Startup funding strategies for 2025

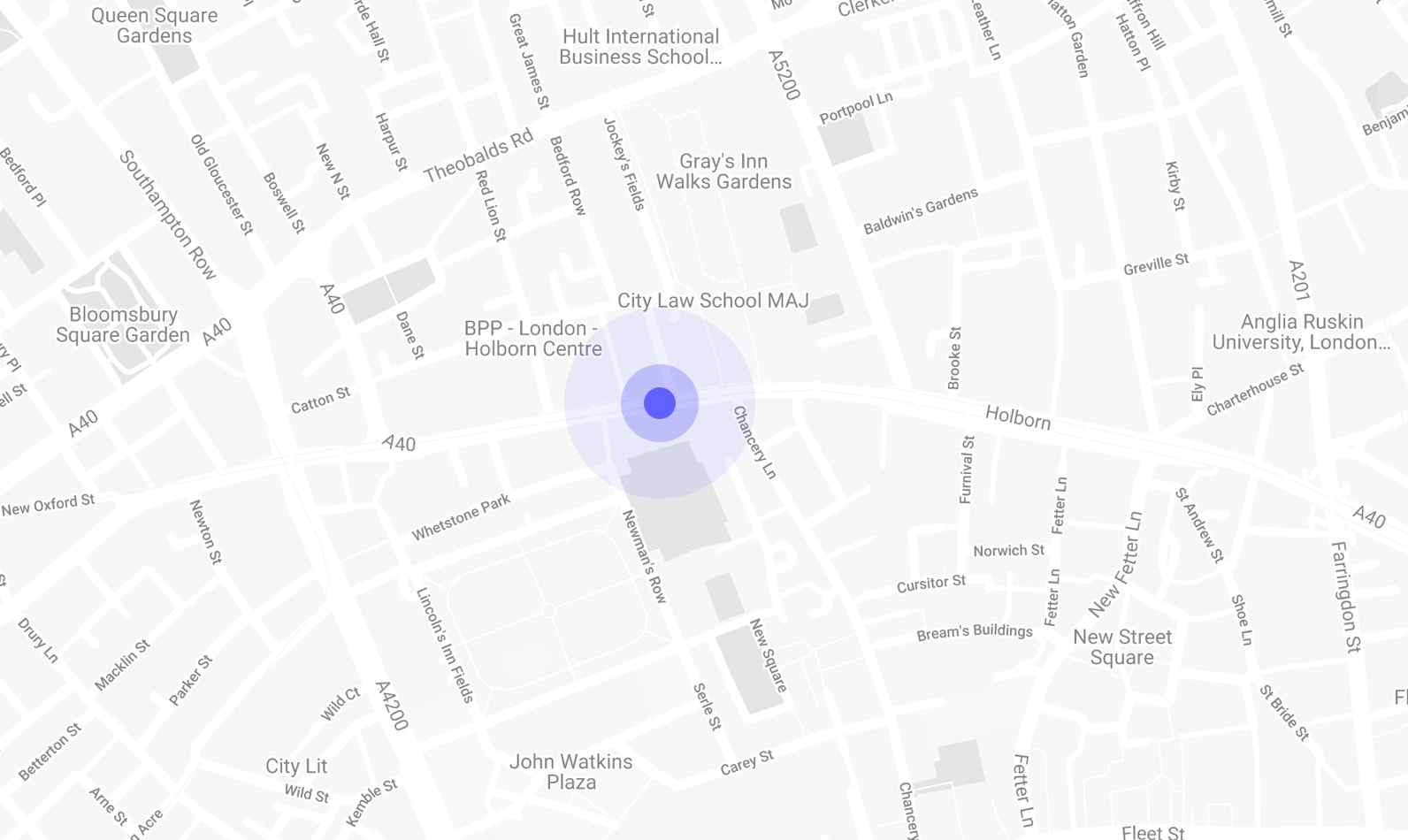

With data, experience and insights gained from £2B+ raised on SeedLegals, we’ve curated these top three funding strategies for 2025.

SeedLegals is the market standard for companies raising investment, incentivising their teams with share options, doing their SEIS/EIS, and managing their cap tables. With one in three UK early-stage funding rounds and EMI option schemes now on SeedLegals, we're proud that in just four years we've transformed the way companies start, grow and scale.

companies on SeedLegals

for funding rounds, cap tables & share option schemes

raised on SeedLegals

SeedLegals was founded by serial entrepreneur Anthony Rose and serial angel investor Laurent Laffy who met at a party in Rome. They'd both had enough of paying insane amounts of money to lawyers for the same legal documents at every funding round, and funding rounds taking months to negotiate and close. They decided to change it.

Fast forward 6 months and SeedLegals launched as the world’s first platform that lets founders and investors easily create, negotiate and sign all the legal agreements they need to do a funding round. In less than 3 years, SeedLegals is now the largest closer of funding rounds in the UK.

Advanced Subscription Agreements allow investors to ‘pre-pay’ for shares. ASAs can be a faster, more efficient and S/EIS...

Create the perfect pitch deck with our free template, including tips from industry experts and step-by-step guidance.

You need funding, and you need it fast. Advanced Subscription Agreements are instruments commonly used by start-ups to r...

From food to FinTech and beyond, join thousands of startups who use SeedLegals to start, raise and grow faster.

More customer stories