Advisory shares: How much equity should you give your advisor?

Startups commonly give 1% equity to General Advisors paid only in equity, who work less than 2 days a month. Discover m...

It’s never easy to assign a value to a company that you’ve put your heart and soul into. Especially since you have to size up how much equity you’re prepared to give away as part of that equation.

When you pitch to investors, what’s the ‘right’ valuation for your early stage company? There’s no quick answer to this. However, we do have data from the thousands of funding rounds closed on SeedLegals to help you make an informed decision about where your company stands – and perhaps more importantly, how to justify that valuation to your investors.

Contents

Generally when building your pitch deck, you’ll need to make three key decisions:

These questions are mathematically intertwined, so there are two approaches you can take:

or:

Some advisors say to raise as much as you can. The steer from VCs and angel investors is usually that you should plan to raise enough to last 12-18 months before you need to raise money again.

Time on the funding trail is time and effort spent away from building your business – and it’s incredibly hard. Here are the key questions to ask yourself:

The reason for a 12-18 month runway is that realistically you’ll need to be on the fundraising trail six months before you’ll have new money in the bank, and you’ll need to show growth between now and then to get new investors interested.

Any shorter than 12 months’ runway and it’s going to be hard to hit key milestones or show any real traction. That means you’re going to find it harder to justify a higher valuation at your next round. It’s called a runway for a reason – if you don’t have lift off before you reach the end, things will come to a sudden stop!

So, if your starting point is figuring out the cash you need, then simply look at your monthly burn rate. Add in the team members you plan to hire, marketing spend, dev costs, etc and then look at your monthly burn rate again. Now multiply this by the number of months’ runway you need. Remember to factor in a buffer for the unknown as anything can happen – and usually does when you’re piloting a startup.

At this point, it’s important to remember investors won’t be sold on the prospect of funding your monthly burn. So when they ask about why you’re raising your target amount, remember to make your answer about milestones and not survival. Focus on the resources you’ll need to achieve your goals and the length of time it will take to get you there.

As much as Dragons’ Den makes for great TV, here in the real world, equity investment doesn’t work like that. You’re not pitting yourself against an adversary who wants to take a huge chunk of your company.

The general rule of thumb for angel/seed stage rounds is that founders should expect to sell between 10% and 20% of the equity in the company. These parameters weren’t plucked out of thin air. They’re based on what an early equity investor is looking for in terms of return.

Investors are placing bets on you with the clear knowledge that most of their investments will give zero return. They’re exposed to a high-risk/high-potential scenario, so they need a decent slice of equity to get a meaningful return if things go well. And they want a meaningful level of influence and control over key company decisions if they don’t.

