Claim R&D Tax Credits faster

Speed up your R&D Tax Credits claim

✔ Automate the admin, leave the rest to our experts

✔ Maximise your R&D Tax Credits claim

✔ Get unlimited support from R&D specialists

Low-effort, high-impact R&D claims

The days of swapping spreadsheets and endless emails are over. This is how R&D claims should work.

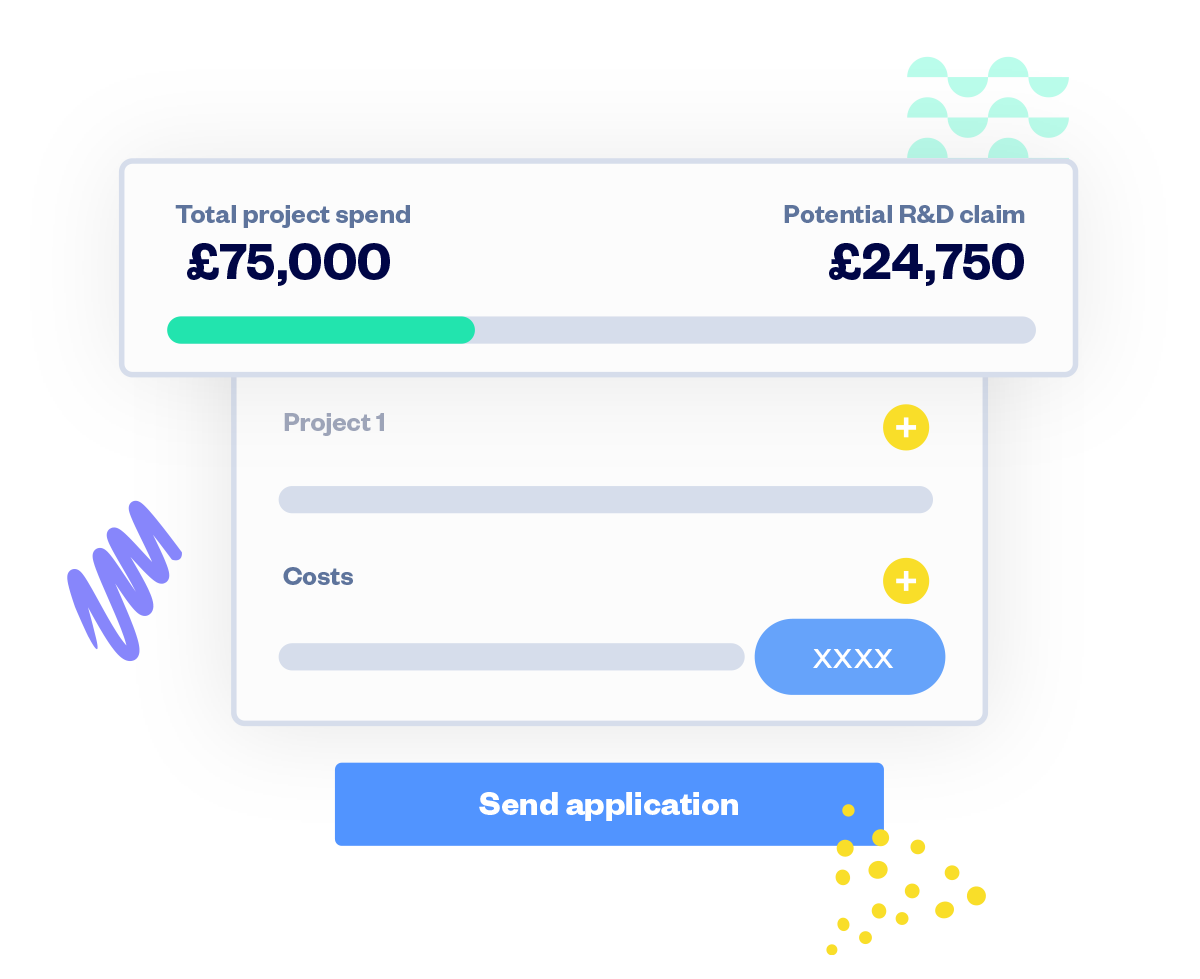

Quick and easy claim builder

Experts optimise your claim

Sync, track and store

Support at every stage

How much R&D can you claim?

-

Profit makingLoss making

-

£

-

£

-

£

-

£

We estimate you could get back up to

You invested in R&D. Let’s get your money back.

Tell us about your company

Build your claim

Receive your cash or credit

Built and reviewed by R&D experts

Maximise your R&D Tax Credits claim

On SeedLegals, your R&D claim is quick to build, expertly reviewed and ticks all HMRC boxes for a faster, more reliable payout.

