US taxes and reporting: What founders need to know

Starting a company is exciting – but alongside the challenge of building your business comes the task of keeping on top...

Having a strong board of directors on your side can help you as a startup founder. Your board can open doors to new connections and help make company decisions to guide you towards success.

In this article, we’ll explain how to set up a startup board, understand its responsibilities and what to pay your board members (if anything at all).

A startup’s board of directors is a group of people who help guide the company’s direction and make key decisions. They oversee corporate governance and support the founders in growing the business. A board of directors ideally has a diverse set of skills, expertise and industry knowledge relevant to the startup.

Every company must have at least one director – when you set up a company, you decide who your director(s) will be. If you’re just a solo founder at the moment, don’t worry – a board can consist of just one director. You can then add to your startup’s board as your company grows.

Startup boards have to agree on some major company decisions. To reach an agreement, the board of directors can get together and decide on something by majority vote (called a board meeting). Or they can provide written consent without a meeting if they agree on something unanimously.

You can also give some board duties to a specific director or a group of directors. For example, financial tasks are often handled by the chief financial officer (CFO). If a director is given the power to do something – like sign supply contracts – the board of directors doesn’t need to meet or give consent every time the company needs a new contract. The director with the authority can go ahead and make decisions within their assigned role.

Anthony RoseAim to have people on the board who are truly invested in the success of the company and who will complement the knowledge and experience of the founders. For example, if the founders are mostly technical experts, you should aim to have other directors who can help with financial expertise, business growth, partnerships and sales.

Remember, the board is about governing the company, not getting advice, and it should be founder-led rather than investor-led. Investors sometimes want a different outcome than the founders, so remain in control of your own company and ensure that you have more of a say in who’s on the board than your investors.

Co-founder & CEO,

At SeedLegals, we recommend that if there are just two or three founders, you all have a seat on the board. Why? Well, because founders are more invested in the running and success of the company than outsiders and usually have more stock than anyone else. When founders are made board directors, they have the ability to shape the company and they’re in the best position to do so because they’re immersed in the day-to-day of the company.

But, if there are four or more founders, not everyone needs to be part of the board. At that stage, we recommend those founders with the largest stockholding should have a board seat.

Anthony RoseIn general, if your company has one to three founders you should all have a seat on the board to remain in control, particularly in the early stages. You can revisit it around the Series B stage, when perhaps your lead investor has more equity than some of the founders.

Co-Founder & CEO,

When you raise startup funding from VC investors, the lead investor from your funding round will usually ask for a seat on the board. Investors generally ask for a board seat so that they can have a say in company decisions and the strategic direction of the company. Think carefully when selecting investor directors and consider things like how much value they’ll add, the stage of your company, and the way the board’s set up.

A board of directors is responsible for governing the company, making decisions and guiding the company’s strategic direction. They must act in the best interests of all the company’s stakeholders (its stockholders, employees, investors, customers, suppliers, community, etc) and uphold high standards of corporate responsibility.

Their responsibilities are:

Overall, the startup board is responsible for guiding the company towards sustainable growth and success while upholding the principles of good corporate governance and ethical business practices.

It’s not always a given that board members should receive cash payments. Some may do the job voluntarily, particularly if they share the company’s values.

But paying startup board members could be important in attracting experienced people who can provide valuable guidance.

Startups can offer equity or cash. Early-stage companies often rely on equity, while later-stage startups may introduce cash payments.

Here’s a general breakdown of our thoughts plus some figures from the Corporate Governance Institue:

There’s no minimum number of board meetings prescribed by law – directors should meet often enough to make sure that they are meeting their obligations and duties.

It’s common for startups to meet at least once a year to run an annual review of the company’s progress against high-level targets.

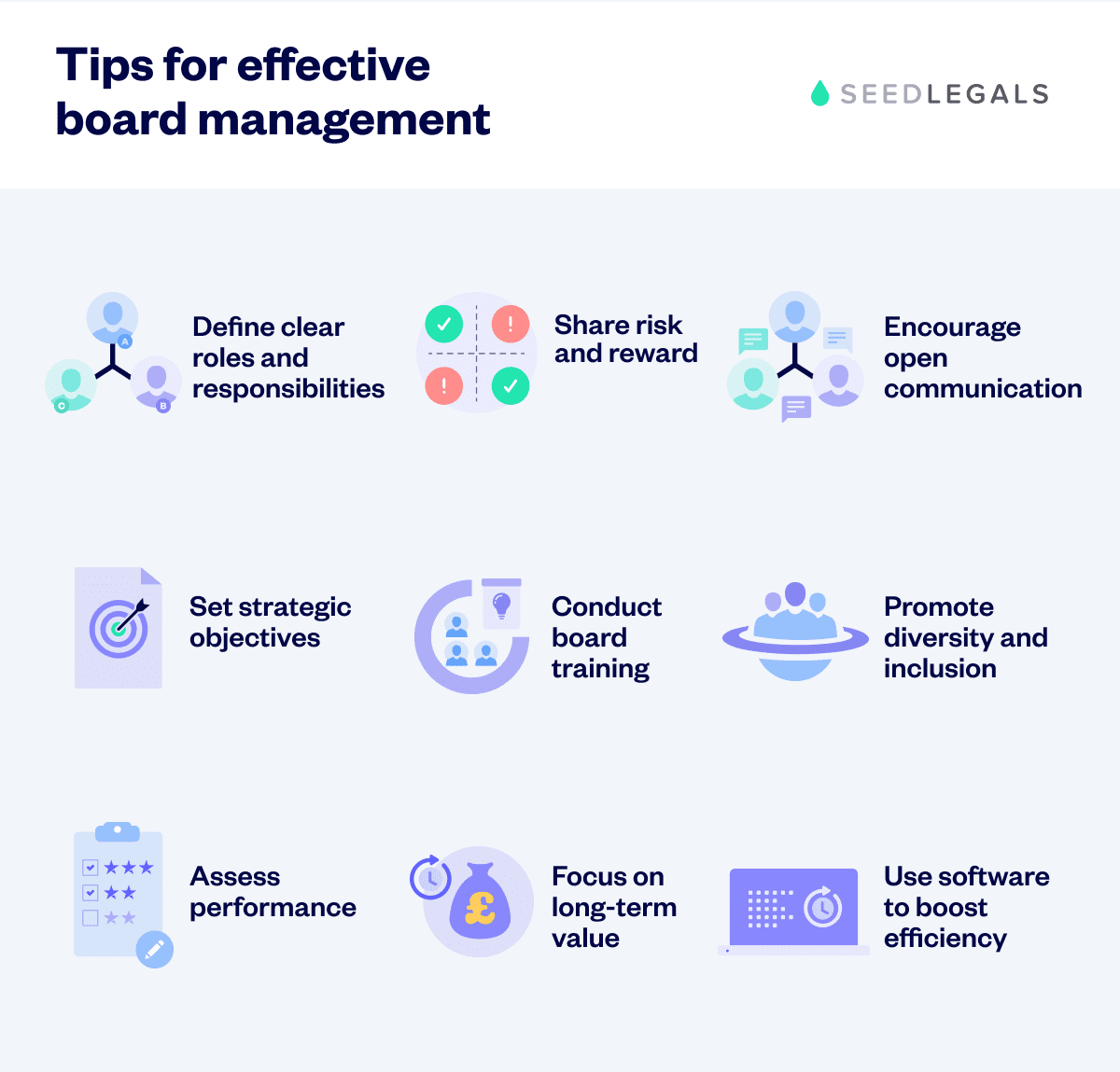

So what does good look like when it comes to building a brilliant startup board of directors? Here are our top tips 👇

Establish clear roles and responsibilities for each board member. This includes setting the board’s purpose, outlining individual duties, and establishing expectations for participation and contribution.

Make risky decisions together and share responsibility for them. Govern the company well and share in its success.

Anthony RoseImagine your company is planning a risky new expansion into a new product or territory that’s going to cost a fair fraction of the company’s cash reserves. If it doesn’t work out, the company could go bankrupt or face serious regulatory issues. That’s going to affect all stakeholders in the company negatively. That’s why big decisions need to be made collectively.

Co-founder & CEO,

Create an environment where directors feel comfortable expressing their opinions, discussing challenges and offering constructive feedback.

Work collaboratively to define the company’s strategic objectives and long-term vision. Regularly revisit and update these goals to align with market trends and the company’s performance.

Invest in board training and development to make sure directors are well-informed about the industry, market dynamics, and regulatory changes. Continuous education helps them make informed decisions and remain effective in their roles.

Strive for a diverse board that includes directors from different backgrounds, experiences and expertise. A diverse board enhances creativity, better decision-making and a broader understanding of stakeholders’ perspectives.

Regularly conduct board evaluations to assess individual and collective performance. Use the findings to identify areas of improvement and tailor development plans for the board as a whole.

Encourage agile decision-making by swiftly responding to opportunities and challenges. Avoid lengthy bureaucratic processes that could limit the company’s ability to adapt to changing market conditions.

Avoid short-term thinking and focus on creating sustainable long-term value for the company and its stakeholders. Make decisions that align with the company’s overall mission and strategic goals.

You can use board management software that helps you stay organized and save time. These can allow you to:

… so it could be useful to your business!

Book a free call with our team to find out how we can help with your fundraise.

Want to try SeedLegals for free first? Start your 7-day free trial.

Bring all your questions - we’ve got the answers! We’ll match you with the right specialist.