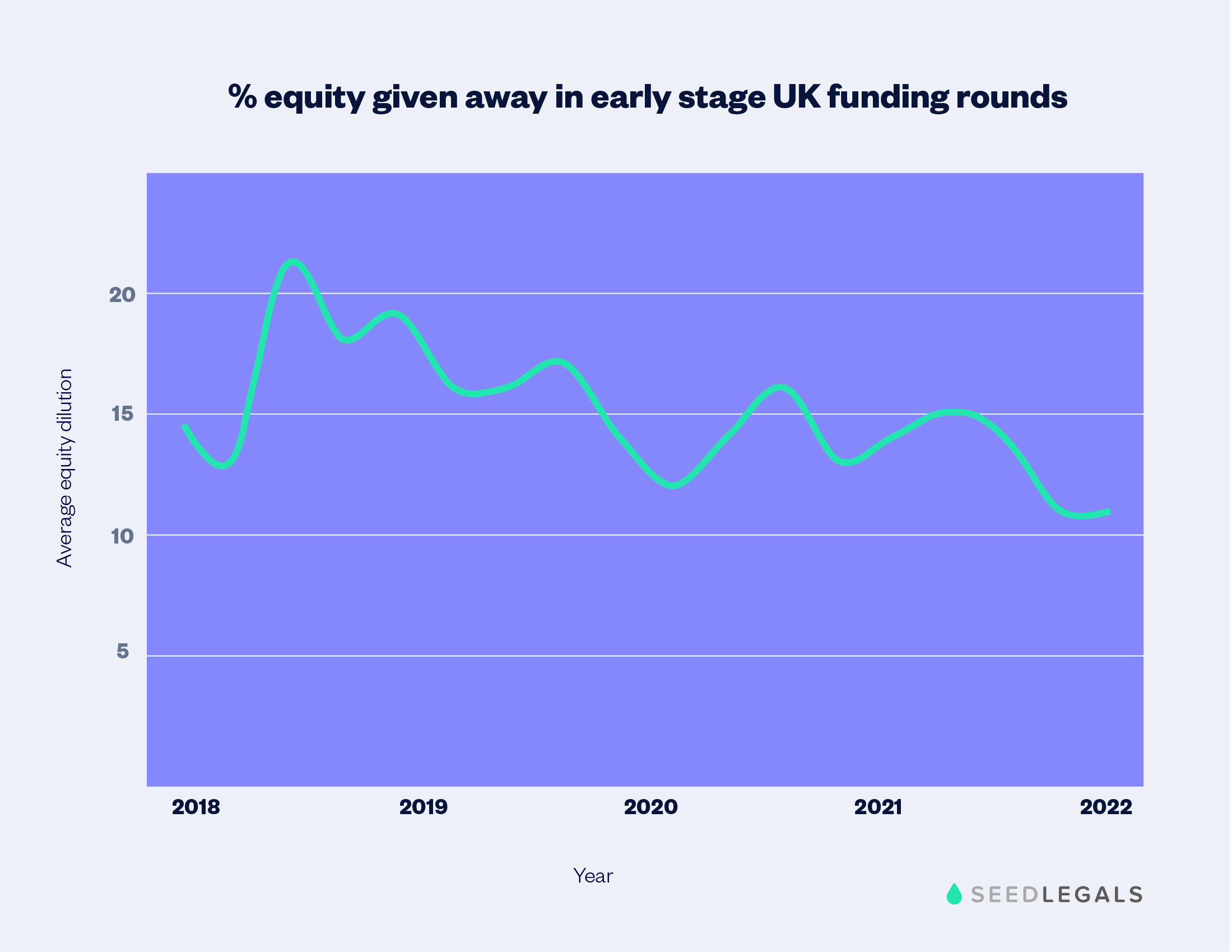

In the table below, you can see the average percentage of equity given away in early stage UK funding rounds on SeedLegals.

Our data shows that between 10% and 20% is the norm, with an average of 14% given away to investors at the early round stage.

The good news is that there’s now another way to raise funds, outside of the traditional go-big-or-go-bust funding cycle. It’s called agile funding and it allows you to take advantage of investment opportunities, whenever and wherever they appear.

With SeedLegals, it’s quick and simple to take in smaller amounts of funding as and when you need to in between funding rounds.

Previously, a little-and-often raising pattern would be a bad idea because:

We’ve changed all that with our simple and secure SeedFASTs and Instant Investments.

SeedFAST is our name for an advance subscription agreement. It’s a quick way to take in a one-off investment before your funding round. You don’t need to commit to a valuation, because they only convert into shares when you complete your next funding round. With a SeedFAST, you specify the timeframe to complete your next round – usually within a year.

Essentially, investors pre-pay for shares. This means you don’t need to rush to agree to a valuation – it buys you more time to consider the right valuation to raise at, while still allowing you to take in capital.

With Instant Investment, you can quickly take a one-off investment after a funding round at the same terms as your previous funding round, using your previous valuation.

So far, we’ve approached the valuation question from what you as a founder want to get out of the equation.

Of course, investors have their own systems. But exact valuation figures aren’t any easier for them either. If you asked VCs how to value your company, you’d get a wide range of responses, including:

Some VCs are led by their head, others by their heart. Some will want to value your company on its own merits, while others will evaluate it relative to similar companies.

Either way, there’s no substitute for a data-driven decision, and thanks to our data that shows what actually happens across a range of funding round sizes, you’re well placed to not just come up with a number, but justify it too.

