US taxes and reporting: What founders need to know

Starting a company is exciting – but alongside the challenge of building your business comes the task of keeping on top...

As a founder, it’s important to keep an accurate record of who owns shares in your company – and a cap table provides just that. It acts as a source of truth for stock ownership, tracking changes over time.

In this article, we’ll explain what a cap table is, why you need one and how you can make one for your company.

“Cap table” is short for “capitalization table”. It’s a set of database entries that shows who owns the stock in a company. Historically, it was kept on paper or on a spreadsheet. But there are much better ways to maintain them now (we cover them in ‘How do I set up a cap table?’ below).

A cap table will include the names of the stockholders, the amount and class of stock they hold, the price paid for that stock, and their percentage ownership.

The main purpose of a cap table is to track the ownership structure of your company. This can change over time if certain events take place.

For example, the cap table would need to be updated if new investors came in, or if your employees exercised their stock options.

And that’s why it’s so useful – it’s a living, breathing database that evolves to show the current ownership position in a company.

Your cap table can (and should) be used to see what your company’s equity position would be in different scenarios.

It can show you, for example, what each stockholder’s ownership would look like if the entire employee option pool was issued and exercised.

Or it can help you forecast how diluted existing investors would become if your company went through another fundraise.

So, the cap table can be used as a tool to see how future events could affect equity in the company.

When you’re planning for a funding round, you’ll need an up-to-date cap table. Potential investors will want to see a snapshot of the current stockholding in the company.

The cap table can also help you decide what terms you’d be happy to accept in a fundraise. For example, you may want to keep hold of the majority of the company’s stock yourself after the round has completed. So, you can plug numbers into the cap table to see how much stock you can afford to sell while keeping yourself above the 50% threshold.

This will give you a better understanding of your equity ownership and control in your company in the future.

If you’re the only stockholder in your company, you don’t need to spend time setting a formal cap table using any tool or spreadsheet right now unless you’re planning to take on investment or give shares to others.

But most startups would benefit from a formal cap table to show who owns equity in the company.

Initially, you may only have a few stockholders – the founders, maybe friends and family. But, when others want to invest in your company (say, angel investors or VCs) it becomes more important to keep track of stock ownership.

Potential investors will ask to see your cap table so they know who currently owns stock in your company, and what they’ll get for their investment.

There’s no universally-agreed format for capitalization tables, but the best ones are quick to set up, simple to manage and easy to read.

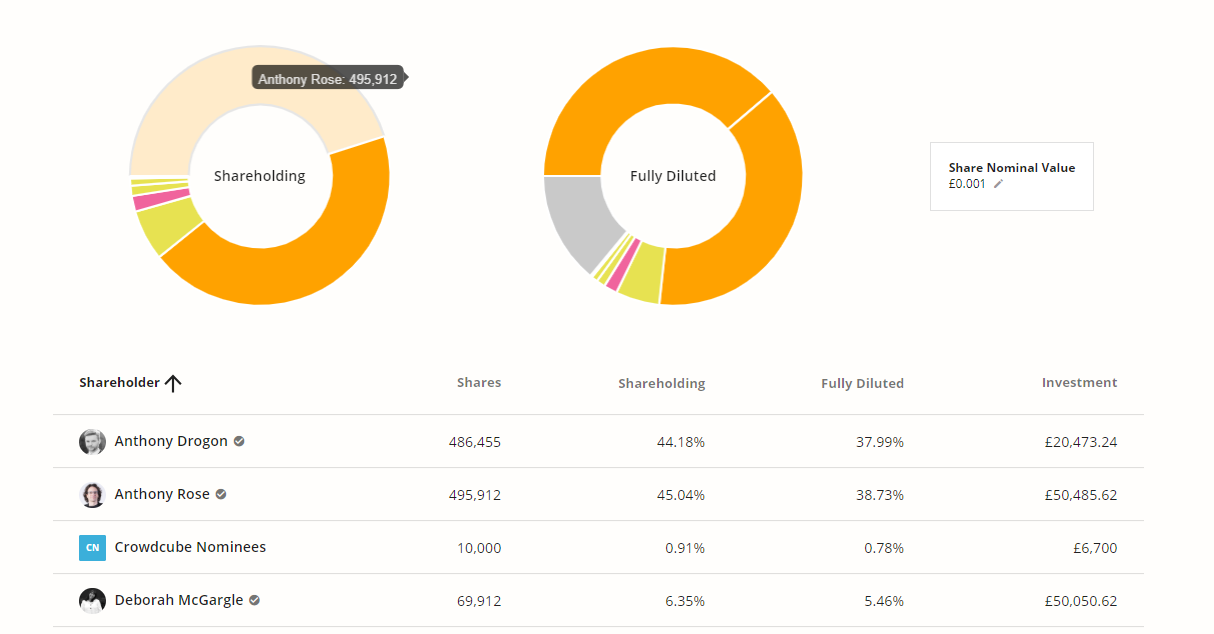

Here’s an example of a cap table:

In this example, you can see the stockholders, their stockholding and investment amounts in the table, with the data represented in the charts above.

This makes it easy for anyone viewing your cap table to find the information they need.

In this example, you can see the stockholders, their stockholding and investment amounts in the table, with the data represented in the charts above.

This makes it easy for anyone viewing your cap table to find the information they need.

Use a spreadsheet: The cheapest (but not the best) way to do it is by using a spreadsheet – you’ll be able to find a bunch of cap table templates online. But, every time the stockholdings change, you’ll need to manually update the table. And you need to keep it looking clear and neat, so it’s ready anytime you need to show it to an investor.

The issue is, if you have several people with access to the spreadsheet, you could end up in a mess with errors and out-of-date versions. To avoid this, some companies pay an accountant or lawyer to manage their cap table as a spreadsheet.

Use a cap table management tool: The better alternative to spreadsheets is an online cap table management tool. These solutions create your cap table for you in a neat, easy-to-read format, which you can share with investors. It also means there won’t be different versions of your cap table floating around. But, with most tools, you’ll still need to do the data entry manually, and every time you change the stockholdings, you’ll need to update the cap table – it can be time-consuming.

SeedLegals takes cap table management a step further. Unlike other tools, SeedLegals integrates your cap table with your legal documents, so when you make changes to stockholdings within the platform, the cap table updates automatically – no extra steps required. It’s a smarter, more efficient way to manage your cap table.

Your cap table will need to be updated whenever the stockholding of your company changes.

The main events that would trigger a change in the cap table are:

If you use SeedLegals to create your cap table and make these changes to your stockholdings, then the cap table is automatically updated – you don’t need to do anything.

When you hold a stock option, you don’t own the stock just yet. So, individual option holders aren’t shown in a company’s cap table. When an option holder exercises their options and becomes a stockholder, then their name will appear in your cap table.

But, the entire stock option pool can be shown in a cap table – this shows the effect of dilution on other stockholders if all the options were issued and then exercised.

Not really. A cap table is a useful tool to help understand a company’s ownership structure, it’s not sufficient to actually value the company. However, the company’s “capitalization” (meaning the total number of shares) is important for working out the price per share when a company’s value is decided during a funding round.

Valuation can take place by analyzing things like the company’s financial performance, market conditions, growth prospects, and comparable company valuations.

Book a free call with our team to find out how we can help with your fundraise.

Want to try SeedLegals for free first? Start your 7-day free trial.

Bring all your questions - we’ve got the answers! We’ll match you with the right specialist.