No overlooked expenditure - our tech + expert process find it all

Up-to-the-minute R&D expertise - we work closely with HMRC and understand any changes to law and guidance

Xero-effort data entry

Time is money - we’ll get you both back

The sooner you submit your R&D tax credit claim, the sooner the money lands back in your account. We streamline every part of your application so it’s quick and simple to build.

Speedy data entry - connect to Xero to add your expenses data

Fast review times - we return your reviewed claim in just 3 to 4 business days

All your documents in one place

Capture R&D spend year round

Already using SeedLegals for your Employment Agreements? Great! We'll populate your R&D tax credit claim to reflect your team automatically. And if you’ve filed a claim with us before, it’ll be even faster next time.

Save time - we pre-fill your forms with data we already have

Capture costs and projects in the same place you manage your staff onboarding documents

See an accurate, real-time forecast of how much you could claim throughout the year

Unlimited help with R&D tax credits

Chat online anytime with our experts

Need to know whether to claim under the SME or the RDEC (Research and Development Expenditure Credit) scheme? Not sure if your project is eligible or how to categorise your costs? Our expert team is here to guide you through the entire process.

Unlimited support from our experts - no extra cost

Talk to us your way - chat, phone, email, video call

Ask us anything - we're here 9am to 6pm Monday to Friday

More resources on R&D Tax Credits

What our customers say

From agritech to AI and beyond, over 50,000 companies trust SeedLegals. Here's what some of our customers say about our R&D Tax Credits service...

More customer storiesFAQs

Frequently asked questions about R&D tax relief

How do R&D tax credits work?

R&D tax credits are a form of tax relief designed to encourage companies to spend money on developing new products and services, and boost innovation in the UK.

There are two different schemes that companies can use to claim R&D: the SME (for startups and small businesses) and the RDEC (for larger businesses - and qualifying SMEs). See the next FAQ for more information about the differences between them.

The type and amount of tax relief you can claim under the SME scheme depends on how much you’ve spent, what you’ve spent it on and whether your company is making a profit or not.

To claim R&D tax relief, you need to file an R&D claim with HMRC detailing the amount you’ve spent on R&D projects. You’ll submit this claim at the same time as you file your Corporation Tax return.

You can also claim R&D tax relief for the previous two accounting periods by submitting an amended tax return. For example, if your accounting year end is 31 December 2023, you have until 31 December 2025 to submit your claim.

Find out more: R&D tax credits: the ultimate guideHow is R&D tax relief changing in April 2023?

From 1 April 2023, there are changes to the cost categories and rates for both the SME and RDEC schemes.

To view the changes in full, read our post, R&D tax credits are changing from April 2023 – find out how it could affect your businessWhat’s the difference between the SME and the RDEC schemes?

SME R&D tax relief scheme

The SME scheme is for small and medium-sized businesses.

Your company must:

• employ fewer than 500 people

• turn over under €100M (~£85M) or have a balance sheet total of under €86M (~£73M)

In some circumstances, small businesses don’t qualify for the SME scheme and have to claim under the RDEC instead.

SMEs can’t claim SME R&D tax relief if:

• they have been subcontracted to do R&D work by a large company

• they have received certain grants or subsidies for their R&D project

• the project is already getting state aid

RDEC scheme (Research and Development Expenditure Credit)

The RDEC (Research and Development Expenditure Credit) scheme is for larger companies and SMEs that don’t qualify for the SME R&D scheme.

Your company must:

• employ more than 500 people

• turn over more than €100M (~£85M) or have a balance sheet total of €86M or

more (~£73M)What counts as an R&D project?

To qualify for R&D tax relief, you don’t have to invent a brand new product or process. Most of the claims that we see involve an ‘appreciable’ improvement to existing technology. You need to demonstrate that this improvement was not straightforward and that you faced 'technological uncertainty' trying to achieve it.

To pass HMRC’s bar for a qualifying R&D project, you’ll need to show that your project:- looked for an advance in a field of science or technology

- had to overcome scientific or technological uncertainty

- attempted to solve the technological uncertainty in a way that would not be readily achievable or obvious to a competent professional in a relevant field

Find out more in our guide to R&D eligibility criteria.What expenses qualify for R&D tax credits?

For full details, see this list of qualifying expenses in our ultimate guide to R&D.

In general, you can claim for:- Staff costs

- Gross salaries

- Employer NI contributions

- Employer pension contributions

- Bonuses (paid within 9 months of the financial year end)

- Any reimbursed expenses relating to the R&D project

- Subcontractor and third party costs

- Including any work subcontracted out to a company, individual or other organisation

- Externally provided workers, for example agency workers who contributed to the R&D effort

- Consumable items

- Costs of raw materials used or transformed during the R&D process (these can’t be sold on or form part of the final sellable product)

- Utilities costs such as water, gas, electricity

- Software costs

- Any licence costs for software used in R&D activities (eg CAD/CAM/GitHub)

It can be difficult to separate qualifying costs from non-qualifying costs. If you use SeedLegals to build your R&D claim, we’ll go over all your costs with you and make sure your claim is accurate.

