assets limit. That means you should ask standard investors to wait until the EIS shares are issued before sending in their money – otherwise you could find yourself in a tricky situation with HMRC.

Your company also needs to pass the UK Permanent Establishment Test. A non-UK-owned company can take part in EIS as long as it has a ‘permanent establishment’ in the UK. This means that the company has either:

or:

The ‘permanent establishment’ in the UK must be maintained for 3 years from the start of trading or from the date the EIS shares are issued.

To be compliant with EIS eligibility criteria, an investment must be in the holding company rather than a subsidiary. Subsidiary companies don’t qualify for EIS investment.

You can find more guidance on this complicated topic here: I have a holding company and a subsidiary – what to do about SEIS/EIS?

To summarise, if you’re running a multi-tier company, you must raise investment in the holding company for your investors to successfully access the Enterprise Investment Scheme.

The Risk to Capital Condition is a test that HMRC introduced in 2018. HMRC is intentionally vague about how to pass this test and judges each company on a case by case basis. However, you’ll need to provide evidence that:

Remember that to qualify for EIS, you need HMRC to focus on the opposite of what you want investors to focus on. While investors want to see all the reasons your company is going to succeed, HMRC wants to see all the risks inherent in your business.

We recommend building two pitch decks: one for investors and one for your EIS application.

If you can demonstrate that your company fulfils HMRC’s criteria for a Knowledge Intensive Company, then you’ll be eligible for extra benefits under EIS. It’s definitely worth checking, as we find a lot of companies don’t realise that their business activities count as ‘Knowledge Intensive’.

You could qualify as a KIC if:

Extra advantages for KICs under EIS include: