Raise ahead of a funding round

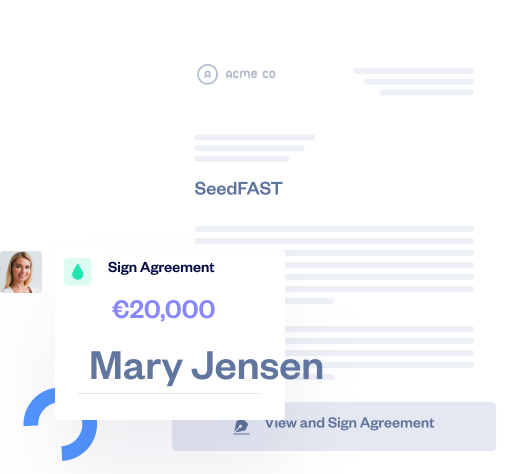

Our SeedFAST advance subscription agreements let you raise investment before a funding round. Ready to sign in minutes.

Introducing SeedFAST

Raise before a funding round

Decide your valuation later

Internationally accepted

Here's how it works

SeedFAST, perfect for international investments

SeedFAST is a carefully constructed, simple and now incredibly popular alternative to a convertible note. Plus it's suitable for US investors and UK SEIS/EIS compatible.

Try our SeedFAST equity dilution calculator

Low transparent pricing

It's the best value in town.

SeedFAST

Raise before a round with our SEIS/EIS-friendly advanced subscription agreement.

What's included?

SeedFAST Agreement

Investor Consent Notice

Shareholders Resolution

Board Minutes

Unlimited help from our support team

How it works

- 1Create a free SeedLegals account

- 2Enter your investment details

- 3Invite your investor to review and sign on SeedLegals

- 4Your investor transfers you the funds directly

Requires any subscription plan (first7 days free)

Frequently asked questions

Still have questions?

What is a SeedFAST?

A SeedFAST is a type of Advance Subscription Agreement. These are individual, super simple, super quick agreements for future equity in the company where investors will pre-pay for shares that will then be allocated in the next funding round.When should I use a SeedFAST

SeedFASTs should be used as a bridge to a later funding round (that will usually take place within a year), when you need to quickly take in a small amount of investment and you don’t want to commit to a valuation.When does the investor get issued equity?

The SeedFAST Agreement will convert to equity at the next funding round, when you raise above a preset qualifying amount, or at the long stop date, the date at which it will automatically convert if you don’t raise any more funds.Are SeedFASTs SEIS/EIS compliant for UK investors?

Yes! SeedFAST Agreements are SEIS and EIS compliant! As long as you convert the SeedFAST investor to equity within six months of them sending over the funds.When can investors claim their SEIS/EIS relief?

Investors can claim their SEIS/EIS tax relief in the tax year in which the shares were issued. This means that the investors won’t be able to claim their relief until the SeedFAST Agreement converts to equity.

You’re in safe hands

Our team of legal and funding experts have helped thousands of entrepreneurs raise money and grow their businesses.

Beautifully organised

Your company's core agreements, all in one place

Secure signatures

Share and collect signatures online via SeedLegals

Backed by real lawyers

Create the exact documents you need at every stage of growth

Serious about security

Your information stays safe and confidential in our secure system

Helpful humans

Talk to one of our friendly team anytime on live chat

Extra protection

Don't worry, our insurance covers claims related to our platform

We’ve helped over 35,000 startups

From food to FinTech and beyond, join thousands of startups who use SeedLegals to start, raise and grow faster.

More customer stories