From 1 April 2023, there are some new rules about qualifying expenses. To read the full list, read our post, R&D tax credits are changing from April 2023 – find out how it could affect your business- Staff costs

What are the R&D tax relief rates?

This depends on the size of your company and whether you’re profitable or not.

Before 1 April 2023

Small and medium-sized businesses (under 500 employees) that are making a loss can claim back up to 33% of their R&D spend. Claims for profitable small and medium businesses will typically be around 25% of total R&D spend.

Larger companies can claim just over 10% of their R&D spend.

Find out how to calculate R&D tax credit rates in our ultimate guide to R&D.

From 1 April 2023

For loss-making companies, the SME R&D scheme benefit be a maximum of 18.6% cashback. (For every £1 of R&D spend, the maximum you could get back will be 18.6p)

For profit-making companies, the tax relief will be a maximum of 16.34% (16.34p for every £1 spent on R&D).

For the RDEC scheme, the rate will increase from 13% to 20%. The overall tax benefit from the RDEC scheme will increase from 10.54% to 16.2%. Taking into account the rise in Corporation Tax, the tax relief under RDEC will be worth 9.75p for every £1 spent on R&D.

For more about the rate changes from 1 April 2023, read our post.How long does it take to get R&D tax credits?

HMRC have increased their standard processing time from 28 days to 40 days. This is a temporary change and we expect this to fall back to 28 days in the near future.

If you receive payable tax credits, it will then take around one to two weeks for the money to arrive in your bank account.How far back can you claim R&D tax credits?

You can claim R&D tax relief retrospectively for your previous two accounting periods. For example, if your accounting year end is 31 December 2023, you have until 31 December 2025 to submit your claim.

This means you can submit an amended tax return for a previous period within the last two years if you think you missed out on potential tax credits or tax savings.What can I use R&D tax credits for?

There are no conditions on what you can spend your R&D cashback on. For many companies, it’s a welcome cash injection that helps with day-to-day running costs. It can be a useful way to extend your runway between funding rounds, by delaying the need to take in new investment.

Of course, you can also reinvest it into your research and development activities. For example, hire new developers or buy new manufacturing equipment.How do I claim R&D tax credits?

You submit a claim for R&D tax credits alongside your Corporate Tax return or via an amendment to your tax return. The submission includes a technical report to HMRC that explains why your company’s activity qualifies for R&D tax relief, and a breakdown of what you spent.

If you build your claim on SeedLegals, we’ll help you generate your technical report and the figures you need to claim for tax relief.

Here’s how it works:- Sign in to SeedLegals, go to R&D Tax Credits and choose R&D Claim

- Fill in your company and industry information

- Select Add project and follow the prompts to start building your technical report

- Connect to your Xero account to complete your R&D expenditure

- Import your employee costs and other expenses

- If you don’t use Xero for your financial accounts, you’ll simply enter your expenditure details into SeedLegals

- Upload supporting information and documents, including:

- Your company accounts

- The tax return for the accounting period of your R&D claim

- Send us your claim to review

- Our R&D experts review your claim in 3 to 4 working days

- We’ll get back to you with our suggested changes

- Submit your claim to HMRC with confidence

For full details, see How to apply for R&D Tax Credits on SeedLegals.How do I connect my Xero account to my R&D claim?

R&D claims used to mean hours spent putting data into spreadsheets. On SeedLegals you can connect straight to your Xero account, pull in and categorise your R&D expenses, giving you more time to focus on running your business.

Not only does this save you hours per application, it also helps make sure your costs are accurate and categorised correctly - and it only takes a few clicks.

Here’s how it works:- To add your employee costs from Xero, choose Import from Xero

- Select the employees to import

- Enter additional details, including job titles and % time spent on R&D activities

- To add your other R&D expenses, choose Import from Xero

- Select the costs you want to claim for and categorise by type (subcontractor, software, consumable, prototype, other)

- Add extra information, including start and end dates, and adjust percentages

- Finish building your claim on SeedLegals

- To add your employee costs from Xero, choose Import from Xero

Can I still create an R&D claim on SeedLegals if I don’t use Xero?

Absolutely! If you don’t use Xero for your financial accounts, it’s still simple to enter your expenditure details directly into our workflow.

You’re in safe hands

Our team of legal and funding experts have helped thousands of entrepreneurs raise money and grow their businesses.

Beautifully organised

Your company's core agreements, all in one place

Secure signatures

Share and collect signatures online via SeedLegals

Backed by real lawyers

Create the exact documents you need at every stage of growth

Serious about security

Your information stays safe and confidential in our secure system

Helpful humans

Talk to one of our friendly team anytime on live chat

Extra protection

Don't worry, our insurance covers claims related to our platform