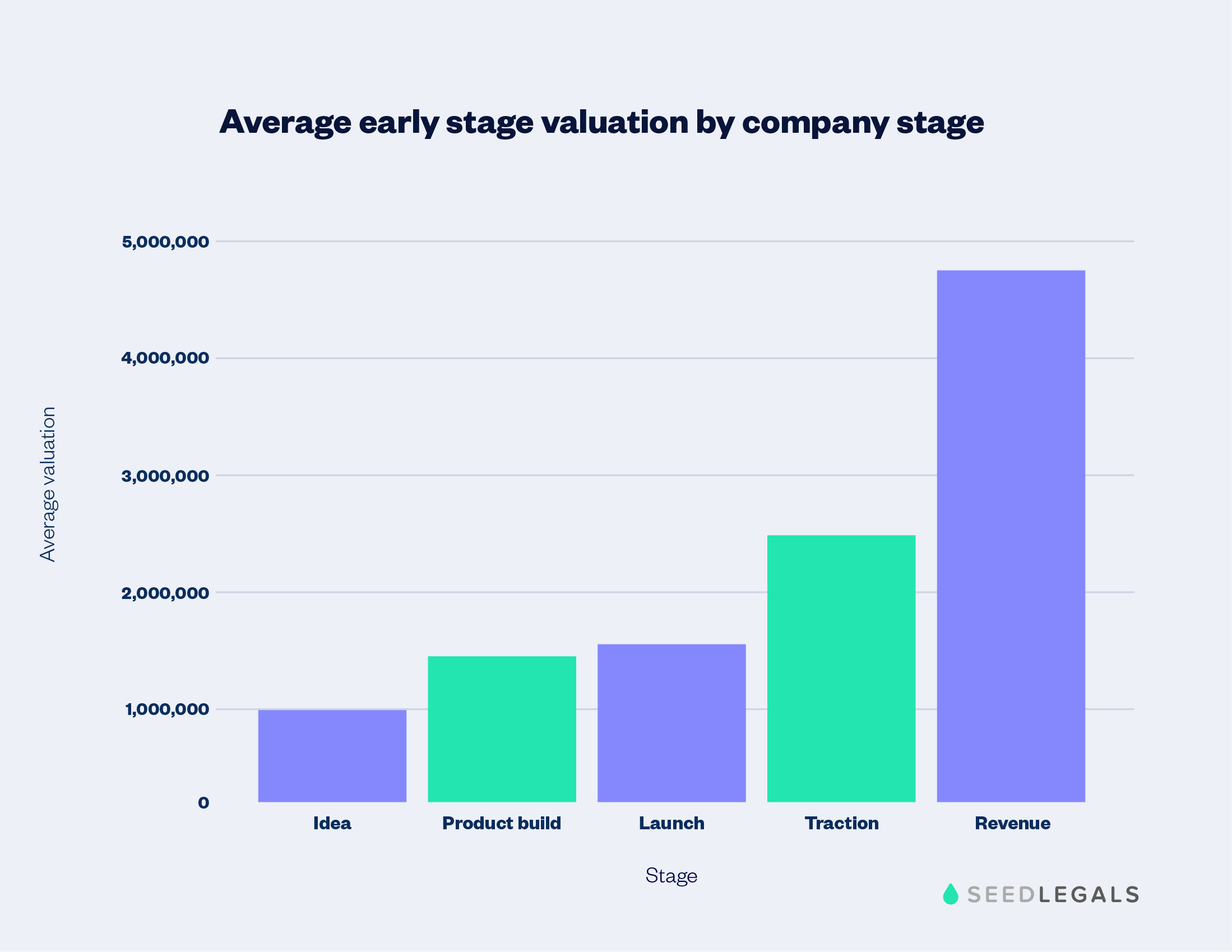

As the UK’s favourite platform for funding rounds, we have more data than anyone else on how early stage funding rounds work. To help you find out if you’re in the ‘right’ ballpark, we’ve mapped out the average valuations we see according to the stage of the startup.

Bear in mind that these figures come from companies raising in the UK.

Average valuation: £1M

You’re looking to raise £50K to £100K to get your idea off the ground. Often at this stage, your investors are friends and family – and the investment terms are pretty informal. On SeedLegals, we have a streamlined funding round package to help you close a simple investment quickly. It’s called the Bootstrap Round and it costs from £990.

Valuation: £1.3M – £1.5M

You’ve spent months refining the idea, doing user testing, and building a working prototype. You’re either about to launch or have just launched but haven’t got significant traction yet. You’re looking to raise somewhere between £100k and £250k, most likely from angel investors.

Valuation: £1.5M

You’ve just launched your minimum viable product and things are going well. You now want to raise money for more product development and for marketing to grow your user base.

Valuation: £2M – £3M

You’re seeing good signs of early traction, enough to get angel investors and early stage funds interested. You have revenue plans, but nothing to show yet.

Valuation: £3.5 – £6M

You’re pulling in recurring revenue between £20,000 and £50,000 a month and steadily growing your user base. You’re looking for investment to develop your product further and step up your marketing efforts.

Ultimately, your company valuation is whatever you and your investors agree it is. We hope that this article will help you reach a credible valuation that gives you wide investor appeal without overly diluting the founders.